Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

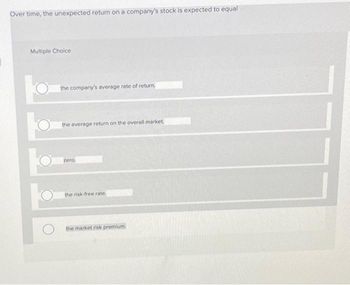

Transcribed Image Text:Over time, the unexpected return on a company's stock is expected to equal

Multiple Choice

the company's average rate of return.

the average return on the overall market.

zero,

the risk-free rate.

the market risk premium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A special case of the Internal Rate of Return (IRR) is the Yield to Maturity (YTM). Explain how the YTM is used to calculate the yield curve and why investors track moves in the yield curve. I would appreciate a long response and the post attention to be paid on why investors track moves in the yield curve.arrow_forwardFill in the blanks with the number that corresponds to the correct word or phrse below: 1. Deflation 2. GDP deflator 3. Consumer price index (CPI) 4. base 5. Labor statistics 6. Employment cost index 7. dollar 8. Producer price index 9. International price index 10. Consumer expenditure survey 11. Percentage change 12. indices Price are created to calculate an overall average change in relative prices over time. To convert the money spent on the market basket of goods, to an index number, economists arbitrarily choose one year to be the year, or starting point from which we measure changes in prices. The year, by definition, has an index number equal to 100. The inflation rate is not derived by subtracting the index numbers, but rather through the calculation. Index numbers have no signs or other units attached to them. The most commonly cited measure of inflation in the United States is the The Bureau of is responsible for the computation of the Consumer Price Index. is a national…arrow_forwardThe simple model of finacnial planning assumes which of thr following: Only assest are expected to increase the same rate as the sales projection The sales projextion is the inly thing expected to increase Assets liabilities equity and expenses are projected to increase at the same rate as the sales projectionsarrow_forward

- 1. The more optimistic investors are about a company’s future profits, the ________ the ratio of the company’s market value to book value.greaterlowerno effect onarrow_forwardA company's required rate of return, typically its cost of capital, is also called the: Group of answer choices Average rate of return. Cut-off rate. Payback rate. Maximum rate. Internal rate of return.arrow_forwardWhich investment criteria answers the question: "How quickly do we recover our investment, in nominal dollars?" A) net present value B) internal rate of return C) profitability index D) payback periodarrow_forward

- Interpreting beta A firm wishes to assess the impact of changes in the market return on annasset that has a beta of 1.20arrow_forwardCreate a unique hypothetical weighted average cost of capital (WACC) and rate of return. Recommend whether or not the company should expand, and defend your position.arrow_forwardFirms with higher expected growth opportunities usually sell for: Select one: O a. the same price earnings multiple for all firms. b. a price that depends on the payout ratio only. c.a price independent of the P/E. O d. a higher price earnings multiple. O e. a lower price earnings multiple.arrow_forward

- Multiple Choice Questions 1. The following are the factors to be considered in Suitability, except A. Environment B. Capabilities C. Expectations D. Scenarios 2. The ____________ for a firm is the internal rate of return on existing investments, based on real cash flows. A. cash flow return on investment (CFROI) B. Economic Value Added (EVA) C. Total Shareholders Return D. Return on Investment 3. The elements that must be considered in using EVA are as follows, except ___________. A. Reasonableness of earnings B. Appropriate cost of Capital C. Volatility of the market D. None of the abovearrow_forwardCompared to a company that uses the FIFO method, during periods of rising prices acompany that uses the LIFO method will most likely appear more:A. liquid.B. efficient.C. profitable.arrow_forwardWhat are the advantages/disadvantages of using the market multiples method to estimate the value of a company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education