FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:CO

II

om/iln/takeAssignment/takeAssignmentManrao?inprogress=true

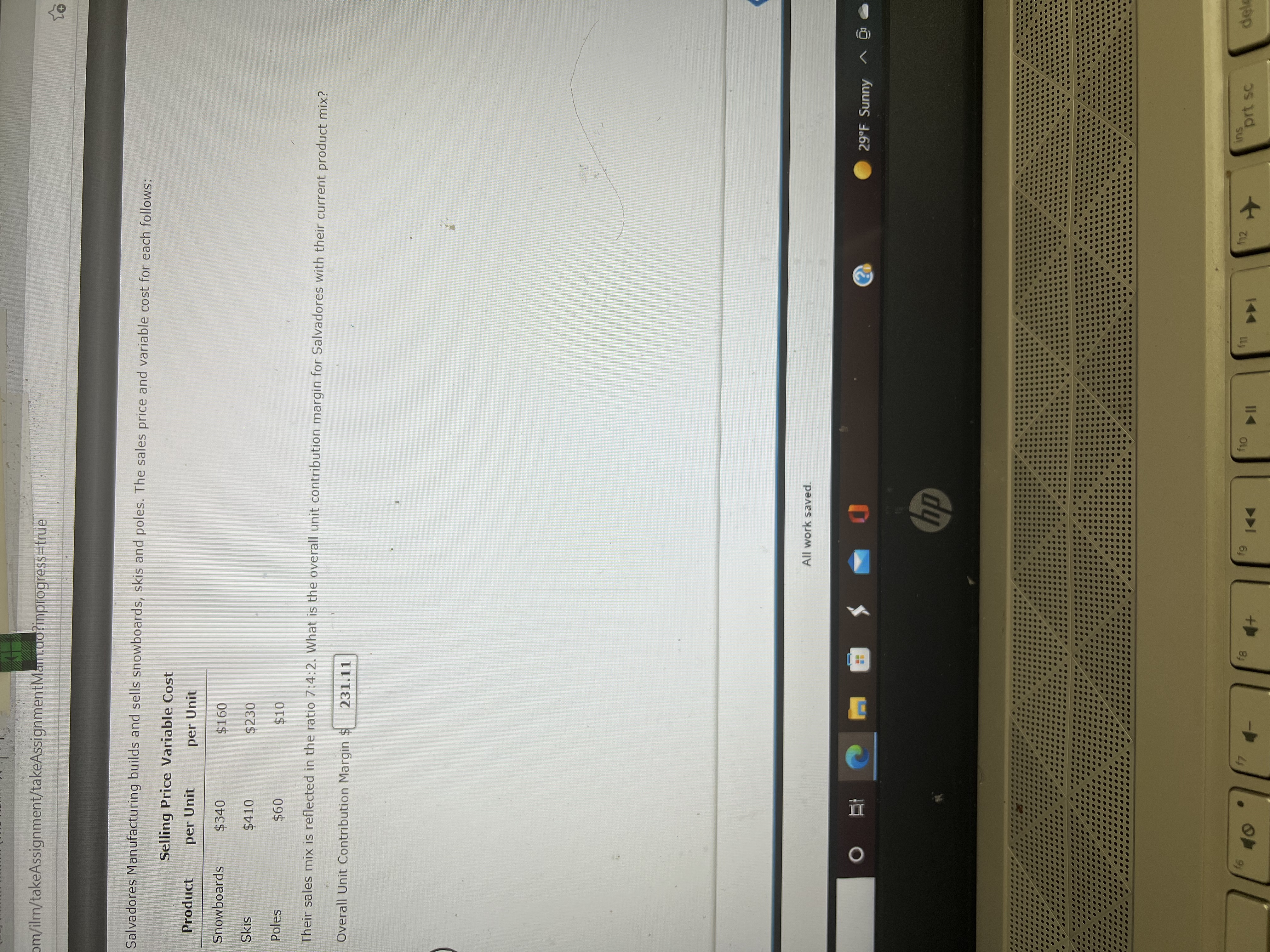

Salvadores Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each follows:

Selling Price Variable Cost

Product

per Unit

per Unit

Snowboards

$340

$160

Skis

$410

$230

Poles

$10

09$

Their sales mix is reflected in the ratio 7:4:2. What is the overall unit contribution margin for Salvadores with their current product mix?

Overall Unit Contribution Margin $

231.11

All work saved.

29°F Sunny ^ @

SU

prt sc

12

II 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A jeans maker is designing a new line of jeans called Slams. Slams will sell for $315 per unit and cost $214.20 per unit in variable costs to make. Fixed costs total $66,000. (Round your answers to 2 decimal places.) 1. Compute the contribution margin per unit. Contribution margin 2. Compute the contribution margin ratio. Numerator: Denominator: 3. Compute Income if 6,200 units are produced and sold Income Contribution Margin Ratio Contribution margin ratio 0arrow_forwardBusiness Solutions sells upscale modular desk units (60% of sales) and office chairs (40% of sales). Selling prices are $1,160 per desk unit and $690 per chair. Variable costs are $695 per desk unit and $345 per chair. Fixed costs are $204,330. Required: 1. Compute the weighted-average contribution margin. 2. Compute the break-even point in units. 3. Compute the number of units of each product that would be sold at the break-even point. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the weighted-average contribution margin. (Round your final answer to the nearest whole number.) Weighted-average contribution margin Business Solutions sells upscale modular desk units (60% of sales) and office chairs (40% of sales). Selling prices are $1,160 per desk unit and $690 per chair. Variable costs are $695 per desk unit and $345 per chair. Fixed costs are $204,330. Required: 1. Compute the weighted-average contribution margin. 2.…arrow_forwardSalvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each are shown: Salvador Manufacturing data Product Selling price per unit Variable cost per unit Snowboards $283 $198 Skis 431 225 Poles 132 47 Their sales mix is reflected in the ratio 8:3:5. Calculate the contribution margin per composite unit.arrow_forward

- A company's product sells at $12.26 per unit and has a $5.39 per unit variable cost. The company's total fixed costs are $96,700. The contribution margin per unit is:arrow_forwardA jeans maker is designing a new line of jeans called Slams. Slams will sell for $205 per unit and cost $164 per unit in variable costs to make. Fixed costs total $60,000. 1. Compute the contribution margin per unit. Contribution margin 2. Compute the contribution margin ratio. Numerator: I Denominator: 1 3. Compute income if 5,000 units are produced and sold. Income Contribution Margin Ratio = Contribution margin ratio 0arrow_forwardBusiness Solutions sells upscale modular desk units (60% of sales) and office chairs (40% of sales). Selling prices are $1,340 per desk unit and $590 per chair. Variable costs are $805 per desk unit and $295 per chair. Fixed costs are $171,210.Required:1. Compute the weighted-average contribution margin.2. Compute the break-even point in units.3. Compute the number of units of each product that would be sold at the break-even point.arrow_forward

- Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $554,200, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats 50 40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forwardJersey Town sells two products, helmets and bats. Last year, Jersey sold 14,000 units of helmets and 56,000 units of bats. Related data is below. Calculate the following: (a) Jersey's sales mix of the products and (b) Jersey's unit contribution margin of E, with E representing one overall "enterprise" product? Unit Unit Selling Variable Price Cost Helmets $120 $80 Bats 80 60arrow_forwardEstela Company produces skateboards and scooters. Their per unit selling prices and variable costs follow. Skateboards require 2 machine hours per unit. Scooters require 3 machine hours per unit. Selling price per unit Skateboards $ 200 Scooters) $ 400 120 310 Variable costs per unit (a) Compute the contribution margin per unit (b) Compute the contribution margin per machine hour (a) Contribution margin pet und Contion margm per machine hour Skateboards Scootersarrow_forward

- 3. JJ Manufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Product Selling price per unit Variable cost per unit Trunk switch $60.00 $28.00 Gas door switch $75.00 $33.00 Glove box light $40.00 $22.00 Their sales mix is reflected in the ratio 4:4:1. What is the overall Composite Unit Contribution Margin for JJ Manufacturing with their current product mix? If annual fixed costs shared by the three products are $18,840, how many units of each product are to be sold in order for JJ Manufacturing to break even? Trunk Switch? Gas Door Switch? Glove Box Light? Determine their break-even point in sales dollars. Trunk Switch? Gas Door Switch? Glove Box Light?arrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $251,600, and the sales mix is 40% bats and 60% gloves The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $50 $40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education