FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

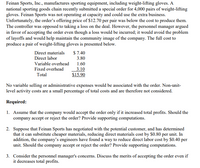

Transcribed Image Text:Feinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A

national sporting goods chain recently submitted a special order for 4,000 pairs of weight-lifting

gloves. Feinan Sports was not operating at capacity and could use the extra business.

Unfortunately, the order's offering price of $12.70 per pair was below the cost to produce them.

The controller was opposed to taking a loss on the deal. However, the personnel manager argued

in favor of accepting the order even though a loss would be incurred; it would avoid the problem

of layoffs and would help maintain the community image of the company. The full cost to

produce a pair of weight-lifting gloves is presented below.

Direct materials

$ 7.40

Direct labor

3.80

Variable overhead

1.60

Fixed overhead

3.10

$15.90

Total

No variable selling or administrative expenses would be associated with the order. Non-unit-

level activity costs are a small percentage of total costs and are therefore not considered.

Required:

1. Assume that the company would accept the order only if it increased total profits. Should the

company accept or reject the order? Provide supporting computations.

2. Suppose that Feinan Sports has negotiated with the potential customer, and has determined

that it can substitute cheaper materials, reducing direct materials cost by $0.80 per unit. In

addition, the company's engineers have found a way to reduce direct labor cost by $0.40 per

unit. Should the company accept or reject the order? Provide supporting computations.

3. Consider the personnel manager's concerns. Discuss the merits of accepting the order even if

it decreases total profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thornton Airlines is a small airline that occasionally carries overload shipments for the overnight delivery company Never-Fall, Incorporated. Never-Fall is a multimillion-dollar company started by Wes Never Immediately after he falled to finish his first accounting course. The company's motto is "We Never-Fall to Deliver Your Package on Time." When Never-Fall has more freight than It can deliver, It pays Thornton to carry the excess. Thornton contracts with Independent pilots to fly its planes on a per-trip basis. Thornton recently purchased an airplane that cost the company $5,588,000. The plane has an estimated useful life of 25,400,000 miles and a zero salvage value. During the first week In January, Thornton flew two trips. The first trip was a round trip flight from Chicago to San Francisco, for which Thornton pald $370 for the pilot and $320 for fuel. The second flight was a round trip from Chicago to New York. For this trip, It paid $320 for the pilot and $160 for fuel. The…arrow_forwardZachary Airlines is a small airline that occasionally carries overload shipments for the overnight delivery company Never-Fail, Incorporated. Never-Fail is a multimillion-dollar company started by Wes Never immediately after he failed to finish his first accounting course. The company's motto is "We Never-Fail to Deliver Your Package on Time." When Never-Fail has more freight than it can deliver, it pays Zachary to carry the excess. Zachary contracts with independent pilots to fly its planes on a per-trip basis. Zachary recently purchased an airplane that cost the company $4,883,000. The plane has an estimated useful life of 25,700,000 miles and a zero salvage value. During the first week in January, Zachary flew two trips. The first trip was a round trip flight from Chicago to San Francisco, for which Zachary paid $300 for the pilot and $250 for fuel. The second flight was a round trip from Chicago to New York. For this trip, it paid $250 for the pilot and $125 for fuel. The round…arrow_forwardsdarrow_forward

- Jireh Limited also manufactures prefab components for the housing industry. They have just been offered a new four year contract to supply a component, subject to them meeting certain quality requirements set by GREDA Ghana. The production manager is concerned that the current machine, which has been fully depreciated, will not be able to meet the stringent quality controls that will be required because the technology is obsolete, and the machine is unreliable. The company currently spends £50,000 per year to maintain and operate this machine which has no secondhand market value. On the basis of the production managerʼs recommendation, management has decided to replace the current machine. It is estimated that the replacement machine will cost £1 million with a four-year useful life. The companyʼs depreciation policy is to use a 20% reducing balance method over the life of the asset. As part of the purchase agreement for the new machine, the suppliers are offering a special maintenance…arrow_forwardSafe Travel produces car seats for children from newborn to 2 years old. The company is worried because one of its competitors has recently come under public scrutiny because of product failure. Historically, Safe Travel's only problem with its car seats was stitching in the straps. The problem can usually be detected and repaired during an internal inspection. The cost of the inspection is $5.00 per car seat, and the repair cost is $1.00 per car seat. All 200,000 car seats were inspected last year, and 5% were found to have problems with the stitching in the straps during the internal inspection. Another 1% of the 200,000 car seats had problems with the stitching, but the internal inspection did not discover them. Defective units that were sold and shipped to customers needed to be shipped back to Safe Travel and repaired. Shipping costs are $8.00 per car seat, and repair costs are $1.00 per car seat. However, the out-of-pocket costs (shipping and repair) are not the only costs of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education