FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

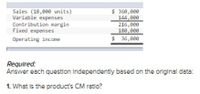

Transcribed Image Text:Sales (18,000 units)

Variable expenses

Contribution margin

Fixed expenses

$ 360,000

144,e00

216,eee

180,eee

Operating income

$ 36,eee

Required:

Answer each question Independently based on the original data:

1. What is the product's CM ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly.contribution format Income statement follows: Percent of Sales 100% Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 92,000 36,800 55,200. 44,160 $ 11,040 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 7% increase in unit sales. Answer is not complete. Complete this question by entering your answers in the tabs below. increases Required 1 Required 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. (Round your intermediate calculations to 2 decimal places. Round your percentage answer to 2 decimal places (.e.1234 should be entered as 12.34).) Net operating income.…arrow_forwardA company has four divisions. Division A has sales, variable expenses and traceable fixed expenses of 200,000, 103,000, 33,000, respectively. If the company as a whole has common fixed expenses of 50,000. What is division A’s segment Margin?arrow_forward

- Alpesharrow_forwardplease solve for A1 and Barrow_forwardRemmel Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (6,000 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 300,000 240,000 60,000 59,000 $ 1,000 If sales increase to 6,020 units, the increase in net operating income would be closest to: Multiple Choice ○ $1,000.00 ○ $200.00 ○ $800.00 ○ $3.33arrow_forward

- The following information is available for Concord Corporation: Total fixed $150000 expenses == Total variable. 320000 expenses Sales Cost of goods sold $570000 370000 A CVP income statement would report O gross profit of $250000, contribution margin of $420000. Ogross profit of $200000. O contribution margin of $250000.arrow_forwardCullumber Company makes three models of tasers. Information on the three products is given below. Sales Variable expenses Contribution margin Fixed expenses Net income (a) Net income $ (b) Shocker Net Income Tingler $300,000 $500,000 Tingler Net Income $ Total Net Income (c) Why or why not? Compute current net income for Cullumber Company. ta Net income would 151,400 148,600 $ 119,400 S $29,200 Fixed expenses consist of $298,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $80,800 (Shocker), and $34,300 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Shocker 197,000 303,000 229,800 $73,200 Compute net income by product line and in total for…arrow_forwardrange of production is 500 units to 1,500 units): Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant Mc Graw Hill 'Z² ± 080 2 A Sales Variable expenses Contribution margin Z Fixed expenses Net operating income Contribution margin per unit 2 Required: What is the contribution margin per unit? (Round your answer to 2 decimal places.) F2 ((1:1) @ W S F3 # 3 X Alt / £ E D F4 $ 4 $ C ¢ $ R 23,900 13,300 10,600 7,632 2,968 F F5 OIO % 5 V F6 粥 ¤ T G л 6 B F7 ? Y H F8 & 7 N Jy L § F12 ) 0 14 Alt Car Scr Lk Arrêtdef P - PrtSc/Imprecr. SysRq/Syst. 目 1½/2 2 + 11 ? Pause Break/Interr. 1 | | ^ = 3/4 A } >> \ o « Insert ]] < Delete/Suppr. V. A V 1 ▷arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education