FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

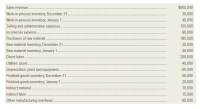

The following data refer to San Fernando Fashions Company for the year 20x2:

2. Cost of goods sold: $580,000

Required:

1. Prepare San Fernando Fashions’ schedule of cost of goods manufactured for the year.

2. Prepare San Fernando Fashions’ schedule of cost of goods sold for the year.

3. Prepare San Fernando Fashions’ income statement for the year.

4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if raw-material purchases amounted to $190,000 and indirect labor was $20,000.

Transcribed Image Text:Sales revenue.

$950,000

Work-in-process inventory, December 31.

30,000

Work-in-process inventory, January 1

40,000

Selling and administrative expenses.

150,000

Income tax expense.

90,000

Purchases of raw material

180,000

Raw-material inventory, December 31.

Raw-material inventory, January 1

Direct labor.

Utilities: plant.

25,000

40,000

200,000

40,000

Depreciation: plant and equipment..

60,000

Finished-goods inventory, December 31 .

50,000

Finished-goods inventory, January 1

20,000

Indirect material..

10,000

Indirect labor.

15,000

Other manufacturing overhead..

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardAnswer BOTH of the required questionsarrow_forwardSelecting a Basis for Predicting Shipping Expenses (Requires Computer Spreadsheet*) Cambridge SoundWorks sell portable speakers systems and bluetooth headphones. In an effort to improve the planning and control of shipping expenses, management is trying to determine which of three variables-units shipped, weight shipped, or sales value of units shipped- has the closest relationship with shipping expenses. The following information is available: Weight Sales Value of Shipping Month Units Shipped Shipped (lbs.) Units Shipped Expenses May 10,000 7,500 $350,000 $38,000 June 12,000 8,760 July 15,000 9,200 August 20,000 10,500 432,000 42,000 420,000 50,100 400,000 72,500 September 12,000 7,600 300,000 41,000 October 8,000 6,000 320,000 35,600 Required a. With the aid of a spreadsheet program, determine whether units shipped, weight shipped, or sales value of units shipped has the closest relationship with shipping expenses. Complete the r-squared values between each possible independent…arrow_forward

- Hill & Scott Company makes financial calculators. During the current year, Hill & Scott manufactured 106,700 financial calculators. Finished goods inventory had the following units on hand: January 1 1,386 units December 31 1,144 units How many financial calculators did Hill & Scott sell during the year? Group of answer choicesarrow_forwardRequired information [The following information applies to the questions displayed below.] In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 340 units at $9 on January 1, (2) 630 units at $10 on January 8, and (3) 930 units at $12 on January 29. Assuming 1,170 units are on hand at the end of the month, calculate the cost of goods available for sale, ending inventory, and cost of goods sold under LIFO. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold LIFOarrow_forwardkau.3arrow_forward

- Required information [The following information applies to the questions displayed below.] In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 150 units at $7 on January 1, (2) 560 units at $8 on January 8, and (3) 860 units at $10 on January 29. Assuming 1,065 units are on hand at the end of the month, calculate the cost of goods available for sale, ending inventory, and cost of goods sold under LIFO. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold LIFO + $ 14,130arrow_forwardPlease answer this questions on 10 minutes I will give likes to your answer. Correctly . I need help from expert. Thanksarrow_forward3arrow_forward

- The Walton Toy Company manufactures four dolls and a sewing kit. It provided the following data for next year: Demand Next Selling Price year (units) per Unit 61,000 $ 20.00 53,000 46,000 Direct Materials $ 5.40 $2.20 $ 8.09 $ 3.10 $ 6.50 $33.50 44,400 $14.00 336,000 $ 9.10 $ 4.30 Product Debbie Trish Sarah Mike Sewing kit The following additional information is available: a. The company's plant has a capacity of 113,140 direct labor-hours per year on a single-shift basis. Each employee and piece of equipment are capable of making all five products. b. Next year's direct labor pa rate will be $9 per hour. c. Fixed manufacturing costs total $630,000 per year. Variable overhead costs are $2 per direct labor-hour. d. All of the company's nonmanufacturing costs are fixed. e. The company's finished goods inventory is negligible and can be ignored. Required: 1. How many direct labor-hours are used to manufacture one unit of each of the company's five products? 2. How much variable overhead…arrow_forwardplease provide correct answer for all with all working and steps answer in text please remember answer all with complete workarrow_forward[The following information applies to the questions displayed below] National Retail has two departments, Housewares and Sporting. Indirect expenses for the period follow. Rent Advertising Insurance Total $45,000 25,000 10.000 $80,000 The company occupies 4,000 square feet of a rented building. In prior periods, the company divided the $80,000 of indirect expenses by 4,000 square feet to find an average cost of $20 per square foot, and then allocated indirect expenses to each department based on the square feet it occupied. The company now wants to allocate indirect expenses using the allocation bases shown below. Department Sporting Hotal Square Feet 1,400 2,600 4,000 Value of Insured 40,000 $100,000 Problem 22-2A (Algo) Part 1 Required: 1. Allocate indirect expenses to the two departments using the allocation method used in prior periods. Department Square Footage Sparting Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education