Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

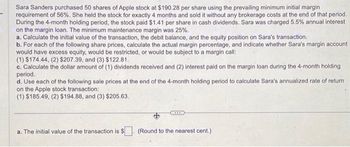

Transcribed Image Text:Sara Sanders purchased 50 shares of Apple stock at $190.28 per share using the prevailing minimum initial margin

requirement of 56%. She held the stock for exactly 4 months and sold it without any brokerage costs at the end of that period.

During the 4-month holding period, the stock paid $1.41 per share in cash dividends. Sara was charged 5.5% annual interest

on the margin loan. The minimum maintenance margin was 25%.

a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction.

b. For each of the following share prices, calculate the actual margin percentage, and indicate whether Sara's margin account

would have excess equity, would be restricted, or would be subject to a margin call:

(1) $174.44, (2) $207.39, and (3) $122.81.

c. Calculate the dollar amount of (1) dividends received and (2) interest paid on the margin loan during the 4-month holding

period.

d. Use each of the following sale prices at the end of the 4-month holding period to calculate Sara's annualized rate of return

on the Apple stock transaction:

(1) $185.49, (2) $194.88, and (3) $205.63.

a. The initial value of the transaction is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 11 images

Knowledge Booster

Similar questions

- An investor bought 100 shares of a manufacturing company at $102 per share, with an initial margin of 60%. The investor was charged 9% margin interest annually. One year later, the investor sold the stock for $140 per share. The investor's holding period return is closest to:(a)54 % . (b)56 % . (c)123%. (d)223 %.arrow_forwardIsabella made an initial investment of $5000 in a trading account with a stock brokerage house. After a period of 17 months, the value of the account had increased to $6400. Assuming that there were no additions or withdrawals from the account, what was the nominal annual interest rate earned on the initial investment?arrow_forwardJedson Pinto is a trader for Articuno Capital. He decided to buy 100 shares of Tesla at $ 150 per share. Two-thirds of the purchase was paid with cash, with the remainder using borrowed money. One month later, the stock price increased to $165 per share. The annual interest rate is 2%. What is Pinto's levered return? Group of answer choices 19.67% 14.83% 10.00% 29.63%arrow_forward

- On January 1 of this year, Skamania Company completed the following transactions (assume a 8% annual interest rate): (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use the appropriate factor(s) from the tables provided. a. Bought a delivery truck and agreed to pay $60,200 at the end of three years. b. Rented an office building and was given the option of paying $10,200 at the end of each of the next three years or paying $28,200 immediately. c. Established a savings account by depositing a single amount that will increase to $90,400 at the end of seven years. d. Decided to deposit a single sum in the bank that will provide 8 equal annual year-end payments of $40,200 to a retired employee (payments starting December 31 of this year). Required: a. What is the cost of the truck that should be recorded at the time of purchase? b. Which option for the office building results in the lowest present value? c. What single amount must be deposited in this account on January 1 of this year?…arrow_forwardAmelia purchased 500 shares of Xienna stock at RM50 per share. She owns RM15,000 to invest and the minimum initial margin requirement is 50%. She held the stock for exactly four months and sold it without any brokerage cost at the end of that period. During the four-month holding period, the stock paid RM1.50 per share in cash dividends. Amelia was charged 8% annual interest on the margin loan. The minimum maintenance margin was 30%. While her husband, Afiq prefer to trade in stock futures. Afiq are bearish on Sunway stock and decide to short sells 300 shares. The initial margin is 50%, and the maintenance margin is 35%. A year later, Sunway price has risen from RM25 to RM37, and the stock has paid a dividend of RM2.00 per share. Required: a. Calculate the initial value of Amelia investment and borrowing amounts. b. What is the percentage margin when she first purchases the stock? c. Calculate the (1) dividend received and (2) interest paid on the margin loan during the four-month…arrow_forwardTammy Jackson purchased 109 shares of All-American Manufacturing Company stock at $33.60 a share. One year later, she sold the stock for $41 a share. She paid her broker a $35 commission when she purchased the stock and a $43 commission when she sold it. During the 12 months she owned the stock, she received $198 in dividends. Calculate Tammy's total return on this investment. Note: Round all intermediate calculations and final answer to the nearest whole number. Total returnarrow_forward

- Seven months ago, you purchased 400 shares of stock on margin. The initial margin requirement on your account is 70 percent and the maintenance margin is 30 percent. The call money rate on the margin loan is 6.65 percent. The purchase price was $16 a share. Today, you sold these shares for $18.00 each. What is your annualized rate of return? O 64.64 percent O 56.87 percent O 33.35 percent O 42.77 percent O 29.39 percent O Oarrow_forwardDerek purchased 845 shares of Texas Instruments Incorporated (TXN) for $172,540 in a margin account and posted initial margin of 45%. His broker, Justin, stated the maintenance margin requirement is 25%. The price of TXN, below which Derek would get a margin call, is closest to A. $100 B. $150 C. $200 D. $250arrow_forwardOn January 15th, Sahar purchased 5,000 shares of National Cement Co. on a margin of $160 per share. On March 15th the price of National Cement stock declined to $140. The initial margin and maintenance margin requirements were 60% and 40% respectively. What is the actual market value (AM) on March 5th ? 54.29% 42.86 % 40% 60%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education