FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

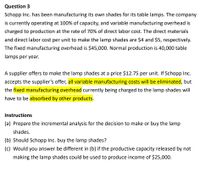

Transcribed Image Text:Question 3

Schopp Inc. has been manufacturing its own shades for its table lamps. The company

is currently operating at 100% of capacity, and variable manufacturing overhead is

charged to production at the rate of 70% of direct labor cost. The direct materials

and direct labor cost per unit to make the lamp shades are $4 and $5, respectively.

The fixed manufacturing overhead is $45,000. Normal production is 40,000 table

lamps per year.

A supplier offers to make the lamp shades at a price $12.75 per unit. If Schopp Inc.

accepts the supplier's offer, all variable manufacturing costs will be eliminated, but

the fixed manufacturing overhead currently being charged to the lamp shades will

have to be absorbed by other products.

Instructions

(a) Prepare the incremental analysis for the decision to make or buy the lamp

shades.

(b) Should Schopp Inc. buy the lamp shades?

(c) Would you answer be different in (b) if the productive capacity released by not

making the lamp shades could be used to produce income of $25,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishnuarrow_forwardIPort Products makes cases for portable music players in two processes, cutting and sewing. The cutting process has a capacity of 115,000 units per year; sewing has a capacity of 150,000 units per year. Cost information follows. Inspection and testing costs $ 47,500 Scrap costs (all in the cutting dept.) 147,500 Demand is very strong. At a sales price of $15.00 per case, the company can sell whatever output it can produce. IPort Products can start only 115,000 units into production in the Cutting Department because of capacity constraints. Defective units are detected at the end of production in the Cutting Department. At that point, defective units are scrapped. Of the 115,000 units started at the cutting operation, 17,250 units are scrapped. Unit costs in the Cutting Department for both good and defective units equal $11.30 per unit, including an allocation of the total fixed manufacturing costs of $264,500 per year to units. Direct…arrow_forwardA company makes 36,000 motors to be used in the production of its blender. The average cost per motor at this level of activity is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead An outside supplier recently began producing a comparable motor that could be used in the blender. The price offered to the company for this motor is $23.95. There would be no other use for the production facilities and none of the fixed manufacturing overhead cost could be avoided. The annual financial advantage (disadvantage) for the company as a result of making the motors rather than buying them from the outside supplier would be: Multiple Choice O O O ($68,400) $214,200 $9.50 $ 8.50 $ 3.45 $ 4.40 90,000 $158,400arrow_forward

- Nardin Outfitters has a capacity to produce 21,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $1,800 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Total costs The company has received a special order for 2,300 tents at a price of $780 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $63 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case Required: a. What is the…arrow_forwardCrane Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 56% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 31,100 curtain rods per year. A supplier offers to make a pair of finials at a price of $13.30 per unit. If Crane Ranch accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $47,500 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net Inco Make Buy Increase (De Direct 2$ 124400 i $ $ materials Direct labor 155500 i Variable overhead 87080…arrow_forwardBenitez Company currently outsources a relay switch that is a component in one of its products. The switches cost $40 each. The company is considering making the switches internally at the following projected annual production costs: Unit-level material cost $ 8 Unit-level labor cost $ 7 Unit-level overhead $ 6 Batch-level set-up cost (4,000 units per batch) $ 30,000 Product-level supervisory salaries $ 40,000 Allocated facility-level costs $ 25,000 The company expects an annual need for 4,000 switches. If the company makes the product, it will have to utilize factory space currently being leased to another company for $2,000 a month. If the company decides to make the parts, total costs will be: Multiple Choice a.$18,000 more than if the switches are purchased. b.$43,000 more than if the switches are purchased. c.$22,000 less than if the switches are purchased. d.$25,000 less than if the switches are purchased.arrow_forward

- Sheridan Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 51% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 31,700 curtain rods per year. A supplier offers to make a pair of finials at a price of $13.05 per unit. If Sheridan Ranch accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $46,900 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) Direct materials Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Make $ Buy…arrow_forwardTom's Toolery is operating at 70% of its productive capacity. It is currently paying $23 per unit for a part used in its manufacturing operation. Tom's estimates it could make the part internally for a total cost of $26 per unit, consisting of $19 of unit-level production costs and $7 of facility-level costs that are currently attributed to other products. Tom's usually purchases 51,000 units of the part each year. These units could be manufactured using Tom's excess capacity. What is the effect on cost if the company decides to start making the part? Multiple Choice $204,000 cost decrease $102,000 cost increase $204,000 cost increase $1,020,000 cost increasearrow_forwardSheridan Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 66% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 34,300 curtain rods per year. A supplier offers to make a pair of finials at a price of $13.05 per unit. If Sheridan Ranch accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $45,700 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials. Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Total…arrow_forward

- Sheridan Inc. has been manufacturing its own shades for its table lamps. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 50% of direct labour costs. The direct materials and direct labour costs per unit to make the lampshades are $4.50 and $5.50, respectively. Normal production is 48,000 table lamps per year. A supplier offers to make the lampshades at a price of $13.20 per unit. If Sheridan Inc. accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $40,000 of fixed manufacturing overhead currently being charged to the lampshades will have to be absorbed by other products. Prepare the incremental analysis for the decision to make or buy the lampshades. (Round answers to O decimal places, e.g. 5,275. If an amount reduces the net income then enter with a negative sign preceding the number e.g. -15,000 or parenthesis, e.g. (15,000). While alternate approaches are…arrow_forwardNardin Outfitters has a capacity to produce 12,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $900 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 440 Fixed manufacturing costs 90 Variable selling and administrative costs 80 Fixed selling and administrative costs 50 Total costs $ 660 The company has received a special order for 500 tents at a price of $600 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $45 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case $ 600 Variable manufacturing costs 440 Fixed manufacturing costs 90 Variable selling and administrative costs 45 Fixed selling and…arrow_forwardIvanhoe Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 61% of direct labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively. Normal production is 32,300 curtain rods per year. A supplier offers to make a pair of finials at a price of $12.90 per unit. If Ivanhoe accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $46,500 of fixed manufacturing overhead currently being charged to the finials will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45)) Direct materials Direct labor Variable overhead costs Fixed manufacturing costs Purchase price Total annual cost (c) (b)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education