FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

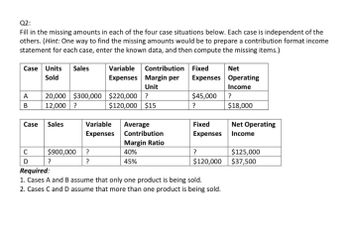

Transcribed Image Text:Q2:

Fill in the missing amounts in each of the four case situations below. Each case is independent of the

others. (Hint: One way to find the missing amounts would be to prepare a contribution format income

statement for each case, enter the known data, and then compute the missing items.)

Case Units Sales

Variable

Sold

Contribution

Expenses Margin per

Unit

Fixed

Net

Expenses Operating

Income

A

20,000 $300,000 $220,000 ?

$45,000

?

B

12,000 ?

$120,000 $15

?

$18,000

Case Sales

Variable Average

Fixed

Net Operating

Expenses

Contribution

Expenses

Income

Margin Ratio

с

D

$900,000

?

40%

?

$125,000

?

?

45%

$120,000

$37,500

Required:

1. Cases A and B assume that only one product is being sold.

2. Cases C and D assume that more than one product is being sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- Do not give image formatarrow_forwardAssume a company with two divisions (A and B) prepared the following segmented income statement: A B Total Sales $ ? $ 200,000 $ ? Variable expenses 120,000 140,000 260,000 Contribution margin ? ? ? Traceable fixed expenses 100,000 80,000 180,000 Segment margin $ ? $ (20,000 ) ? Common fixed expenses 50,000 Net operating income $ 10,000 What is Division A’s contribution margin? Multiple Choice $140,000 $180,000 $160,000 $200,000arrow_forwardCopr. Goedl Uplift, Inc. reported the following financial data for the segmented income statements: Sales $125,000 Variable expenses $63,000 Contribution margin $62,000 Total fixed expenses $42,000 Common fixed expenses $15,000 How much are traceable fixed expenses? $83,000 $20,000 $48,000 $27,000 SUBMIT B 4 5 LO 5arrow_forward

- D.Insert a column called percentage contribution in an appropriate area of the spreadsheet, to display the total contribution to overall sales by each salesperson. The answer is to be formatted as percentage. e.Company policy dictates that all sales volumes exceeding nine million ($8,000, 000.00) but not exceeding ten million ($10, 000, 000.00) should receive an incentive of US $700.00, otherwise they should receive US $200.00. In an appropriate area of the spreadsheet create a heading called Special Incentive 1 and make the necessary calculations using the necessary function f.Company policy also dictates that all sales volumes exceeding ten million ($10,000, 000.00) but less than or equal to twelve million ($12, 000, 000.00) should receive a trip to any Air Jamaica destination, otherwise they should not receive a trip. In an appropriate area of the spreadsheet create a heading called Special Incentive 2 and make the necessary calculations using the necessary functionarrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease help mearrow_forward

- Engberg Company installs lawn sod in home yards. The company's most recent monthly.contribution format Income statement follows: Percent of Sales 100% Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 92,000 36,800 55,200. 44,160 $ 11,040 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 7% increase in unit sales. Answer is not complete. Complete this question by entering your answers in the tabs below. increases Required 1 Required 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. (Round your intermediate calculations to 2 decimal places. Round your percentage answer to 2 decimal places (.e.1234 should be entered as 12.34).) Net operating income.…arrow_forwardPlease help me with all answers thankuarrow_forwardFill in the missing data for each of the following independent cases. (Ignore income taxes.) Note: Do not round intermediate calculations. Leave no cells blank - be certain to enter "0" wherever required. 1. 2. 3. 4. Sales Revenue Variable Expenses 225,000 50,000 $ 98,000 145,000 18,000 Total Contribution Margin 48,000 290,000 Fixed Expenses 78,400 Net Income 200,000 20,800 Break-Even Sales Revenue $ 98,000 225,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education