FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

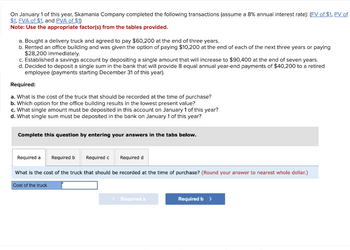

Transcribed Image Text:On January 1 of this year, Skamania Company completed the following transactions (assume a 8% annual interest rate): (FV of $1, PV of

$1, FVA of $1, and PVA of $1)

Note: Use the appropriate factor(s) from the tables provided.

a. Bought a delivery truck and agreed to pay $60,200 at the end of three years.

b. Rented an office building and was given the option of paying $10,200 at the end of each of the next three years or paying

$28,200 immediately.

c. Established a savings account by depositing a single amount that will increase to $90,400 at the end of seven years.

d. Decided to deposit a single sum in the bank that will provide 8 equal annual year-end payments of $40,200 to a retired

employee (payments starting December 31 of this year).

Required:

a. What is the cost of the truck that should be recorded at the time of purchase?

b. Which option for the office building results in the lowest present value?

c. What single amount must be deposited in this account on January 1 of this year?

d. What single sum must be deposited in the bank on January 1 of this year?

Complete this question by entering your answers in the tabs below.

Required d

What is the cost of the truck that should be recorded at the time of purchase? (Round your answer to nearest whole dollar.)

Cost of the truck

Required a

Required b

Required c

< Required a

Required b >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, a company agrees to pay $12,000 in eight years. If the annual interest rate is 4%, determine how much cash the company can borrow with this agreement. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.)arrow_forwardThe Strug Company purchased office furniture and equipment for $8,600 and agreed to pay for the purchase by making five annual installment payments beginning one year from today. The installment payments include interest at 8%. What is the required annual installment payment? Note: Use tables, Excel, or a financial calculator (EV of $1. PV of $1, EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Multiple Choice $1,994 $1720 $1,466 $2.154arrow_forwardKavra Corporation purchased a building by signing a $150,000 long-term mortgage with monthly payments of $2,000. The mortgage carries an interest rate of 12 percent. 1. Prepare a monthly payment schedule showing the monthly payment, the interest for the month, the reduction in debt, and the unpaid balance for the first three months. (Round to the nearest dollar.)2. Prepare the journal entries to record the purchase and the first two monthly payments.arrow_forward

- On January 1 of this year, Shannon Company completed the following transactions (assume a 9% annual interest rate): (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Bought a delivery truck and agreed to pay $61,900 at the end of three years. Rented an office building and was given the option of paying $11,900 at the end of each of the next three years or paying $34,000 immediately. Established a savings account by depositing a single amount that will increase to $93,800 at the end of seven years. Decided to deposit a single sum in the bank that will provide 9 equal annual year-end payments of $41,900 to a retired employee (payments starting December 31 of this year). Required: a. What is the cost of the truck that should be recorded at the time of purchase? (Round your answer to nearest whole dollar.) b. Which option for the office building results in the lowest present value? multiple choice Pay in three…arrow_forwardA property was purchased for $3799.00 down and payments of $1377.00 at the end of every six months for 4 years. Interest is 6% per annum compounded quarterly. What was the purchase price of the property? How much is the cost of financing?arrow_forwardOn January 1, 20x1, Lawrence Lenders loaned $9.6 million to Wilkins Food Products, Inc. to purchase a frozen food storage facility. Wilkins signed a three-year, 4% installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the following for Lawrence Lenders: 1. Prepare the journal entry for lending the funds on January 1, 20x1. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment received on December 31, 20x1. 4. Prepare the journal entry for the third installment payment received on December 31, 20x3. Complete this question by entering your answers in the tabs below. Req 2 Saved Req 1 3 and 4 2021 Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.) Dec. 31 Cash…arrow_forward

- Langara Woodcraft borrowed money to purchase equipment. The loan is repaid by making payments of $902.51 at the end of every six months over five years. If interest is 6.4% compounded monthly, what was the original loan balance?arrow_forwardDon James purchased a new automobile for $14,000. Don made a cash down payment of $3,500 and agreed to pay the remaining balance in 30 monthly installments, beginning one month from the date of purchase. Financing is available at a 24% annual interest rate. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:Calculate the amount of the required monthly payment. (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.)arrow_forwardA firm acquires a warehouse costing $60,000 on January 31. The firm makes a down payment of $7,000 and assumes a 20 year, 6% mortgage for the balance. Interest is payable on January 31 each year. If interest payment on mortgage is recognized on february 28th of the same year, what will be the interest payable.arrow_forward

- On January 1, Year 1, Brown Co. borrowed cash from First Bank by issuing a $100,000 face value, four-year term note that had an 8 percent annual interest rate. The note is to be repaid by making annual cash payments of $30,192 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $52,000 cash per year. Prepare an income statement, a balance sheet, and a statement of cash flows for each of the four years.arrow_forwardYour Corporation bought $450, 000 of equipment using an installment loan 1/1/20. The note provides for 4.5 % annual interest and equal annual payments of interest and principal of $91,395.50 on December 31 of each year. What is the amount of principal reduction related to the YEAR 2 payment?arrow_forwardDon James purchased a new automobile for $28,000. Don made a cash down payment of $7,000 and agreed to pay the remaining balance in 30 monthly installments, beginning one month from the date of purchase. Financing is available at a 24% annual interest rate. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.). Required: Calculate the amount of the required monthly payment. (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.) Monthly paymentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education