Concept explainers

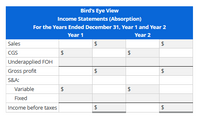

Bird’s Eye View manufactures satellite dishes used in residential and commercial installations for satellite-broadcasted television. For each unit, the following costs apply: $50 for direct material, $100 for direct labor, and $60 for variable

| Year 1 | Year2 | |

| Selling price per unit | $500 | $500 |

| Number of units sold | 24,000 | 28,800 |

| Number of units produced | 30,000 | 26,400 |

| Beginning inventory (units) | 18,000 | 24,000 |

| Ending inventory (units) | 24,000 | ? |

a. Prepare pre-tax income statements under absorption and variable costing for Year 1 and Year 2, with any volume variance being charged to Cost of Goods Sold.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Han Products manufactures 21,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is: Direct materials$ 3.50Direct labor9.00Variable manufacturing overhead2.50Fixed manufacturing overhead9.00Total cost per part$ 24.00 An outside supplier has offered to sell 21,000 units of part S-6 each year to Han Products for $20 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $71,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier’s offer?arrow_forwardOriole Inc. has been manufacturing its own shades for its table lamps. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at the rate of 45% of direct labour costs. The direct materials and direct labour costs per unit to make the lampshades are $4.70 and $5.90, respectively. Normal production is 50,800 table lamps per year. A supplier offers to make the lampshades at a price of $13.60 per unit. If Oriole Inc. accepts the supplier's offer, all variable manufacturing costs will be eliminated, but the $42,700 of fixed manufacturing overhead currently being charged to the lampshades will have to be absorbed by other products. (a) Prepare the incremental analysis for the decision to make or buy the lampshades. (Round answers to O decimal places, eg 5.275. If an amount reduces the net income then enter with a negative sign preceding the number eg.-15,000 or parenthesis, eg (15,000) While alternate approaches are possible,…arrow_forwardEvery year Riverbed Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials $ 5.00 Direct labor 11.00 Variable manufacturing overhead 6.00 Fixed manufacturing overhead 10.00 Total $32.00 Ivanhoe, Inc., has offered to sell 7,300 units of part 231 to Riverbed for $34 per unit. If Riverbed accepts Ivanhoe’s offer, its freed-up facilities could be used to earn $10,500 in contribution margin by manufacturing part 240. In addition, Riverbed would eliminate 40% of the fixed overhead applied to part 231.(a) Calculate total relevant cost to make and net cost to buy. Total relevant cost to make $enter a dollar amount Net relevant cost to buy $enter a dollar amount (b) Should Riverbed accept Ivanhoe’s offer?arrow_forward

- Han Products manufactures 40,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per uni for part S-6 is: Direct materials Direct labor Variable manufacturing overhead $ 3.30 12.00 2.70 Fixed manufacturing overhead Total cost per part 6.00 $ 24.00 An outside supplier has offered to sell 40,000 units of part S-6 each year to Han Products for $22 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $90,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? Answer is complete but not entirely correct. Financial advantage $ 8,000 ×arrow_forwardHan Products manufactures 38,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per part $ 3.10 10.00 2.90 9.00 $ 25.00 An outside supplier has offered to sell 38,000 units of part S-6 each year to Han Products for $21 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company for $88,000 per year. However, Han Products determined two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part S-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? > Answer is complete but not entirely correct. Financial advantage $ 126,000arrow_forwardEvery year Marigold Industries manufactures 6,100 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) Total relevant cost to make $ $4.00 Net relevant cost to buy 10.00 Carla Vista, Inc., has offered to sell 6,100 units of part 231 to Marigold for $34 per unit. If Marigold accepts Carla Vista's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Marigold would eliminate 40% of the fixed overhead applied to part 231. $ 6.00 10.00 Calculate total relevant cost to make and net cost to buy. $30.00arrow_forward

- Beta makes a component used in its engine. Monthly production costs for 1,000 component units are as follows: Direct materials $46,000 Direct labor 11,500 Variable overhead costs 34,500 Fixed overhead costs 23,000 Total costs $115,000 It is estimated that 8% of the fixed overhead costs will no longer be incurred if the company purchases the component from an outside supplier. Beta has the option of purchasing the component from an outside supplier at $97.75 per unit. 22) If Beta accepts the offer from the outside supplier, the monthly avoidable costs (costs that will no longer be incurred) total 23) If Beta purchases 1,000 units from the outside supplier per month, then what would be the change in operating income?arrow_forwardPenagos Corporation is presently making part Z43 that is used in one of its products. A total of 5,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity: Direct materials. Direct labor Variable overhead Supervisor's salary Depreciation of special equipment Allocated general overhead An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided. If management decides to buy part Z43 from the outside supplier rather than to…arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $30 per unit and $45 is used in direct labor, while the direct material for the double is $45 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 10,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: Activity CostPools Driver EstimatedOverhead Use perTwin Use perDouble Framing Square Feet of Pine $270,000 6,000 3,000 Padding Square Feet of Quilting 230,000 130,000 100,000 Filling Square Feet of Filling 240,000 450,000 350,000 Labeling Number of Boxes 250,000 850,000 400,000 Inspection Number of Inspections 165,000 11,000 4,000 After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Purchasing (per order) $56 Utilities (per square foot) 2 Machine Setups (per machine hour) 7 Supervision (per direct labor hour)…arrow_forward

- Old Camp Company manufactures awnings for its own line of tents. The company currently is operating at capacity and received an offer from one of its suppliers to make the 11,000 awnings it needs for $20 each. Old Camp’s costs for making the awning are $7 in direct materials and $6 in direct labor. Variable manufacturing overhead is 75 percent of direct labor. If Old Camp accepts the offer, $37,000 of fixed manufacturing overhead currently being charged to the awnings will have to be absorbed by other product lines. Required: Complete the incremental analysis for the decision to make or buy the awnings in the table provided below. Should Old Camp continue to manufacture the awnings, or should it purchase the awnings from the supplier? Assuming the capacity released by purchasing the awnings allowed Old Camp to record a profit of $35,000, should Old Camp continue to manufacture or purchase the awnings?arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently: The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is Oat Treats' relevant cost? What does Simmons Cereal's offer cost? If Oat Treats accepts the offer, what will the effect on profit be? Incremental dollar amount = _________ Increase or Decrease? . ___________ Please note: Your answer is either "Increase" or "Decrease" - capital first letters and no quotes.arrow_forwardDiamond Brands manufactures rice, wheat, and oat cereals. Sanders Company has approached Diamond Brands with a proposal to sell the company the rice cereals at a price of $22,000 for 20,000 pounds. The following costs are associated with production of 20,000 pounds of rice cereal: Direct material $13,000 Direct labor 5,000 Manufacturing overhead 7,000 Total $25,000 The manufacturing overhead consists of $5,000 of variable costs with the balance being allocated to fixed costs. What is the amount of avoidable costs if Diamond Brands buys rather than makes the rice cereal? $25,000 $23,000 $21,000 $20,000 $22,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education