ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

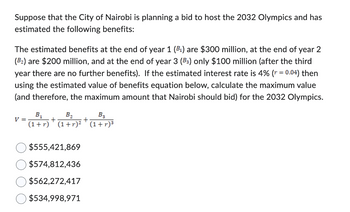

Transcribed Image Text:Suppose that the City of Nairobi is planning a bid to host the 2032 Olympics and has

estimated the following benefits:

The estimated benefits at the end of year 1 (B₁) are $300 million, at the end of year 2

(B₂) are $200 million, and at the end of year 3 (B3) only $100 million (after the third

year there are no further benefits). If the estimated interest rate is 4% (r = 0.04) then

using the estimated value of benefits equation below, calculate the maximum value

(and therefore, the maximum amount that Nairobi should bid) for the 2032 Olympics.

V =

B₁ B₂ B3

(1+r) (1+r)² (1+r)³

+

$555,421,869

$574,812,436

$562,272,417

$534,998,971

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are a Vice President of Finance for a small waste disposal company who has just been fined $500,000.00. You believe you will need the money in six years, currently money market rates are paying 2.00% . How much do you need to invest at 2.00% to each year to have the money available in six years? $83,569.69 $76,124.29 $79,262.91 $78,159.39arrow_forwardQ12arrow_forwardRosa, age 35, is starting her savings plan this year by putting away $2,900.00 at the end of every year until she reaches age 65. She will deposit this money at her local savings and loan at an interest rate of 6%. The future value annuity interest factor is 79.0582. Based on the information provided, by the time Rosa turns 65, she will have . Nick started his investment program five years earlier and set aside more than Rosa. By the time Nick turns 65, he will have accumulated more than Rosa.arrow_forward

- You finish your engineering degree with $17,350 in student loans. The interest rate on your loans is 0.6% per month. The loan repayment period is 10 years and your monthly payment is set to be $203.24 [= $17,350(A/P, 0.6%, 120)]. Question 1: You can reduce the interest rate to 0.5% per month if you agree to repay the loan over the next 5 years. If you agree to this, how much is the monthly payment? Round your answer to the nearest cent (e.g., 473.24). Question 2:arrow_forwardSuppose $100 is invested today in a project that returns $330 in 6 years. Calculate the IRR of this investment.arrow_forwardLabco Scientific sells high-purity chemicals to universities, research laboratories and pharmaceutical companies. The company wants to invest in new equipment that will reduce shipping costs by better matching the size of the completed products with the size of the shipping container. The new equipment is estimated to cost $575,000 to purchase and install now. (See cash flow diagram below) j= 8% A=? 1 3 4 A= Represents savings every year $575,000 The correct equation to calculate how much Labco must save each year for 5 years in order to justify the investment at an interest rate of 8% per year is: 0.05(1+0.05)* ((1+0.05)* –1) A = 575, 000 0.05 A = 575, 000 ((1+0.05)*–1) 0.08(1+0.08) ((1+0.08) –1) A = 575, 000 O A = 575, 000(1+0.08)°arrow_forward

- John is a very cost-conscious investor. His rule of thumb is that it costs $300 per year, starting in the first year of vehicle life to maintain an automobile. This expense increases by $300 each year over the life of the car. John is now considering the purchase of a six-year old car with 40,000 miles on it for $7,000. How much money will John have to set aside now to pay for maintenance (as a lump sum) if he keeps this car for seven years? John's interest rate is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 4% per year. John will have to set aside $ to pay for maintenance. (Round to the nearest dollar.)arrow_forwardThree months ago, Jim purchased $11,000 of U.S. Treasury bonds. These bonds have a 30-year maturity period, and they pay dividends every three months at an APR of 17%. However, today's interest rates for similar securities have risen to a (17+1)%APR (compounded quarterly). In view of the interest-rate increase to (17+1)%, what is the current value of Jim's bonds today?arrow_forwardJohn is a very cost-conscious investor. His rule of thumb is that it costs $300 per year, starting in the first year of vehicle life to maintain an automobile. This expense increases by $300 each year over the life of the car. John is now considering the purchase of a five-year old car with 40,000 miles on it for $6,000. How much money will John have to set aside now to pay for maintenance (as a lump sum) if he keeps this car for seven years? John's interest rate is 7% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 7% per year. John will have to set aside $ to pay for maintenance. (Round to the nearest dollar.) Carrow_forward

- Globo-Chem Co. is expected to generate a free cash flow (FCF) of $1,065.00 million this year (FCF, = $1,065.00 million), and the FCF is expected to grow at a rate of 26.20% over the following two years (FCF, and FCF,). After the third year, however, the FCF is expected to grow at a constant rate of 4.26% per year, which will last forever (FCF.). Assume the firm has no nonoperating assets. If Globo-Chem Co.s weighted average cost of capital (WACC) is 12.78%, what is the current total firm value of Globo-Chem Co.? (Note: Round all intermediate calculations to two decimal places.) O $21,183,44 million O $3,183.42 million $17,652.87 million $23,939.64 million Globo-Chem Co.s debt has a market value of $13,240 million, and Globo-Chem Co. has no preferred stock, If Globo-Chem Co. has 600 million shares of common stock outstanding, what is Globo-Chem Co.s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimal places.) $8.09 O $6.35 O…arrow_forwardPleasearrow_forwardQuestion 3 You are looking at purchasing a new computer for your four-year undergraduate program. Brand 1 costs $4,040 now, and you expect it will last throughout your program without any upgrades. Brand 2 costs $2,440 now, and will need an upgrade at the end of two years, which you expect to be $1,725. With an 8% annual interest, compounded monthly, which is the less expensive alternative, if they provide the same level of service and will both be worthless at the end of the four years? [NOTE: In general and unless asked for otherwise, comparisons of project should be conducted in present worth dollars] Which Brand is preferred (enter either '1' or '2')? How much will you save by purchasing your preferred brand over the other? (Round your answer to the nearest dollar and enter it as a positive number) $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education