FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Preparing Common-Size Income Statements by Using Base

Period Horizontal Analysis

Refer to the information for Scherer Company on the previous page.

Required:

Prepare common-size income statements by using Year 1 as the base period. (Note: Round

answers to the nearest whole percentage.)

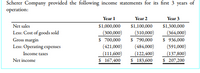

Transcribed Image Text:Scherer Company provided the following income statements for its first 3 years of

operation:

Year 1

Year 2

Year 3

Net sales

$1,000,000

$1,100,000

$1,300,000

Less: Cost of goods sold

Gross margin

Less: Operating expenses

(300,000)

(310,000)

(364,000)

$ 700,000

$ 936,000

$ 790,000

(484,000)

(421,000)

(591,000)

(111,600)

$ 167,400

Income taxes

(122,400)

$ 183,600

(137,800)

$ 207,200

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?arrow_forwardOnly typed answerarrow_forwardMatch the following ratio functions with the ratio (place the number of your chosen answer into the box with the border beside the term you think it goes with : Dividend Yield Debt ratio Current Ratio Price/Earnings Ratio Acid-test ratio Earnings per share 1. The amount of net income earned for each share of the company's common stock 2. The percentage of a stock's market value returned to stockholders as dividends each period 3. The ability to pay current liabilities with current assets. 4. The percentage of assets financed with debt. 5. The ability to pay all current liabilities if they come due immediately. 6. The market price of $1 of earnings.arrow_forward

- Use the following data from Burt Co., taken from the ledger after adjustment on December 31 the end of the fiscal year. Accounts Payable $97,200 Accounts Receivable 64,300 Accumulated Depreciation-Office Equipment 72,750 Accumulated Depreciation-Store Equipment 162,100 Administrative Expenses 56,500 Cash 53,000 Cost of Merchandise Sold 121,700 Interest Expense 12,000 Maeve Burt, Capital 81,750 Maeve Burt, Drawing 52,000 Merchandise Inventory 93,250 Note Payable (due in two years) 154,000 Office Equipment 149,750 Prepaid Insurance 6,500 Rent Revenue 17,500 Salaries Payable 28,700 Sales 365,500 Selling Expenses 41,500 Store Equipment 325,000 Supplies 4,000arrow_forward2) Ratios Based on the information given in picture #1, complete the following ratios for the last TWO years and indicate whether the trend is favorable or unfavorable. Note percentages and times should be to one decimal place (e.g. 14.8%; 5.8x) Profitability Ratios Current Yr. Prior Yr. Fav/Unfav. Gross Margin (%) {Gross Income/Sales Revenue} Profit Margin (%) {Net income/ Sales Revenue} Return on Assets (%) {Net Income/ Average Total Assets}arrow_forwardCurrent assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land T Total assets Total plant and equipment Assets Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities: Mortgage note payable despaces Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ $ $ $ Show Transcribed Text S $ LOGIC COMPANY Comparative Balance Sheet December 31, 2019 and 2020 2020 $ $ $ $ $ $ Amount www. 93,200 13,700 7,700 21,400 22,700 44,100 12,700 17,200 9,200 21,700 27,400 49,100 93,200 24,700 63.800 15,200 14,200 29,400 93,200 Percent. $ $ $ $ S $ $ $ $ $ $ $ ---- 69,900 7,700 5,700 13,400 21,200 34,600 21,700 13,600 35,300 69,900 Amount 2019 9,700 13,200 14,700 10,700 48.300 11,900 9,700 21,600 69,900 Percentarrow_forward

- N1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forwardRequired: 1. Complete the following columns for each item in the comparative financial statements (Negative answers shoul be indicated by a minus sign. Round percentage answers to 2 decimal places, i.e., 0.1243 should be entered as 12.43.): Increase (Decrease) Year 2 over Year 1 Amount Percentage Statement of earnings: Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings $ 45,770 38,650 7,120 4,020 3,100 1,050 $ 2,050 Statement of financial position: Cash (4,720) Accounts receivable (net) (4,220) Inventory 6,200 Property, plant, and equipment (net) 6,380 $ 3,640 Current liabilities (3,840) Long-term debt 3,530 Common shares 0 Retained earnings 3,950 $ 3,640arrow_forwardWhich of the following statements regarding horizontal analysis is not true? a. It can be useful in interpreting the financial performance of a company. b. The amount of each item on a current financial statement is compared to the same item on an earlier statement. c. In horizontal analysis, the earlier year is used as the base year for calculating percentage changes. d. Each item on a current financial statement is compared to the same item on a competitor's statement.arrow_forward

- A condensed income statement for Stock Storage and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. 2. Does Stock's Cost of Goods sold for the current year, as a percentage of revenues, represent better or worse performance as compared to that for the previous year? 3. Has Stock"s net profit margin increased, or decreased, over the two years? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete the vertical analysis by computing each missing line item as a percentage of sales revenues. (Round your answers to the nearest whole percent.) STOCK STORAGE Income Statement (summarized) (in millions of U.S. dollars) Current Year Previous Year Sales Revenues $ 2,090 100 % $ 2,170 100 % Cost of Goods Sold 1,697 81 % 1,661 % Selling, General, and Administrative Expenses 285 % 286 13 % Other Operating Expenses 51 2 %…arrow_forward8arrow_forwardUsing the income statement information for Omega Corporation that follows, prepare a vertical analysis of the income statement for Omega Corporation. If required, round percentages to one decimal place. Percentage sign will appear automatically. Omega Corporation Income Statement 1 Amount Percentage 2 Sales $500,000.00 3 Cost of goods sold 300,000.00 4 Gross profit $200,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education