FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me with all I will give upvote thanku

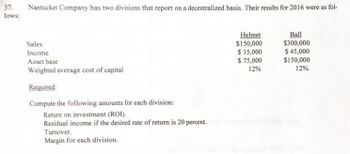

Transcribed Image Text:37.

lows:

Nantucket Company has two divisions that report on a decentralized basis. Their results for 2016 were as fol-

Sales

Income

Asset base

Weighted average cost of capital

Required:

Compute the following amounts for each division:

Return on investment (ROI).

Residual income if the desired rate of return is 20 percent.

Turnover.

Margin for each division.

Helmet

$150,000

$ 15,000

$ 75,000

12%

Ball

$300,000

$ 45,000

$150,000

12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help with the question that is attached as a picture. thanksarrow_forwardYou pull up to a stop light and of course there’s a homeless person asking for money. Although you usually don’t even make eye contact with these people, for some reason this guy really tugs at your heartstrings. You pull out $10 and hand it to him so that he can buy a sandwich. This makes you feel warm & fuzzy. It might also earn you a higher or better place in the afterlife, who knows? But does it give you a charitable contribution deduction? Why or why not?arrow_forwardGive typing answer with explanation and conclusionarrow_forward

- E 3 17 R H Herzing College | Canadian Care: X HAC202 Acc Il 07/23: Topic Four A: X + https://online.herzing.ca/mod/assign/view.php?id=333642 HERZING Question 7: Submission status Big Trust is a non-governmental organization that gives charity to orphans in Ontario. The members of the Trust make subscriptions to fund the organization. There are ten members who are required to make subscriptions of $140,500 each per annum. All subscriptions for the year 2020 were received. Three members contributed a total of $240,640 in excess for that year. They agreed that the excess subscriptions can be carried forward to the following year. Required: 1. What is the accounting name given to theses excess subscriptions? 2. Shall the excess subscriptions be recorded as assets or liabilities of Big Trust? Explain. 3. Provide the end of the year accounting treatment for the excess subscriptions as they would appear in: o The income statement • The statement of financial position Submission A ✩ No attempt…arrow_forwardOptional. P Search vout References Mailings Review View Help Aav Aoミ、E、、三E4T AaBbCcDc AaBbCcDc AaBbC AaBbCcl AaB ン、A、三 三三加、、田 I Normal 1 No Spac. Heading 1 Heading 2 Title Paragraph Styles 4. Jeff, age 50, is thinking of purchasing a S100,000 permanent life insurance policy to fund a gift to his local hospital. He was recently treated there after an automobile accident. He does not expect the policy to be surrendered for a number of years and is concerned that inflation might erode the value of his gift. Which of the following products would best suit Jeff's needs? (A) A whole life participating policy with dividends used to reduce the annual premium. (B) A term to 100 life insurance policy. (C) A whole life participating policy with a paid-up additions dividend option. (D) A whole life non-participating policy.arrow_forwardIf you give time at a charitable organization can you deduct your transportation?arrow_forward

- M Federal Financial Aid P x Students Home Ch. 7 Quiz: Invoices, Tr X A Ch. 7 Quiz: Invoices, Tr X W Ch. 7 Hmwk Invoices, X Students Home i webassign.net/web/Student/Assignment-Responses/last?dep=27277752 Apps M Gmail YouTube A Maps No. R-7539 Panorama Products INVOICE DATE June 16, 20XX 486 5th Avenue CUSTOMER'S ORDER NO. 14155 Eureka, CA 95501 FOl dIHS SAME J.M. Hardware Supply 2051 West Adams Blvd. Lansing, MI 48901 SALESMAN SHIPPED VIA Marshall Trucking TERMS Net 30 Days Effingham, IL H. Gilbert QTY. ORDERED QTY. SHIPPED DESCRIPTION LINO 17 cases Masking Tape 1/2" Standard $21.70 11cases Masking Tape 1 1/2" Standard 2" Reflective Tape saxoq 97 37case 37case Sandpaper Assorted INVOICE SUBTOTAL SHIPPING CHARGES Insurance 66 INVOICE TOTAL Type here to search M ins prt sc 144 9.arrow_forwardPlease do not give solution in image format thankuarrow_forwardQuestion is attached in the screenshot thanks for the help greatly appreciated 13y14yko1yko15kyo1yk15oky1o5kyokxfdokarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education