FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

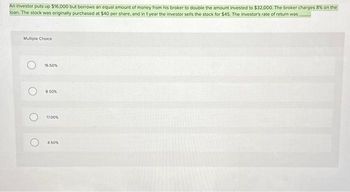

Transcribed Image Text:An investor puts up $16,000 but borrows an equal amount of money from his broker to double the amount invested to $32,000. The broker charges 8% on the

loan. The stock was originally purchased at $40 per share, and in 1 year the investor sells the stock for $45. The investor's rate of return was

Multiple Choice

O

O

16.50%

8.50%

17.00%

4.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Jacob purchased a bond for $880 with a 9% coupon. He sold the bond after one year when it was paying him a current yield of 10%. What is the holding period return? 9.0% 9.5% 10.0% 11.0% 12.5%arrow_forwardC.You register a saving plan offering $200,000 at the end of 20 years. The saving plan promises 6% APR (per year). How much do you need to deposit per year in the saving plan? D. You have a preferred stock paying $3 dividend. Its required rate of return is 10%. How much is the preferred stock? (Hint: the value of preferred stock is estimated with PV of perpetuity).arrow_forwardYou purchase 2,000 shares of Nice Kick Group (NKG) at $45 per share by giving your broker $60,000 to establish your margin account and borrowing the rest from your broker. A year has passed (t=1), and NKG paid out a dividend of $2 per share. The maintenance margin is 25%. If you paid an interest at a rate of 8% on the funds you borrowed from your broker, what is the NKG price at which would trigger a margin call? A. $60.94 B. $36.25 C. $71.07 D. $18.93arrow_forward

- 1. A mutual fund has an offer price of $7.82 per share and a net asset value of $7.41. What is the sales charge percent? (Round to the nearest tenth.) A. 5.2% B. 5.5% C. 6.5% D. 94.8% 2. If Tanya's husband were to die, she and her children could live on $64,400 per year. Tanya makes $35,100 annually, and estimates additional income of $21,500 from other sources. How much insurance should she purchase on her husband to cover the shortfall, assuming a 16.7% prevailing interest rate? (Round your answer to the nearest $1,000.) A. $40,000 B. $42,000 C. $47,000 D. $48,000arrow_forwardYou have a margin account and deposit Rs.90,000. Assuming the prevailing marginrequirement is 20%, commissions are ignored and D.G.K Cement stock is selling atRs.55 per share while Askari Cement stock is selling at Rs. 85 per share. You invest 40%of your investment in D.G.K cement while remaining is deposited in Askari cement.a. How many shares of each stock can you purchase using the maximum allowablemargin if you invest in both?b. What is your total and percentage profit (loss) if:1. the price of D.G.K Cement Rises to Rs.65 per share while Askari Cement stockrises to Rs. 97 per share?2. the price of D.G.K Cement reduces to Rs.42 per share while Askari Cementstock reduces to Rs. 76 per share?c. If you invest all money in D.G.K cement ONLY and the maintenance margin is 25%,to what price can D.G.K Cement stock fall before you will receive a margin call?d. If you invest all money in Askari cement ONLY and the maintenance margin is 25%,to what price can Askari cement stock fall before you…arrow_forwardSuppose Tyler initially pays $76,000 toward the purchase of $108,000 worth of stock, borrowing the remaining balance from one of notorious brokers, Diego. In this case, Tyler’s initial percentage margin is closest to A. 70.37%. B. 60.50%. C. 39.50%. D. 29.63%. Clear my choicearrow_forward

- Jedson Pinto is a trader for Articuno Capital. He decided to buy 100 shares of Tesla at $ 150 per share. Two-thirds of the purchase was paid with cash, with the remainder using borrowed money. One month later, the stock price increased to $165 per share. The annual interest rate is 2%. What is Pinto's levered return? Group of answer choices 19.67% 14.83% 10.00% 29.63%arrow_forwardYou sold short 200 shares of common stock at $60 per share. The initial margin is 65%. What would your rate of return be if you repurchase the stock at $80 per share. Ignore interest on the margin.arrow_forwardDee Trader opens a brokerage account and purchases 200 shares of Internet Dreams at $50 per share. She borrows $3,300 from her broker to help pay for the purchase. The interest rate on the loan is 6%. Required: a What is the margin in Dee's account when she first purchases the stock? b. If the share price falls to $40 per share by the end of the year, what is the remaining margin in her account?arrow_forward

- Seven months ago, you purchased 400 shares of stock on margin. The initial margin requirement on your account is 70 percent and the maintenance margin is 30 percent. The call money rate on the margin loan is 6.65 percent. The purchase price was $16 a share. Today, you sold these shares for $18.00 each. What is your annualized rate of return? O 64.64 percent O 56.87 percent O 33.35 percent O 42.77 percent O 29.39 percent O Oarrow_forwardFinance You short sold 700 shares of a stock at $25 a share. The initial margin requirement is 75 percent and the maintenance margin is 35 percent. The price of the stock has changed to $30 a share today. How much money do you owe your broker today? Provide the answer in dollars, accurate to two decimal places.arrow_forwardYou've just opened a margin account with $33,880 at your local brokerage firm. You instruct your broker to purchase 800 shares of Landon Golf stock, which currently sells for $77 per share. Suppose the call money rate is 6.5 percent and your broker charges you a spread of 1.25 percent over this rate. You hold the stock for four months and sell at a price of $84 per share. The company paid a dividend of $.32 per share the day before you sold your stock. a. What is your total dollar return from this investment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Dollar return b. What is your effective annual rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual return %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education