FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

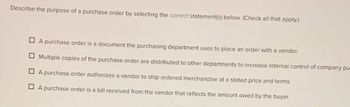

Transcribed Image Text:Describe the purpose of a purchase order by selecting the correct statement(s) below. (Check all that apply.)

A purchase order is a document the purchasing department uses to place an order with a vendor.

Multiple copies of the purchase order are distributed to other departments to increase internal control of company pu

A purchase order authorizes a vendor to ship ordered merchandise at a stated price and terms.

A purchase order is a bill received from the vendor that reflects the amount owed by the buyer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A receiving report is filled out when we receive: An inventory shipment from a vendor. Items that a customer is authorized to return from a previous sale. A payment on a customer's account. a and b only. Answer is not the First option!arrow_forwardCompare and contrast a manual accounting system with a computerized accounting system for process vendors transactions. What uses are there for using tje vendor balance summary and AP aging summary reports? Explain why the balance in merchandise inventory different than in accounts payable? Be sure to include at least one reference from an online resource.arrow_forwardIf a customer purchases merchandise on credit and returns the defective merchandise beforepayment, what accounts would recognize this transaction?A. sales discount, cashB. sales returns and allowances, cashC. accounts receivable, sales discountD. accounts receivable, sales returns and allowancesarrow_forward

- Suppose you are being interviewed for a bookkeeping job for a retailer that uses a perpetual inventory system. The employer feels that the only way to determine whether or not the person being interviewed actually understands how to record transactions, is to ask them to provide an example showing the accounts (no amounts necessary) that would be debited and credited for the following: Purchase merchandise inventory on account. Sale of goods on account Return of part of the merchandise purchased in 1. above to the supplier. Payment to supplier, taking advantage of the discount that was offered. Return of goods by customer for credit. Payment received from customer, taking advantage of discount that was offered.arrow_forwardHow does a price list get assigned to a sales order?a. It is copied from the business partner master to the sales order.b. Each warehouse has an associated price list.c. You have to manually assign a price list in the sales order.d. The main price list from the item master record is used in the sales order.arrow_forwardEach of the below describes a procedure consistent with a strong system of internal control except… Question 7 options: The customer order department determines when a sale has occurred and should be recorded. The accounts payable department agrees purchase requisitions, purchase orders, receiving reports, and invoices prior to payment. Quantities ordered are excluded from the receiving department copy of a purchase order so receiving personnel count and inspect merchandise received. The use of remittance advices for customers' payments on accounts receivable received in the mail.arrow_forward

- Please answer multichoice question in photo. There may be more than one answerarrow_forwardSales orders are written by sales people who have no access to the goods, which are released by warehouse personnel. This is example of: an analytical review establishing a system for storing and counting inventory proper documentation that is monitored properly segregation of dutiesarrow_forwardAll of the following are documents used for inventory control except Oa. a receiving report. Ob. a petty cash voucher Oc. a vendor's invoice.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education