FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

QuickBooks - Computerized Accounting. Issues with my Balance Sheet and Profit and Loss Summary

Can you give me any advice that can reconcile these account balances? I have submitted the Profit and Loss Summary Along with the Balance Sheets I created in Quickbooks; along with pictures documenting what the accounts are meant to be. Any help you be appreciated!

Can you give me any advice that can reconcile these account balances? I have submitted the Profit and Loss Summary Along with the Balance Sheets I created in Quickbooks; along with pictures documenting what the accounts are meant to be. Any help you be appreciated!

Puppy Luv Pampered Pooch - Allison Young

Profit and Loss

July 1 - August 10, 2026

|

|

|

|---|---|

|

|

TOTAL

|

|

|

|

|

743.50 |

|

|

50.00 |

|

|

$793.50 |

|

|

$793.50 |

|

|

|

|

15.23 |

|

|

250.00 |

|

|

389.10 |

|

|

1,033.00 |

|

|

245.00 |

|

|

63.54 |

|

|

2,604.46 |

|

|

47.00 |

|

|

450.00 |

|

|

16.84 |

|

|

$5,114.17 |

|

|

$ -4,320.67 |

|

|

$ -4,320.67 |

Puppy Luv Pampered Pooch - Allison Young

Balance Sheet

As of August 10, 2026

|

|

|

|---|---|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

51,521.63 |

|

|

$51,521.63 |

|

|

|

|

220.50 |

|

|

$220.50 |

|

|

|

|

3,300.00 |

|

|

0.00 |

|

|

$3,300.00 |

|

|

$55,042.13 |

|

|

|

|

16,000.00 |

|

|

$16,000.00 |

|

|

$71,042.13 |

|

|

|

|

|

|

|

|

|

|

315.80 |

|

|

$315.80 |

|

|

|

|

47.00 |

|

|

$47.00 |

|

|

$362.80 |

|

|

$362.80 |

|

|

|

|

75,000.00 |

|

|

|

|

-4,320.67 |

|

|

$70,679.33 |

|

|

$71,042.13 |

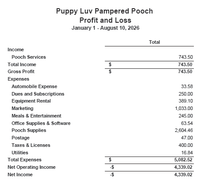

Transcribed Image Text:Puppy Luv Pampered Pooch

Profit and Loss

January 1 - August 10, 2026

Total

Income

Pooch Services

743.50

Total Income

%24

743.50

Gross Profit

743.50

Expenses

Automobile Expense

33.58

Dues and Subscriptions

250.00

Equipment Rental

389.10

Marketing

1,033.00

Meals & Entertainment

245.00

Office Supplies & Software

63.54

Pooch Supplies

2,604.46

Postage

47.00

Taxes & Licenses

400.00

Utilities

16.84

Total Expenses

5,082.52

Net Operating Income

4,339.02

Net Income

4,339.02

%24

%24

%24

Transcribed Image Text:Puppy Luv Pampered Pooch

Balance Sheet

As of August 10, 2026

Total

ASSETS

Current Assets

Bank Accounts

Los Angeles City Bank

46,955.73

Savings LACB

10,000.00

Total Bank Accounts

56,955.73

Accounts Receivable

Accounts Receivable (A/R)

220.50

Total Accounts Receivable

220.50

Other Current Assets

Prepaid Expenses

3,300.00

Undeposited Funds

0.00

Total Other Current Assets

24

3,300.00

Total Current Assets

60,476.23

Fixed Assets

Equipment

16,000.00

Total Fixed Assets

%24

16,000.00

TOTAL ASSETS

76,476.23

LIABILITIES AND EQUITY

Liabilities

Current Liabilities

Accounts Payable

Accounts Payable (A/P)

315.80

Total Accounts Payable

24

315.80

Credit Cards

City Credit Union

499.45

Total Credit Cards

%24

499.45

Other Current Liabilities

Loan Payable

5,000.00

Total Other Current Liabilities

24

5,000.00

Total Current Liabilities

5,815.25

Total Liabilities

5,815.25

Equity

Owner's Investment

75,000.00

Retained Earnings

Net Income

4,339.02

Total Equity

%24

70,660.98

TOTAL LIABILITIES AND EQUITY

76,476.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ADDITIONAL PRACTICE PROBELM: TRANSACTION JOURNAL ENTRIES Do you know your Left from your Right? Debits and Credits as you shop Instructions: Below are some examples of transactions that college students might engage in. For each transaction record the proper journal entry. Transaction Journal entry 1. You buy a computer for $1,500.00 on credit DR: $1,500.00 CR: $1,500.00 | 2. You purchase for cash ($2.00) and consume a DR: $2.00 St. Pauli Girl at the local pub. CR: $2.00 3. You purchase for future consumption a case DR: $35.00 of St. Pauli Girl for $35.00 cash CR: $35.00 4. You work a part-time job and receive $500 in DR: $500.00 monthly compensation CR: $500.00 5. You pay $1,000 toward the computer purchased DR: $1.000.00 in (1) above. CR: $1,000.00arrow_forwardGood day, please may you help me with accounting debtors journal and allowances on Nerina traders a gift shop situated in Illovo. debtors journal headings day,details,debtors controloutput vat,sales debtors allowances headings day,debtors control,input vat ,sales returnarrow_forwardRequired: Below is a Chart of Accounts of a Service Business, submit a research on the nature or definition of every item in the chart of accounts.arrow_forward

- A Pre-Closing Trial Balance for Shady Lane Senior Living Center is listed below. From the list of accounts provided, prepare an activity statement. In this instance, there are no assets released from restrictions. Download the excel file provided. Prepare the activity statement, save it on your computer, and upload your response in the drop box below. Cash $121,000 Pledges Receivable 50,240 Interest Income Receivable 500 Inventory 1,000 Investments – long term 492,600 Land 42,000 Building 162,800 Vintage Car Collection 60,000 Allowance for Uncollectible Pledges 1,000 Accumulated Depreciation 22,600 Accounts Payable 600 Notes Payable 1,000 Deferred Revenue 400 Long Term Loans Payable 100,000 Mortgage Payable 14,000 Net Assets: UR Undesignated 100,000 Net Assets: UR Designated 60,000 Net Assets: TR 100,000 Net Assets: PR 200,000 Program Expenses 42,300 SS: Mgt & Genl Exp 9,600 SS: Fundraising Exp 3,600 Reclassifications OUT-TR 44,200 Loss on Disposal of equipment 600 Revenue:…arrow_forwardNeed help with this questiin please. Thank youarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- usiness AccountingQ&A LibraryGet live help whenever you need from online tutors!Try bartleby tutor todayarrow_forward Question Asked Sep 11, 2020 1 views Jordan Shi operates a consulting firm called X, which began operations on August1. On August 31 the company's records show the following accounts and the amount of August. Cash =$25,460. Acct Receivable =$22,510; Land = $44,130 Office equipment =20,160 Office Supplies =$5,380; Acct payable =$10,370 Dividends =$ 6130 Consulting fees earned =$27,130 Rent expense =$9690 Salaries expense =$5710 Telephone expense =$1010 Miscellaneous expense =$ 620 Common stock =$103,300 Use the above information to prepare an August statement of retained ernigs for the company.(Net income for August is $10,100) Get live help whenever you need from online tutors!Try bartleby tutor todayarrow_forward Question Asked Sep 11, 2020 1 views Jordan Shi operates a consulting firm called X, which began operations on August1. On August 31 the…arrow_forwardAnswer full question please.arrow_forwardrequired:Prepare the preliminary trial balance. Arrange the Accounts in their correct order thank youarrow_forward

- Use the Adjusted Trial Balance Lion Consulting. (Note: I am including the Adjusted Trial Balance below in this question to use for questions 18-23 and 40-46, but it would be easier if you refer to the separate file I provided.)On the Income Statement, what would the Gross Profit be for Lion Consulting? Lion Consulting Adjusted Trial Balance June 30, 2019 Debit Balances Credit Balances Cash 92,000 Accounts Receivable 450,000 Merchandise Inventory 370,000 Estimated Returns Inventory 5,000 Office Supplies 10,000 Prepaid Insurance 12,000 Office Equipment 220,000 Accumulated Depreciation - Office Equip. 58,000 Store Equipment 650,000 Accumulated Depreciation - Store Equip. 87,500 Accounts Payable 38,500 Customer Refunds Payable 10,000 Salaries Payable 4,000 Note Payable (final payment due 2029)* *140,000 M.T.…arrow_forwardPlease do not give solution in image format thankuarrow_forwardComplete the General Ledger based on the recorded journal entries. Remember to: write the date, explanation, and fill out the value in the corresponding DR or CR column. Your explanation should only contain the other account names as per your journal entries, separated by a "/" where necessary.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education