FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

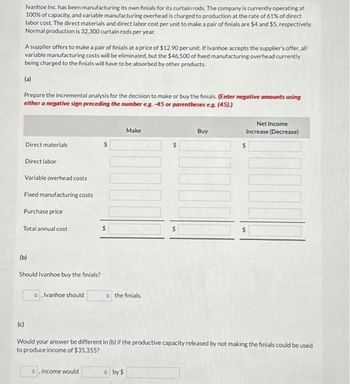

Transcribed Image Text:Ivanhoe Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at

100% of capacity, and variable manufacturing overhead is charged to production at the rate of 61% of direct

labor cost. The direct materials and direct labor cost per unit to make a pair of finials are $4 and $5, respectively.

Normal production is 32,300 curtain rods per year.

A supplier offers to make a pair of finials at a price of $12.90 per unit. If Ivanhoe accepts the supplier's offer, all

variable manufacturing costs will be eliminated, but the $46,500 of fixed manufacturing overhead currently

being charged to the finials will have to be absorbed by other products.

(a)

Prepare the incremental analysis for the decision to make or buy the finials. (Enter negative amounts using

either a negative sign preceding the number eg.-45 or parentheses e.g. (45))

Direct materials

Direct labor

Variable overhead costs

Fixed manufacturing costs

Purchase price

Total annual cost

(c)

(b)

Should Ivanhoe buy the finials?

o, Ivanhoe should

o, income would

Make

JOONU

o the finials.

by $

Buy

Would your answer be different in (b) if the productive capacity released by not making the finials could be used

to produce income of $35,355?

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Session Company uses 5,000 units of Part Y each year as a component in the assembly of one of its products. The company is presently producing Part Y internally at a total cost of $72,000 as follows: Direct materials $18,000 Direct labor $20,000 Variable MOH $10,000 Fixed MOH $24,000 Total costs $72,000 An outside supplier has offered to provide Part Y at a price of $12 per unit. If Session Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated. Accepting the outside supplier's offer leads to an annual advantage/disadvantage of: Advantage of $4,000 Disadvantage of $4,000 Disadvantage of $12,000 Advantage of $12,000arrow_forwardMelbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs: Direct materials $ 250,000 Direct labor $ 200,000 Variable manufacturing overhead $ 190,000 Fixed manufacturing overhead $ 120,000 Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for revenue of $80,000 per year if the subcomponent were purchased from the outside supplier. The financial advantage (disadvantage) of making the subcomponent would be: Multiple Choice $0 $280,000 $120,000 $200,000arrow_forwardVishnuarrow_forward

- Nardin Outfitters has a capacity to produce 21,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $1,800 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Total costs The company has received a special order for 2,300 tents at a price of $780 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $63 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case Required: a. What is the…arrow_forwardMorning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,900 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Suppose it sells each birdbath for $24. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,800 units.arrow_forwardColt Company owns a machine that can produce two specialized products. Production time for Product TLX is three units per hour and for Product MTV is five units per hour. The machine’s capacity is 2,600 hours per year. Both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 4,420 units of Product TLX and 5,995 units of Product MTV. Selling prices and variable costs per unit to produce the products follow. $ per unit Product TLX Product MTV Selling price per unit $ 11.50 $ 6.90 Variable costs per unit 3.45 4.14 Determine the company's most profitable sales mix and the contribution margin that results from that sales mix. (Round per unit contribution margins to 2 decimal places.)arrow_forward

- Tom's Toolery is operating at 70% of its productive capacity. It is currently paying $23 per unit for a part used in its manufacturing operation. Tom's estimates it could make the part internally for a total cost of $26 per unit, consisting of $19 of unit-level production costs and $7 of facility-level costs that are currently attributed to other products. Tom's usually purchases 51,000 units of the part each year. These units could be manufactured using Tom's excess capacity. What is the effect on cost if the company decides to start making the part? Multiple Choice $204,000 cost decrease $102,000 cost increase $204,000 cost increase $1,020,000 cost increasearrow_forwardWhispering Winds Inc. has been manufacturing capacity, and variable manufacturing and direct labour costs per unit to make the A supplier offers to make the lampshades per year. variable manufacturing costs will be its own shades for its table lamps. The company is currently operating at 100% of overhead is charged to production at the rate of 50% of direct labour costs. The direct materials lampshades are $4.70 and $5.60, respectively. Normal production is 48,800 table lamps at a price of $13.50 per unit. If Whispering Winds Inc. accepts the supplier's offer all eliminated, but the $41.300 of fixed manufacturing overhead currently being charged to the lampshades will have to be absorbed by other productsarrow_forwardNardin Outfitters has a capacity to produce 12,000 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $900 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 440 Fixed manufacturing costs 90 Variable selling and administrative costs 80 Fixed selling and administrative costs 50 Total costs $ 660 The company has received a special order for 500 tents at a price of $600 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $45 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case $ 600 Variable manufacturing costs 440 Fixed manufacturing costs 90 Variable selling and administrative costs 45 Fixed selling and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education