FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

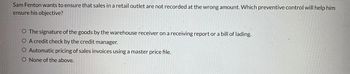

Transcribed Image Text:Sam Fenton wants to ensure that sales in a retail outlet are not recorded at the wrong amount. Which preventive control will help him

ensure his objective?

O The signature of the goods by the warehouse receiver on a receiving report or a bill of lading.

O A credit check by the credit manager.

O Automatic pricing of sales invoices using a master price file.

O None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which, if any, of the following situations represent improper segregation of functions?A. The billing department prepares the customers ‘invoices, and the AR department posts to thecustomers’ accounts.B The sales department approves sales credit memos as the result of product returns, and subsequentadjustments to the customer accounts are performed by the AR department.C The shipping department ships goods that have been retrieved from stock by warehouse personnel.D. The general accounting department posts to the general ledger accounts after receiving journalvouchers that are prepared by the billing department.arrow_forwardIn response to the six primary physical control weaknesses that have been identified, make recommendations (one for each bullet). The purchase transaction should not be authorized by the purchases. The inspection of receiving items should be on basis of blind copy of purchase order provided not by the packing slip. The inventory subsidiary ledger is updated by the inventory control. The recording in accounts payable subsidiary ledger is without the supporting documents as recorded only on invoice receiving. The journal vouchers and summary reports from accounts payable department, cash disbursement system and inventory control should be received by general ledger department. The cash disbursements journal and check register are not in use.arrow_forwardWhich internal control activity is being violated when the cashier in a retail store also records the daily receipts in a journal? adequate documents and records safeguards over assets and records independent checks on recorded amounts segregation of dutiesarrow_forward

- Able, an accounts payable supervisor for ABC Company, bought supplies for a company he owned on the side. Able entered vouchers in ABC Company’s accounts payable system for the cost of the supplies. Checks were cut to pay for these unauthorized expenses during normal daily check runs. The goods ordered were drop-shipped to a location where Able could collect them. This is an example of: a. An expense reimbursement scheme b. A commission scheme c. A billing scheme d. An invoice kickback schemearrow_forwardIn the evaluation of sales transaction processing and control design in the following information:(a)identify two or three potential weaknesses. breifly explain the potential mistatement, recommended correction and possible weakness of all two or three potential weaknesses identified. Marco uses the PC network to manage inventory, sales requisitions, and sales orders. Salesclerks who can read the perpetual inventory records via their PCs take customer orders. Most orders originate from phone requests, but a few arrive on a walk-in basis and some occasionally come in the mail. Usually, building contractors or their representatives call to get current price quotes and find out if specific appliances are in stock. When goods are available and the price is satisfactory, a salesclerk originates a sales requisition and the process of approving and filling it begins if customers plan to pick up their order the same day. Orders received after 4:00 PM cannot be delivered the same day; buyers…arrow_forwardWhich of the following best represents a key control for ensuring sales are properlyauthorized when assessing control risks for sales? A. The separation of duties between the billing department and the cash receipts approval department. B. The use of an approved price list to determine unit selling price. C. Copies of approved sales orders sent to shipping, billing, and accounting departments. D. Sales orders are sent to the credit department for approval.arrow_forward

- Credit card fraud involving filling out multiple blank sales slips using the card is known as: skimming true name fraud merchant scamming nonreceipt fraudarrow_forwardEach of the below describes a procedure consistent with a strong system of internal control except… Question 7 options: The customer order department determines when a sale has occurred and should be recorded. The accounts payable department agrees purchase requisitions, purchase orders, receiving reports, and invoices prior to payment. Quantities ordered are excluded from the receiving department copy of a purchase order so receiving personnel count and inspect merchandise received. The use of remittance advices for customers' payments on accounts receivable received in the mail.arrow_forwardWhich of the following software functions can help protect sales revenue from external and internal threats of theft? a) Reconcile inventory reductions with product issues from kitchen. b) Reconcile product issues from kitchen with guest check totals. c) Create over and short computations by server, shift, and day. d) All of the above e) Only a. and b. abovearrow_forward

- Please answer multichoice question in photo. There may be more than one answerarrow_forwardSales orders are written by sales people who have no access to the goods, which are released by warehouse personnel. This is example of: an analytical review establishing a system for storing and counting inventory proper documentation that is monitored properly segregation of dutiesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education