Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

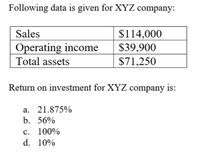

Transcribed Image Text:Following data is given for XYZ company:

Sales

$114,000

Operating income

Total assets

$39,900

$71,250

Return on investment for XYZ company is:

a. 21.875%

b. 56%

с. 100%

d. 10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- LaLa Company has income from operations of $23,280, invested assets of $97,000, and sales of $388,000. What is the return on investment (ROI) for this company? Group of answer choices 24% 25% 100% none of thesearrow_forwardFood and Health Company is expanding and has an average-risk project under consideration. The company decides to fund the project in the same manner as the company’s existing capital structure. The cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 11.50%. Incremental cash flows: Category T0 T1 T2 T3 Investment -$2,500,000 NWC -$250,000 $250,000 Operating Cash Flow $750,000 $750,000 $750,000 Salvage $50,000 Given the expected incremental cash flows provided in this question what is the net present value (NPV) of this project? Show all steps, workings, and formula(s) clearly.arrow_forwardSelected financial data for Woody Company's Furniture Division is as follows: Sales Operating income Total assets Current liabilities Target rate of return Weighted average cost of capital $2,100,000 $420,000 $1,050,000 $200,000 12% 10% What is Woody Company's Furniture Division return on investment? A) 9.52% B) 40.00% C) 20.00% D) 2000.00%arrow_forward

- Assume a company reported the following results: Sales Variable expenses Contribution margin Fixed expenses $ 400,000 268,000 140,000 40,000 $ 100,000 $ 425,000 Net operating income Average operating assets If the company's minimum required rate of return on average operating assets is 16%, its residual income would be: Multiple Choice $33.000. $35.000. $32.000. $34,000arrow_forwardA company has the following information available for three of its divisions. COMPANY INFORMATION FOR THREE DIVISIONS Division M Investment in Assets $ 1,200,000 Division N ? Division O $ 2,500,000 Operating Income Sales Revenue ? $ 160,000 250,000 ? $ 3,200,000 ? Profit Margin Ratio 10.00% ? 6.25% Required Rate of Return 10.00% 12.50% 15.00% Return on Investment 15.00% 20.00% ? What is Division O's sales revenue? $1,666,667. $4,000,000. $2,000,000. $ 375,000.arrow_forwardThe Millard Division's operating data for the past two years are provided below: Return on investment Net operating income Turnover Margin Sales Multiple Choice O $264,800 $232,000 $99,300 Year 1 $132,400 15% ? 77 ? $ 3,310,000 Millard Division's margin in Year 2 was 130% of the margin in Year 1. The net operating income for Year 1 was: (Round intermediate percentage computations to the nearest whole ? Year 2 20% $ 580,000 5 ? ?arrow_forward

- Mason Division had $650,000 in invested assets, sales of $700,000, income from operations of $99,000, and a minimum acceptable return of 15%. The profit margin for Mason Division is a.7.1% b.15.2% c.14.1% d.20%arrow_forwardThe Central Division for Chemical Company has a return on investment of 21% and an investment turnover of 2.23. The profit margin is a.14.13% b.9.42% c.7.53% d.11.30%arrow_forwardDivision D of Saunders Company has sales of $350,000, cost of goods sold of $120,000, operating expenses of $58,000, and invested assets of $150,000. The profit margin for Division D is a. 49.1% b. 42.9% c. 83.4% d. 65.7%arrow_forward

- The following are selected data for the division for the consumer products of ABC Corp for 2020: Sales P 10,000,000 Average invested capital 4,000,000 Net Income 400,000 Cost of Capital 8% What is the return on sales for the division? 1. 4% 2. 8% 3. 10% 4. 20% O 1 O 2 O 3 O 4arrow_forwardRequired Information of 15 The following information applies to the questions displayed below] Westerville Company reported the following results from last year's operations: $2,300,000 Sales Variable expenses Contribution margin Fixed expenses 1,630, 000 24 460,000 $41,437,500 Net operating income erInt Average operating assets At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 460,000 se% of sales $ 161,000 The company's minimum required rate of return is 15%. Required: 1 What is last year's margin? Prev 15 of 15 Nex てし Type here to search ye. 近 (6) F4 F5 F7 F8arrow_forwardCompany A Company B Company C Sales $2,448,000 $1,665,000 Net operating income $318,240 $266,400 Average operating assets $1,530,000 $2,550,000 Margin 13 % 16 % 4 % Turnover 1.60 2.10 Return on investment (ROI) 0.21 % 8.00 % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education