ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

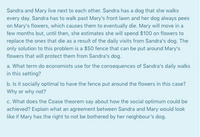

Transcribed Image Text:Sandra and Mary live next to each other. Sandra has a dog that she walks

every day. Sandra has to walk past Mary's front lawn and her dog always pees

on Mary's flowers, which causes them to eventually die. Mary will move in a

few months but, until then, she estimates she will spend $100 on flowers to

replace the ones that die as a result of the daily visits from Sandra's dog. The

only solution to this problem is a $50 fence that can be put around Mary's

flowers that will protect them from Sandra's dog.

a. What term do economists use for the consequences of Sandra's daily walks

in this setting?

b. Is it socially optimal to have the fence put around the flowers in this case?

Why or why not?

c. What does the Coase theorem say about how the social optimum could be

achieved? Explain what an agreement between Sandra and Mary would look

like if Mary has the right to not be bothered by her neighbour's dog.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are an avid 34 year old coffee drinker, and never miss a day without your $4.00 Starbucks caffe latte. However, you also understand the importance of the time value of money and saving for retirement early, so you set a New Year's Resolution to abstain from your coffee-drinking ways this year. At the end of the year, you will place all of your coffee savings in a retirement account. How much will this savings amount to when you retire in 30 years at the age of 65, if invested at a 7.5% annual interest rate (rounded to the nearest dollar)? Assume that the cost of the cup of coffee remains unchanged throughout the year.arrow_forwardMary Ann requires approximately 30 pounds of bananas each month, January through June, and 35 pounds of bananas each month, July through December, to make banana cream pies for her friends. Bananas can be bought at a local market for 40 cents/lb. If Mary Ann’s cost of money is 3%, approximately how much should she set aside at the beginning of each year to pay for the bananasarrow_forwardA volunteer has been asked to drop off some supplies at a facility housing victims of a hurricane evacuation. The volunteer would like to bring at least 132 bottles of water, 82 first aid kits, and 45 security blankets on his visit. The relief organization has a standing agreement with two companies that provide victim packages. Company A can provide packages of 6 water bottles, 4 first aid kits, and 3 security blankets at a cost of $3. Company B can provide packages of 9 water bottles, 5 first aid kits, and 1 security blanket at a cost of $2. How many of each package should the volunteer pick up to minimize the cost? What amount does the relief organization pay? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- How can we obtain Incremental Cash Flows from Undertaking a Project?arrow_forwardMike breaks his hand playing in his weekly basketball league and needs surgery. The hand surgery costs $10,000 total. If Mike's health insurance plan has a $5,000 deductible, an 80%/20% coinsurance rate, and he has used $500 of his deductible so far this year, how much of the new medical bill will Mike's insurance company pay for?arrow_forward[Use Excel] You are planning to buy a new car before you move to a new place for a job after graduation. You are given two options. The first one is the Toyota Prius which has an initial cost of $25,000 with miles per gallon (MPG) of 50. The second option is a regular sedan car with an initial cost of $18,000 and an MPG of 25. If the gasoline price is $ 4.50/gallon, the annual effective interest rate is 8%, beyond which annual mileage of the car you will choose Prius over the regular car. The car is supposed to stay for 10 years. [Round the final answer to an integer by round(answer,0) command]arrow_forward

- Sabrine purchased 4,500 shares of a mutual fund at an offer price of $8.88 per share. Later, she sold the investment for $7.38 per share. During the time she owned the shares, the fund paid a dividend of $0.52 per share. What was her return on her investment? (Round to the nearest tenth.)arrow_forwardI think the question b should be $500,000 NOT $5,000,000arrow_forwardThe maximum amount an individual can contribute to her Registered Retirement Savings Plan (RRSP) for a year is set by the Canada Revenue Agency. For the year 2011, the maximum contribution was the lesser of $21450 or 18% of the individual's "earned income" in 2010. The lowest amount of earned income for 2010 at which an individual could make a $21450 contribution in 2011 is $ Do not round your answer! Input the whole number part only, e.g., if the answer is 2566.65 input 2566. Do not include a $ sign, commas, or spaces in the answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education