FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

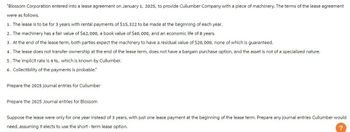

Transcribed Image Text:"Blossom Corporation entered into a lease agreement on January 1, 2025, to provide Cullumber Company with a piece of machinery. The terms of the lease agreement

were as follows.

1. The lease is to be for 3 years with rental payments of $15,322 to be made at the beginning of each year.

2. The machinery has a fair value of $62,000, a book value of $40,000, and an economic life of 8 years.

3. At the end of the lease term, both parties expect the machinery to have a residual value of $20,000, none of which is guaranteed.

4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature.

5. The implicit rate is 4 %, which is known by Cullumber.

6. Collectibility of the payments is probable."

Prepare the 2025 journal entries for Cullumber

Prepare the 2025 Journal entries for Blossom

Suppose the lease were only for one year instead of 3 years, with just one lease payment at the beginning of the lease term. Prepare any journal entries Cullumber would

need, assuming it elects to use the short-term lease option.

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Metlock Company leases a building and land. The lease term is 8 years and the annual fixed payments are $840,000. The lease arrangement gives Metlock the right to purchase the building and land for $13,550,000 at the end of the lease. Based on an economic analysis of the lease at the commencement date, Metlock is reasonably certain that the fair value of the leased assets at the end of lease term will be much higher than $13,550,000. What are the total lease payments in this lease arrangement? Total lease payments Click if you would like to Show Work for this question: Open Show Workarrow_forwardKingbird Company leases a building and land. The lease term is 7 years and the annual fixed payments are $720,000. The lease arrangement gives Kingbird the right to purchase the building and land for $13,000,000 at the end of the lease. Based on an economic analysis of the lease at the commencement date, Kingbird is reasonably certain that the fair value of the leased assets at the end of lease term will be much higher than $13,000,000. What are the total lease payments in this lease arrangement? Total lease payments :____________arrow_forwardOscar, Inc., leased equipment from Reynolds Company on January 1, 2023. Reynolds manufactured theequipment at a cost of $200,000. The equipment has a fair value of $260,000.Information related to the lease appears below:Lease term 5 yearsFirst lease payment January 1, 2023Subsequent lease payments December 31, 2023, 2024, 2025, 2026Economic life of the equipment 6 yearsEstimated value of equipment at end of economic life $0Purchase option, reasonably expected to be exercised by Oscar $20,000Implicit and incremental borrowing rate 8% Prepare the entries to record the lease and the first payment for both the lessee and the lessor onJanuary 1, 2023.arrow_forward

- Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $78,000 under a 5-year lease on December 20, 2022. The lease commences on January 1, 2023, and Leewin will return the automobile to Bumble on December 31, 2027. The automobile has an estimated useful life of 7 years. Leewin made a lease payment of $10,700 on December 20, 2022. In addition, the lease agreement stipulates annual payments of $10,700, due on January 1 of 2023, 2024, 2025, 2026, and 2027. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase option, no lease incentives, no residual value guarantees, and no transfer of ownership. Leewin incurs initial direct costs of $2000.Assuming that this is classified as an operating lease, how much interest expense is recorded in 2023? Group of answer choices $1554 $2140 $0 $1982arrow_forwardGlaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2020, is $700,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Jensen estimates that the expected residual value at the end of the lease term will be $50,000. Jensen amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Glaus desires a 5% rate of return on its investments. Jensen's incremental borrowing rate is 6%, and the lessor's implicit rate is unknown. Instructions (Assume the accounting period ends on…arrow_forwardBrown Enterprises enter into a 4 year lease with ABC Leasing Company. The lease qualifies as an operating lease. The first lease payment of $100,000 was due on January 1, 2024, on the date the lease was executed and all subsequent lease payments due on December 31. The present value of the lease payments was $348,685 and Brown Enterprises correctly recorded the right of use asset and lease liability on January 1, 2024 for this amount. The implicit rate in the lease is 10%. On its 2024 income statement, when Brown Enterprises reports its lease expense for 2024, it will be made up of which of the following components? (Choose all that apply) DAROU amortization $75,132 8. Interest expense $12,829 OCROU amortization $87,171 OD. Interest expense $24,869 Quesdan 12 of 25arrow_forward

- Sunland Company specializes in leasing large storage units to other businesses. Sunland entered a contract to lease a storage unit to Riskey, Inc. for 4 years when that particular storage unit had a remaining useful life of 5 years. The fair value of the unit was $13,000 at the commencement of the lease on January 1, 2020. The present value of the five equal rental payments of $3,481 at the start of each year, plus the present value of a guaranteed residual value of $1,000, equals the fair value of $13,000, Sunland’s implicit rate of return on the lease of 9%. The following is a correct, complete amortization schedule created by Sunland. Date Lease Payment Interest (9%) onOutstanding Lease Receivable Reduction ofLease Receivable Balance ofLease Receivable 1/1/20 $13,000 1/1/20 $3,481 $3,481 9,519 1/1/21 3,481 $857 2,624 6,895 1/1/22 3,481 621 2,860 4,035 1/1/23…arrow_forwardAt January 1, 2024, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. • The lease agreement specifies annual payments of $32,000 beginning January 1, 2024, the beginning of the lease, and on each December 31 thereafter through 2031. . The equipment was acquired recently by Crescent at a cost of $243,000 (its fair value) and was expected to have a useful life of 13 years with no salvage value at the end of Its life. . Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $73,596. Crescent seeks a 9% return on Its lease Investments. . By this arrangement, the lease is deemed to be an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. What will be the effect of the lease on Café Med's earnings for the first year (ignore taxes)? Note: Enter decreases with negative sign. 2. What…arrow_forwardDavidson, Incorporated leased a machine from Barwick Corporation. Barwick completed construction of the machine on January 1, 2024. The lease agreement for the $16,000,000 (fair value and present value of the lease payments) machine specified 4 equal payments at the end of each year. The useful life of the machine was expected to be 4 years with no residual value. Barwick's implicit interest rate was 9%. Lease date Fair value and present value of lease payments Lease term Useful life of machine Residual value Barwick's implicit interest rate 1. Determine the amount of each lease payment using Excel's PMT function 3. Prepare an amortization schedule for the 4-year term of the lease. Date 2. Prepare the journal entry for Davidson, Incorporated at the beginning of the lease on January 1, 2024. Date General Journal Debit January ,2024 January 1, 2024 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 Totals 4. Record the first lease payment on December 31, 2024. Date…arrow_forward

- On January 1, 2024, Blue Co. recorded a right-of-use asset of $869,628 in a 10-year operating lease. The lease calls for ten annual payments of $120,000 at the beginning of each year. The interest rate charged by the lessor was 8%. What amount will Blue Co. record for amortization expense on December 31, 2024? O $60,030 O $64,832 O $86,963 $59,970 ringarrow_forwardRajiv Industries leased exercise equipment to Woodson Gyms on July 1, 2024. Rajiv recorded the lease receivable at $810,000, the present value of lease payments discounted at 10% and fair value of the equipment. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2024. Rajiv had manufactured the equipment at a cost of $750,000. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. What is the total increase in earnings (pretax) on Rajiv’s 2024 income statement?arrow_forwardKing Company leased equipment from Mann Industries. The lease agreement qualifies as a finance lease and requires annual lease payments of $52,538 over a six-year lease term (also the asset’s useful life), with the first payment at January 1, the beginning of the lease. The interest rate is 5%. The asset being leased cost Mann $230,000 to produce. Required:1. Determine the price at which the lessor is “selling” the asset (present value of the lease payments).2. What would be the amounts related to the lease that the lessor would report in its income statement for the year ended December 31 (ignore taxes)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education