ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

12. Solve the given question and give the correct answer.

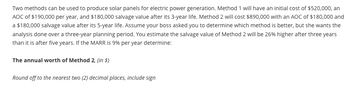

Transcribed Image Text:Two methods can be used to produce solar panels for electric power generation. Method 1 will have an initial cost of $520,000, an

AOC of $190,000 per year, and $180,000 salvage value after its 3-year life. Method 2 will cost $890,000 with an AOC of $180,000 and

a $180,000 salvage value after its 5-year life. Assume your boss asked you to determine which method is better, but she wants the

analysis done over a three-year planning period. You estimate the salvage value of Method 2 will be 26% higher after three years

than it is after five years. If the MARR is 9% per year determine:

The annual worth of Method 2, (in $)

Round off to the nearest two (2) decimal places, include sign

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Table 1: Consumption of Bread and Flour Consumer Consumption Consumption 1 2 3 4 5 of Bread 100 26205 6 15 of Flour 10 90 120 50 75 1202 A supermarket has employed you to do some analysis of their customers' shopping. They have provided you with the data in Table 1. Based on the data in Table 1, explain what preference type you would use in your analysis.arrow_forwardWhat is the total utility at 4 units and the marginal utility when Jenna goes from consuming three units to four units pears? Quantity Marginal Utility 1 35 2 25 3 15 4 10 5 0 6 -5 Group of answer choices Total utility = 85 ; Marginal Utility = 10 Total utility = 85 ; Marginal Utility = 15 Total utility = 75 ; Marginal Utility = 10arrow_forwardOnly typed answer Oscar makes purchases of an existing product (X) such that the marginal utility of the last unit he consumes is 10 utils and the price is $5. He also tries a new product (Y) and the marginal utility of the last unit he consumes is 8 utils and the price is $1. The equal marginal principle suggests that Oscar should Multiple Choice increase his consumption of product X and decrease his consumption of product Y. increasearrow_forward

- Question 9: _____ refers to the satisfaction gained through consumption while _____ refers to the amount of worth a consumer attributes to a good or service. A Scale, wants B Influence, costs C Utility, Valuearrow_forwardQUESTION 23 Quantity Per Week 0 1234 00 0 5 6 7 8 9 Amy 0 5.0 9.9 14.7 194 24.0 28.5 329 37.2 414 Total Utility David 0 600 1200 1800 2400 3000 3600 4200 4800 5400 Robert 0 100 190 270 340 400 450 490 520 510 Michelle 0 60 130 220 310 425 575 900 1275 1770 Refer to the above table. Which of the four people have utility schedules characterized by the law of diminishing marginal utility? O Michelle and David only O Amy and Robert only Michelle only Amy, Robert, and David onlyarrow_forward3. Individual Problems 12-3 Some high-end retailers place their most expensive products right in the entryway of the store, where consumers will see them first, and place their more popular, better-selling items further back. Which of the following would most likely be used by a behavioral economist as a justification for this strategy? A behavioral economist would disagree with the store's strategy. The store is using lower-priced options to drive down price expectations and make later, higher-priced options appear more expensive in comparison. The store is using higher-priced options to drive up price expectations and make later, lower-priced options appear less expensive in comparison. The store is using lower-priced options to drive up price expectations and make later, higher-priced options appear less expensive in comparison.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education