FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

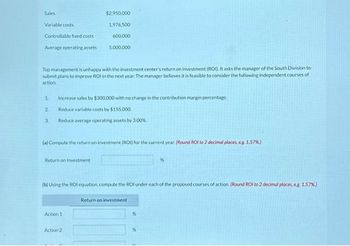

Transcribed Image Text:Sales

Variable costs

Controllable fixed costs

Average operating assets

1

Top management is unhappy with the investment center's return on investment (ROD. It asks the manager of the South Division to

submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of

action

2

3

$2,950,000

1,976,500

600,000

Increase sales by $300,000 with no change in the contribution margin percentage

Reduce variable costs by $155.000

Reduce average operating assets by 3.00%

Return on Investment

5,000,000

(a) Compute the return on investment (RDD) for the current year. (Round Rot to 2 decimal places, eg 1.57%)

Action 1

(b) Using the ROI equation, compute the ROI under each of the proposed courses of action (Round ROI to 2 decimal places, eg 1.57%)

Action 2

Return on investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 28 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $66,000 $60,000 $50,000 $55,000arrow_forwardPlz answer fast Without plagiarism.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Accounting - ROIarrow_forwardNonearrow_forwardQUESTION 29 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 3 Sales $6,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Return on investment 12% 11% 10% 8%arrow_forward

- Coronado Division has the following data: Sales Variable expenses Fixed expenses $509000 231000 286000 The fixed costs are not avoidable and must be allocated to profitable divisions if the segment is eliminated. What will be the incremental effect on net income if Coronado Division is eliminated? O $223000 increase O $278000 decrease O $286000 decrease Cannot be determined from the data providedarrow_forwardA2arrow_forwardQUESTION 26 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 1 Sales $10,000,000 Operating income 200,000 Average operating assets 2,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $40,000 $0 $50,000 $(40,000)arrow_forward

- QUESTION 30 Management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 3 Sales $6,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $66,000 $75,000 $60,000 $70,000arrow_forwardDo not give image formatarrow_forwardjagarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education