FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

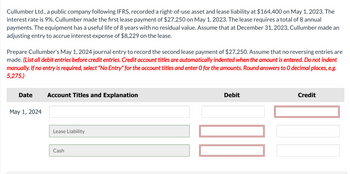

Transcribed Image Text:Cullumber Ltd., a public company following IFRS, recorded a right-of-use asset and lease liability at $164,400 on May 1, 2023. The

interest rate is 9%. Cullumber made the first lease payment of $27,250 on May 1, 2023. The lease requires a total of 8 annual

payments. The equipment has a useful life of 8 years with no residual value. Assume that at December 31, 2023, Cullumber made an

adjusting entry to accrue interest expense of $8,229 on the lease.

Prepare Cullumber's May 1, 2024 journal entry to record the second lease payment of $27,250. Assume that no reversing entries are

made. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g.

5,275.)

Date

May 1, 2024

Account Titles and Explanation

Lease Liability

Cash

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $520,000, and the fair value of the asset on January 1, 2020, is $737,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Blue estimates that the expected residual value at the end of the lease term will be 60,000. Blue amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Blossom desires a 10% rate of return on its investments. Blue’s incremental borrowing rate is 11%, and the lessor’s implicit rate is unknown. (Assume the accounting…arrow_forwardKingbird Company leased equipment from Costner Company, beginning on December 31, 2019. The lease term is 5 years and requires equal rental payments of $78,002 at the beginning of each year of the lease, starting on the commencement date (December 31, 2019). The equipment has a fair value at the commencement date of the lease of $320,000, an estimated useful life of 5 years, and no estimated residual value. The appropriate interest rate is 11%.Click here to view factor tables.Prepare Kingbird’s 2019 and 2020 journal entries, assuming Kingbird depreciates similar equipment it owns on a straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places, e.g. 5,275.)…arrow_forward"Blossom Corporation entered into a lease agreement on January 1, 2025, to provide Cullumber Company with a piece of machinery. The terms of the lease agreement were as follows. 1. The lease is to be for 3 years with rental payments of $15,322 to be made at the beginning of each year. 2. The machinery has a fair value of $62,000, a book value of $40,000, and an economic life of 8 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $20,000, none of which is guaranteed. 4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. 5. The implicit rate is 4 %, which is known by Cullumber. 6. Collectibility of the payments is probable." Prepare the 2025 journal entries for Cullumber Prepare the 2025 Journal entries for Blossom Suppose the lease were only for one year instead of 3 years, with just one lease payment at the beginning of the lease…arrow_forward

- edom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2013. The lease terms, provisions, and related events are as follows: 11 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,00 to be made in advance at the beginning of eacy year. 2. The equipment costs $313,000. the equipment has an estimatd life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the leae is 14%. 5. The intial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Prepare journal entries for Edom for the years 2013 and 2014.arrow_forwardCrane Co. as lessee records a finance lease of machinery on January 1, 2021. The seven annual lease payments of $819,000 are made at the end of each year. The present value of the lease payments at 9% is $4,122,000. Crane uses the effective-interest method of amortization and sum-of-the-years'-digits depreciation (no residual value).arrow_forwardRich Company uses lease as a means of selling its equipment. On July 1,2019, the company leased an equipment to Poor Company. The cost of the equipment to Rich Company was P 684,000. The fair market value ( which was the sales price) was P 792,236.54 at the time of the inception of the lease. Annual lease payments are P 135,000 and are payable in advance for 8 years. The equipment has an expected economic life of 10 years. At the end of the lease term , title to the equipment will pass to Poor Company. Implicit interest rate is 10%. What is the rich Company's total financial revenue pertaining to the lease?arrow_forward

- Hughey Co. as lessee records a capital lease of machinery on January 1, 2020. The seven annual lease payments of $875,000 are made at the end of each year. The present value of the lease payments at 10% is $4,260,000. Hughey uses the effective-interest method of amortization and sum-of-the-years’-digits depreciation (no residual value). (a) Prepare an amortization table for 2020 and 2021. (b) Prepare all of Hughey’s journal entries for 2020.arrow_forwardMorgan Leasing Company signs an agreement on January 1, 2025, to lease equipment to Cole Company. The following informationrelates to this agreement.The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6years.The cost of the asset to the lessor is $245,000. The fair value of the asset at January 1,2025 , is $245,000.The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of$24,335, none of which is guaranteed.The agreement requires equal annual rental payments, beginning on January 1, 2025.Collectibility of the lease payments by Morgan is probable.arrow_forwardOn January 1, 2021, the lessee company signed an operating lease to lease a building from the lessor. Lease payments are $57,000 per year and are made at the beginning of the year. Assume the following is the partial Lease Amortization Schedule (with only two rows and three columns shown) prepared by the lessee company: Date Annual Payment Interest on Liability 1/1/2022 57,000 44,000 1/1/2023 57,000 38,000 In the journal entry made on December 31, 2022, the lessee company should debit/credit Right-of-Use Asset by $___________. (Just enter the amount. Do not put a plus or minus sign in front of the amount.)arrow_forward

- AC3220 Corp., who reports under ASPE, leases computer equipment on January 1, 2023, and records this as a capital lease. Three annual lease payments of $10,000 are required the beginning of each year, starting January 1, 2023. The interest rate for the lease 10%. Title passes to AC3220 at the end of the lease. AC3220 uses the effective interest method of amortization for the lease. The company uses straight-line depreciation over the equipment's expected useful life of three years, with no residual value. Instructions (Round values to the nearest dollar.) a) Calculate the present value of the lease payments b) Prepare a lease amortization table for 2023, 2024, and 2025. c) Prepare the general journal entries relating to this lease for 2023. Paragraph ✓ Date BI UA + v ... Beginning Balance Payment Interest Expense Lease Amortization Ending Balance 11.arrow_forwardMcCormick Ltd., a public company following IFRS 16, recorded a right-of-use asset and lease liability at $150,000 on May 1, 2020. The interest rate is 10% . McCornick made the first lease payment of $25,561 on May 1, 2020. The lease requires a total of eight annual payments. The equipment has a useful lif of eight years with no residual value. Prepare McCornick's December 31, 2020 adjusting entries. Round to the nearest dollar.arrow_forwardMetro Company, a dealer in machinery and equipment, leased equipment to Sands, Inc., on July 1, 2015. The lease is appropriately accounted for as a sales-type lease by Metro and as a capital lease by Sands. The lease is for a 8-year period (the useful life of the asset) expiring June 30, 2023. The first of 8 equal annual payments of $552,000 was made on July 1, 2015. Metro had purchased the equipment for $3,500,000 on January 1, 2015, and established a list selling price of $4,800,000 on the equipment. Assume that the present value at July 1, 2015, of the rent payments over the lease term discounted at 6% (the appropriate interest rate) was $4,000,000. 43. Assuming that Sands, Inc. uses straight-line depreciation, what is the amount of depreciation and interest expense that Sands should record for the year ended December 31, 2015? a. $400,000 and $206,880 b. $250,000 and $103,440 c. $250,000 and $206,880 d. $240,000 and $103,440 44. What is the amount of profit on the sale and the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education