Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

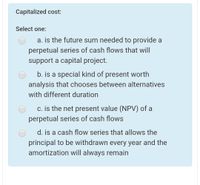

Transcribed Image Text:Capitalized cost:

Select one:

a. is the future sum needed to provide a

perpetual series of cash flows that will

support a capital project.

b. is a special kind of present worth

analysis that chooses between alternatives

with different duration

c. is the net present value (NPV) of a

perpetual series of cash flows

d. is a cash flow series that allows the

principal to be withdrawn every year and the

amortization will always remain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You need to determine whether a project is profitable or not in a long run. Based on the data given, which of theseprojects will be profitable according to engineering economy methods?a. θ = 3 yrs., Net Value: 0b. Accumulated (without interest) net values of the revenues, expenses and investments after 5 years is +300.c. Accumulated (without interest) net values of the revenues, expenses and investments after 4 years is +100.d. θ = 6 yrs., Net Value: +400arrow_forwardDon not solve list the objective function and contraints using variablesarrow_forwardEcono-Cool air conditioners cost $320 to purchase, result in electricity bills of $154 per year, and last for 5 years. Luxury Air modeis cost $520, resuit in electricity bils of $108 per year, and last for 8 years. The discount rate is 25%. a. What is the equivalent annual cost of the Econo-Cool model? (Do not round intermediate calculations, Round your answers to 2 decimal pleces.) Econo-Cool Equivalent annual cost b. What is the equivalent annual cost of the Luxury Air model? (Do not round intermediete calculations. Round your answers to 2 decimal pleces.) Luxury Air Equivalent annual costarrow_forward

- A department has a planned stock turnover of 4 and planned sales of $160,000.00 for a six month season. Plan BOM stock for April if planned sales for April is $20,000.00. a) $33,333.33 b) $20,000.00 c) $26,667.67 d) $40,000.00arrow_forwardGraph on right, shows AW of costs versus number of service years of project X. Based on the graph, economic service life of the project is Larger costs Total AW of costs AW of AOC Capital recovery 3.5 10 Years О 3.5 years O 10 years O 1 year О З уears AW of costs, S/yeararrow_forwardnot use ai pleasearrow_forward

- The projected profit of a hi-tech recording disks retailer is Birr 200,000 for the current year based on sale volume of 200,000 units. The company has been selling the disks for $16 each; variable costs consist of the Birr 10 purchase price and Birr 2 handling cost. The retailer’s annual costs are Birr 600,000. Required: a. Calculate the breakeven point for the current year in units. b. What will be the company’s profit for the current year if there is a 10% increase in projected unit sales volume? c. Management is planning for the coming year when it expects that the unit purchase price of the disks will increase by 30%. What volume of dollar sales must the retailer achieve in the coming year to maintain the current year’s profit if the selling price remains constant at Birr 16arrow_forwardDefine the negative cash flow?arrow_forwardThis can occur when a selection among mutually exclusive alternatives is based wrongly on maximization of IRR on the total cash flow. a. Investment errors O b. Alternative errors Oc. Ranking errors o d. Incremental errorsarrow_forward

- I am confused about the order of operations on this equation here. In what order do I need to move the various variables? Could you give me a step-by-step illustration as oppesed to simply the final answer for this equation? Please see the image for the particular problem. Otherwise it is Problem 5P from Chapter 7 (Rate of Return) in Contemporary Engineering Economics 6th Edition.arrow_forwardPlease do fast ASAParrow_forwardis based on the equivalent worth of all cash inflows and outflows at the end of the planning O a. Future Cost O b. Present Worth O c. Present Cost O d. Future Wortharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning