FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

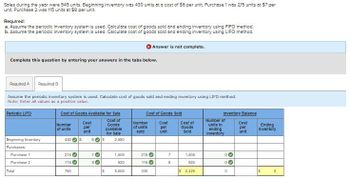

Transcribed Image Text:Soles during the year were 545 units. Beginning inventory was 430 units at a cost of $6 per unit. Purchase 1 was 215 units at $7 per

unit. Purchase 2 was 115 units at $8 per unit.

Required:

a. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method.

b. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required A Required B

Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method.

Note: Enter all values as a positive value.

Periodic LIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Inventory Balance

Number

of unite

Cost

per

Cost of

Goods

Number

Cost

Available

of unite

per

Cost of

Goods

unit

Bold

unit

Sold

for Sale

Number of

units in

ending

Inventory

Cost

per

unit

Ending

Inventory

Beginning Inventory

430

S

6 S

2,580

Purchases:

Purchase 1

215

70

1,505

215

7

1,505

0

Purchase 2

115

8

920

115 →

8

920

0

Total

760

S

5,005

330

S 2,425

0

S

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Submit it in excel formarrow_forward1. Compute the cost assigned to ending inventory using FIFO. 2. Compute the cost assigned to ending inventory using Weighted Average. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost assigned to ending inventory using Weighted Average. (Round average cost per unit to 2 decimal places.) Average Cost Ending Inventory Date March 1 March 5 March 18 March 25 Total Cost of Goods Available for Sale Cost of Goods Available for Sale $5,000.00 100 400 $ 22,000.00 120 $ 7,200.00 200 $ 12,400.00 820 $59.80 $ 46,600.00 # of units Average Cost per unit # of units sold Cost of Goods Sold Average Cost per Unit 580 $ 59.80 240 Average Cost per unit $59.80 Ending Inventory $ 14,352arrow_forwardCh 9 Problem Set B Problem 9-1 Part B The company uses the perpetual inventory method. It began the month of March with 100 units of inventory, at a unit cost of $55. Purchases during March March 5, 60 units at $60 each. March 18, 200 units at $65 each March 29, 40 units at $75 each. Sales during March March 12, 60 units. March 25, 210 units. All units were sold to customer for $100 each. 1. Use the following format to set up this inventory costing problem, as shown in Video #2. Inventory Date Units Cost per Total Cost Date Units Total Cost Unit Beg Balance Units Cost Beginning Balance + Purchases Goods Available for Sale - Sold Ending Balancearrow_forward

- Required:Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.arrow_forwardPlease see imagearrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10. Product InventoryQuantity Cost PerUnit Market Value per Unit(Net Realizable Value) Class 1: Model A 16 $162 $169 Model B 32 190 198 Model C 34 152 148 Class 2: Model D 31 298 309 Model E 42 72 78 Question Content Area a. Determine the value of the inventory at the lower of cost or market applied to each item in the inventory. Inventory at the Lower of Cost or Market Product InventoryQuantity Costper Unit Market Valueper Unit(Net Realizable Value) Cost Market Lower of Cost or Market Model A fill in the blank 1b67cb01c017023_1 $fill in the blank 1b67cb01c017023_2 $fill in the blank 1b67cb01c017023_3 $fill in the blank 1b67cb01c017023_4 $fill in the blank 1b67cb01c017023_5 $fill in…arrow_forwardJames's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardPlease help me with required 1 and 2.arrow_forward

- The following data regarding purchases and sales of a commodity were taken from the related inventory account (perpetual inventory system is used): May 1 Balance 25 units at $41 6 Sale 20 units 8 Purchase 20 units at $42 16 Sale 10 units 20 Purchase 20 units at $43 23 Sale 25 units 30 Purchase 15 units at $45 (a) Determine the total cost of the inventory balance at May 31, using the first-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (b) Determine the total cost of the inventory balance at May 31, using the last-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (a) FIFO (b) LIFOarrow_forwardThe cost of merchandise sold and merchandise inventory is determined from the inventory cost flow assumption. To illustrate, beginning inventory, purchases and sales of shoes are shown below for Grant Co., using a perpetual inventory system. 1. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the FIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise inventory final balances. If units are in inventory or are listed under cost of merchandise sold at two different costs, enter the units that were purchased earliest first. 2. In the table below, fill in the March 24 quantity, unit cost, and total cost in the spaces provided for determining Cost of Merchandise Sold (COMS) and Merchandise Inventory under the LIFO cost flow assumption, assuming 32 shoes are sold on March 24. Determine the COMS and Merchandise…arrow_forwardThe Company uses a periodic inventory system. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education