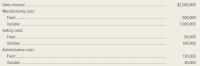

Europa Publications, Inc. specializes in reference books that keep abreast of the rapidly changing political and economic issues in Europe. The results of the company’s operations during the prior year are given in the following table. All units produced during the year were sold. (Ignore income taxes.)

Required:

1. Prepare a traditional income statement and a contribution income statement for the company.

2. What is the firm’s operating leverage for the sales volume generated during the prior year?

3. Suppose sales revenue increases by 10 percent. What will be the percentage increase in net income?

4. Which income statement would an operating manager use to answer requirement (3)? Why?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Income statements illustrate what revenues the firm collects, the expenses required to support revenues, and the firm's profitability over a specified period of time. While balance sheets are a "snapshot" of the firm's status on a specific date, income statements reflect performance over a period of time. Publicly held companies generate income statements every quarter (three months) and for their annual report. INCOME STATEMENT (Thousands of dollars) Net revenues - Cost of goods sold - Operating expenses - Research & development expense Operating costs excluding depreciation - Depreciation and amortization expense Operating income (EBIT) - Interest expense Taxable income - Taxes Net income - Preferred dividends Net income available to common shareholders Dividends Addition to retained earnings The gross margin for this fictional company is: O 14.7% O 9.2% 18.2% 60.3% O 33.3% $ $ On the income statement, interest expense is $ Wages are considered a(n) $ $ In this example, the firm pays…arrow_forwardCompare the two companies and declare which of the two company will be: a. Profitable b. Ideal for investment c. Good for short term investment d. Good for long term investmentarrow_forwardRotorua Products sells agricultural products in the burgeoning Asian market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Current liabilities Sales Current assets: Cash Accounts receivable, net Inventory Total current assets Current liabilities Year 11 Year 2 Year 3 Year 4 Year 5 $4,545,400 $4,737,850 $ 5,126,380 $5,421,900 $5,776,190 Year 1 $ 88,854 418,283 800,380 $ 1,307,517 $ 313,578 Required: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. Note: Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3). % % % % % % Year 2 $ 88,845 $ 77,057 435,833 587,279 $ 90,380 417,076 876,061 $1,383,517 $ 1,350,248 $ 1,466,414 $1,552,502 $ 346,822 $ 336,685 $ 335,107 $ 390,612 825,570 882,078 % % % % % % Year 3 % % % % Year 4 % % $ 80,928 569,984…arrow_forward

- ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Calculate the following ratios for both 2018 and 2019, interpret and analyze them: Days Sales in Inventory Average Collection Periodarrow_forwardThe below information relates to Drake Ltd which manufactures and sells commercial kitchen equipment. The company is constantly profitable. Drake Ltd’s financial statement ratios are as follows: For each of the following transactions or events, indicate the directional effect (increase, decrease, no change) on the Profit Margin, Current Ratio and Debt to Equity in the table below. Note that you must write either ‘increase’, ‘decrease’ or ‘no change’. Consider each transaction independently of all the other transactions. a. Drake Ltd borrowed an additional $200,000 as short-term, 6-month loan from the bank. b. Sold obsolete inventory purchased for $75,000 for $50,000 cash c. Paid $100,000 dividends to shareholders (previously declared)arrow_forwardchoose true or falsearrow_forward

- Q3. After analyzing financial statements of two companies of same industry: Shafer Company and Margo Company. Both are paying income taxes on their earnings, both have large inventories and Replacement cost of their product that are on the rise, over the years. A note to financial statements Disclosed that Shafer company is cost is shown far below to its replacement cost and Margo Inventory is shown at a cost close its current replacement cost. Required: Answer the following questions and explain the reasoning behind your answer. a. What method of inventory valuation is probably used by Shafer and Margo? b. Which company probably has been reporting the higher net income, support with figures? c. If both companies sold their entire inventory at the same sales price, which company would you? Expect to report the larger amount of gross profit, support with figures proving facts?arrow_forwardHansabenarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education