FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

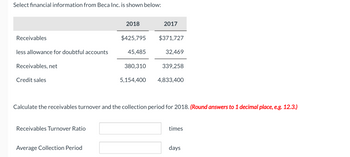

Transcribed Image Text:Select financial information from Beca Inc. is shown below:

Receivables

less allowance for doubtful accounts

Receivables, net

Credit sales

Receivables Turnover Ratio

2018

Average Collection Period

$425,795

45,485

380,310

5,154,400

2017

$371,727

32,469

339,258

Calculate the receivables turnover and the collection period for 2018. (Round answers to 1 decimal place, e.g. 12.3.)

4,833,400

times

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Yao Company reports the following in its 2021 annual report: Sales Accounts Receivable 2021 2020 2019 $2,650,000 $2,800,000 $2,500,000 $250,000 $240,000 $200,000 Answer the following question(s) by filling in the blanks. Do not include any symbols besides decimals in your answers (do not input commas). Formulas are provided after the questions. 1. Calculate the accounts receivable turnover for A. 2021. [1A] times B. 2020. [2A] times Accounts Receivable Turnover = Sales Revenue / Average Accounts Receivable [1A] = 11.52 x (/10.8+/) [1B] = 12.17 x (/12.7+/) 2. Calculate the average collection period for A. 2021. [2A] days B. 2020. [2B] days Average Collection Period Average Accounts Receivable / Average Daily Sales = 365/ Accounts Receivable Turnover = Yao Company reports the following in its 2021 annual report: Sales Accounts. Receivable C 2021 2020 2019 $2,650,000 $2,800,000 $2,500,000 $250,000 $240,000 $200,000 Answer the following question(s) by filling in the blanks. Do not include…arrow_forwardexplain the image provided the Accounts receivable turn over, days to collect, Inventory turnover,Days to sell, accounts payable turnover,days to pay and give recommendationarrow_forwardPT ABC's accounts receivable as of December 31, 2015 and allowance for doubtful accounts of Rp 250,000,000 and Rp 8,500,000. Based on the aging list of accounts receivables as of December 31, 2015, it indicates that a total of Rp 17,500,000 was uncollectible. The net realizable value of accounts receivables is:a. Rp 241,500,000b. Rp 250,000,000c. Rp 232,500,000d. Rp 224,000,000e. All wrongarrow_forward

- How do I solve this?arrow_forwardThe following select financial statement information from Candid Photography. CANDID PHOTOGRAPHY Year Net Credit Sales Ending Accounts Receivable 2017 $2,988,000 $1,290,450 2018 2019 3,750,860 4,000,350 1,345,600 1,546,550 Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What is the Average Accounts Receivable? What is the Net Credit Sales that would be used? What is the Accounts Relievable Turnover? what is the Days in Receivable Ratio?arrow_forwardAt December 31, 2021, Skysong, Inc. reported this information on its balance sheet. Accounts receivable Less: Allowance for doubtful accounts During 2022, the company had the following transactions related to receivables. 1. 2. 3. 4. 5. (a) (b) (c) (d) Sales on account Sales returns and allowances $620,000 42,000 Collections of accounts receivable Write-offs of accounts receivable deemed uncollectible Recovery of accounts previously written off as uncollectible Accounts receivable turnover Compute the accounts receivable turnover and average collection period, assuming the expected uncollectibles information provided in (c). (Round answers to 1 decimal place, e.g. 25.2. Use 365 days for calculation.) Average collection period $2,810,000 63,000 2,510,000 44,000 15,000 times daysarrow_forward

- pre.3arrow_forwardHarlan Company uses the Allowance method for accounting for receivables. They had the following information as of December 31, 2022: Net Credit Sales, year 2022 6,867,750 Accounts Receivable, December 31, 2021 655,000 Accounts Receivable, December 31, 2022 745,000 Allowance for Doubtful Accounts, December 31, 2022 4,350 Credit Harlan Company estimates that 2% of the Accounts Receivable will become uncollectible. What are some things that a company can do to improve the collection of its Accounts Receivable? On January 7, 2023 it was determined that Bundy Company’s account in the amount of $3,800 will be uncollectible. Prepare the entry to write off the Bundy Company account. What is the Cash Realizable Value of the receivables after the write-off of the Bundy Company account?arrow_forwardAt January 1, 2025, Pembina Imports Inc. reported this information on its balance sheet. Accounts receivable Less: Allowance for expected credit losses 1. During 2025, the company had the following summary transactions related to receivables and sales. Pembina uses the perpetual inventory system. Pembina expects a return rate of 3%. 2. 3. 4. $696,000 5. 44,800 Sales on account amounted to $2,800,000. The cost of the inventory sold was $2,100,000. Goods with a total sales price of $44,800 and a cost of $33,600 were restored to inventory. Collections of accounts receivable were $2,464,000. Write-offs of accounts receivable deemed uncollectible, $50,400. Recovery of credit losses previously written off as uncollectible, $16,800.arrow_forward

- Zebra Company reported the following for 2022: Credit sales = $419884 Accounts Receivable = $16376 Allowance for Doubtful Accounts = $291 (credit balance) Bad Debt is estimated at 0.31 of 1% of sales After the adjusting entry is recorded, what is the value of Allowance for Doubtful Accounts? ROUND TO THE NEAREST DOLLARarrow_forward19. The accounts receivable turnover is 8.14, and average net accounts receivable during the period is $400,000. What is the amount of net credit sales for the period? Brief Exercises Identify different types of receivables. BE8.1 (LO 1), C The following are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balan a. Sold merchandise on account for $64,000 to a customer. b. Received a promissory note of $57,000 for services performed. c. Advanced $10,000 to an employee. Record basic accounts receivable transactions. PEO AR Rooord the following transactions on the books of Jarvis Co. (Omit cost of goods sold entries.)arrow_forwardNeed help with this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education