FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

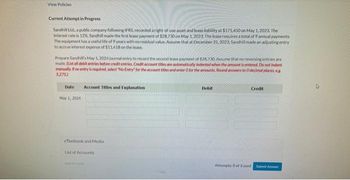

Transcribed Image Text:View Policies

Current Attempt in Progress

Sandhill Ltd, a public company following IFRS, recorded a right-of-use asset and lease liability at $171,450 on May 1, 2023. The

interest rate is 12%. Sandhill made the first lease payment of $28,730 on May 1, 2023. The lease requires a total of 9 annual payments.

The equipment has a useful life of 9 years with no residual value. Assume that at December 31, 2023, Sandhill made an adjusting entry

to accrue interest expense of $11.418 on the lease.

Prepare Sandhill's May 1, 2024 journal entry to record the second lease payment of $28.730 Assume that no reversing entries are

made. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts Round answers to Odecimal places, eg

5,275.)

Date Account Titles and Explanation

May 1, 2024

eTextbook and Media

List of Accounts

Debit

Credit

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2020, is $700,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Jensen estimates that the expected residual value at the end of the lease term will be $50,000. Jensen amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Glaus desires a 5% rate of return on its investments. Jensen's incremental borrowing rate is 6%, and the lessor's implicit rate is unknown. Instructions (Assume the accounting period ends on…arrow_forwardBrown Enterprises enter into a 4 year lease with ABC Leasing Company. The lease qualifies as an operating lease. The first lease payment of $100,000 was due on January 1, 2024, on the date the lease was executed and all subsequent lease payments due on December 31. The present value of the lease payments was $348,685 and Brown Enterprises correctly recorded the right of use asset and lease liability on January 1, 2024 for this amount. The implicit rate in the lease is 10%. On its 2024 income statement, when Brown Enterprises reports its lease expense for 2024, it will be made up of which of the following components? (Choose all that apply) DAROU amortization $75,132 8. Interest expense $12,829 OCROU amortization $87,171 OD. Interest expense $24,869 Quesdan 12 of 25arrow_forwardOn January 1, 2024, Blue Co. recorded a right-of-use asset of $869,628 in a 10-year operating lease. The lease calls for ten annual payments of $120,000 at the beginning of each year. The interest rate charged by the lessor was 8%. What amount will Blue Co. record for amortization expense on December 31, 2024? O $60,030 O $64,832 O $86,963 $59,970 ringarrow_forward

- Norton company leased equipment from factiva leasing Co. On january 1, 2024, in an operating lease. The present value of the lease payments discounts at 5% was $102,000. Six annual lease payments of $20,000 are due beginning january 1, 2024, the beginning of the lease, and at each december 31 thereafter through 2028. The amount right - of - use asset reported on december 31, 2024 balance sheet would bearrow_forwardMetlock Corporation recordeda right-of-use asset for $268,800 as a result of a finance lease on December 31, 2019. Metlock's incremental borrowing rate is 11%, and the implicit rate of the lessor was not known at the commencement of the lease. Metlock made the first lease payment of $51,390 on on December 31, 2019. The lease requires 7 annual payments. The equipment has a useful life of 7 years with no residual value. Prepare Metlock's December 31, 2020, entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit December 31, 2020 (To record interest expense) December 31, 2020 (To record amortization of the right-of-use asset)arrow_forwardOn January 1, 2021, Green Co. recorded a right-of-use asset of $270,360 in an operating lease. The lease calls for ten annual payments of $40,000 at the beginning of each year. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset at December 31, 2021, will be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education