FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:19. The accounts receivable turnover is 8.14, and average net accounts receivable during the period is $400,000. What is the amount of net credit sales for the period?

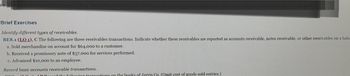

Brief Exercises

Identify different types of receivables.

BE8.1 (LO 1), C The following are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balan

a. Sold merchandise on account for $64,000 to a customer.

b. Received a promissory note of $57,000 for services performed.

c. Advanced $10,000 to an employee.

Record basic accounts receivable transactions.

PEO

AR Rooord the following transactions on the books of Jarvis Co. (Omit cost of goods sold entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this questionarrow_forwardmn.2arrow_forwardAllowance Method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Oct. 2. Received $2,870 from Ian Kearns and wrote off the remainder owed of $2,960 as uncollectible. If an amount box does not require an entry, leave it blank. Oct. 2 Cash Bad Debt Expense Accounts Receivable-Ian Kearns Dec. 20. Reinstated the account of Ian Kearns and received $2,960 cash in full payment. Reinstate Accounts Receivable-Ian Kearns Bad Debt Expense Collection Casharrow_forward

- The allowance method of estimating uncollectible accounts receivable based on an analysis of receivables shows that $772 of accounts receivable are uncollectible. Allowance for Doubtful Accounts has a debit balance of $97. The adjusting entry at the end of the year will include a credit to Allowance for Doubtful Accounts in the amount of a.$97 b.$772 c.$869 d.$675arrow_forwardWhy is the answer A in detail pleasearrow_forwardDo not give solution in imagearrow_forward

- 11. Please answer which is best forarrow_forward3. At 1 July 20X2 the receivables allowance of Q was $18,000. During the year ended 30 June 20X3 debts totalling $14,600 were written off. The receivables allowance required was to be $16,000 as at 30 June 20X3. What amount should appear in Q's statement of profit or loss for receivables expense for the year ended 30 June 20X3? $12,600 $16,600 $48,600 $30,600 C Darrow_forwardIn the statement of financial position at 31 December 20X5, Ken reported net receivables of $12,000. During 20X6 Ken made sales on credit of $125,000 and received cash from credit customers amounting to $ 115,500. At 31 December 20X6, Ken wished to write off debts of $7,100 and increase the allowance for receivables by $950 to $2,100. What is the net receivables figure to include in the statement of financial position at 31 December 20X6?arrow_forward

- d. The company collects Y5,000 subsequently on a specific account that had previously been determined to be uncollectible in (c.). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.arrow_forwardDuring the year, Blossom Enterprises made an entry to write off an $8100 uncollectible account. Before this entry was made, the balance in accounts receivable was $100100 and the balance in the allowance account was $9100 (credit balance). The net realizable value of accounts receivable before and after the write-off entry was O$100100. Ⓒ$99100. O $82900 O $91000arrow_forwardThis question uses the same facts as the previous question and is repeated for your convenience. The following information relates to Hanover Foods, Inc. for the year 20X1: Accounts receivable (January 1, 20X1) Credit sales during 20X1 Collections from credit customers during 20X1 Customer account written off as uncollectible during 20X1 Allowance for Doubtful (Uncollectible) Accounts $334,000 850,000 725,000 12,000 (this balance is given after writing-off uncollectible accounts and has a credit balance) Estimated uncollectible accounts based on aging analysis If the aging approach is used to estimate bad debts, what amount should be recorded as bad debts expense for 20X1? 1,700 13,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education