FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

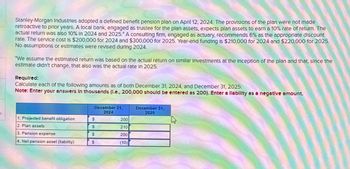

Transcribed Image Text:Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made

retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The

actual return was also 10% In 2024 and 2025.* A consulting firm, engaged as actuary, recommends 6% as the appropriate discount

rate. The service cost is $200,000 for 2024 and $300,000 for 2025. Year-end funding is $210,000 for 2024 and $220,000 for 2025.

No assumptions or estimates were revised during 2024.

"We assume the estimated return was based on the actual return on similar Investments at the Inception of the plan and that, since the

estimate didn't change, that also was the actual rate in 2025.

Required:

Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025:

Note: Enter your answers in thousands (l.e., 200,000 should be entered as 200). Enter a llability as a negative amount.

December 31,

2024

December 31,

2025

1. Projected benefit obligation

S

200

2. Plan assets

S

210

3. Pension expense

$

200

4. Net pension asset (liability)

$

(10)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- La, Inc. sponsors a defined-benefit pension plan. The following data relates to the operation of the plan for the year 2016. Service cost P 220,000 Contributions to the plan 200,000 Actual return on plan assets 180,000 Defined benefit obligation (beginning of year) 2,600,000 Fair value of plan assets (beginning of year) 2,400,000 The discount rate was 10%. The amount of pension expense reported for 2016 isarrow_forwardPendulum Enterprises has a defined benefit plan. Employees receive a pension equal to 2% of the average of the highest 5 years of salary and based on years of service. On December 31 2020, the fair value of the pension assets in the plan is $10.7 M, although pension contributions were in excess of $12.5 M, and the estimated pension obligation is $12.3M. By how much is the plan over or underfunded? (place answer without $ sign in the space below in millions of dollars at up to 2 decimal places) 신arrow_forwardThe following facts apply to the pension plan of Sheridan Inc. for the year 2020. Sheridan applies ASPE. Plan assets, January 1, 2020 $528,000 Defined benefit obligation, funding basis, January 1, 2020 427,000 Defined benefit obligation, accounting basis, January 1, 2020 528,000 Discount/interest rate 8.50% Annual pension service cost 40,600 Contributions 31,700 Actual return on plan assets 53,930 Benefits paid to retirees 33,500 Calculate pension expense for the year 2020, and provide the entries to recognize the expense and contributions for the year assuming that Sheridan has chosen the funding measure of its defined benefit obligation as its accounting policy choice. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Pension expense $enter Pension expense in dollars Date Account Titles and Explanation Debit Credit December 31, 2020…arrow_forward

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 6% as the appropriate discount rate. The service cost is $250,000 for 2024 and $380,000 for 2025. Year-end funding is $260,000 for 2024 and $270,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. 1.…arrow_forwardWildhorse Limited follows ASPE, and the company sponsors a defined benefit pension plan. Wildhorse's actuary provides the following information about the plan (in thousands of dollars): Vested benefit obligation Defined benefit obligation, accounting basis Plan assets (fair value) Interest/discount rate Net defined benefit liability/asset Past service cost, plan amendment, effective December 30, 2023 Service cost for the year 2023 Contributions (funding) 2023 Benefits paid in 2023 Actual return on the plan assets in 2023 $ Net defined benefit liability , January 1, 2023 January 1, 2023 $ $1,500 2,340 Calculate the actual return on the plan assets in 2023. (Enter answers in thousands of dollars.) LA 1,360 170000 10% ? December 31, 2023 $1,530 3,124 2,080 174000 10% ? Calculate the amount of the net defined benefit liability/asset as at January 1, 2023. (Enter answers in thousands of dollars.) 380 320 700 150arrow_forwardBlossom Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances related to this plan. Plan assets (market-related value) $480,000 Projected benefit obligation 650,000 Pension asset/liability 170,000 Cr. Prior service cost 80,000 Net gain or loss (debit) 85,000 As a result of the operation of the plan during 2020, the actuary provided the following additional data for 2020. Service cost $99,000 Settlement rate, 9%; expected return rate, 10% Actual return on plan assets 42,000 Amortization of prior service cost 25,000 Contributions 124,000 Benefits paid retirees 82,000 Average remaining service life of active employees 10 years Using the preceding data, compute pension expense for Blossom Corp. for the year 2020 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive.) PLEASE FIX THE INCORRECT…arrow_forward

- The following information pertains to Havana Corporation's defined benefit pension plan: ($ in thousands) Projected benefit obligation Plan assets Prior service cost-AOCI Net loss-AOCI Multiple Choice $530 thousand. $648 thousand. At the end of 2021, Havana contributed $670 thousand to the pension fund and benefit payments of $624 thousand were made to retirees. The expected rate of return on plan assets was 10%, and the actuary's discount rate is 8%. There were no changes in actuarial estimates and assumptions regarding the PBO. What is Havana's 2021 actual return on plan assets? $1,154 thousand. 2021 Beginning balances $(6,300) 6,060 630 750 None of these are correct. $ 2022 Beginning balances $ (6,804) 6,636 565 816arrow_forwardStanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2021 and 2022.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $140,000 for 2021 and $220,000 for 2022. Year-end funding is $150,000 for 2021 and $160,000 for 2022. No assumptions or estimates were revised during 2021. * We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2022. Required: Calculate each of the following amounts as of both December 31, 2021, and December 31, 2022: (Enter your answers in thousands (i.e., 200,000 should be entered as 200).) 1. Projected benefit obligation 2. Plan assets 3.…arrow_forwardMemanarrow_forward

- Please need answer for all with full working please answer all with steps computation explanation formula please answer all Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $160,000 for 2024 and $210,000 for 2025. Year-end funding is $170,000 for 2024 and $180,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025:…arrow_forwardThe following information pertains to a defined benefit pension plan that Arora Inc. sponsors in 2020. PBO balance, January 1, 2020 $160,000 Service cost 19,000 Interest cost 11,200 Prior service cost adjustment based on past service, January 1, 2020 30,000 Amortization of prior service cost 3,000 Actuarial gain on PBO 6,000 Benefits paid to retirees 2,500 Contributions to plan 18,000 What is the PBO balance on December 31, 2020? Select one: a. $228,700 b. $216,700 c. $211,700 d. $193,700arrow_forwardSarasota Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $ 88,500 Contribution to the plan 107,100 Prior service cost amortization 10,600 Actual and expected return on plan assets 63,100 Benefits paid 40,800 Plan assets at January 1, 2020 648,000 Projected benefit obligation at January 1, 2020 688,100 Accumulated OCI (PSC) at January 1, 2020 148,600 Interest/discount (settlement) rate 11 % Compute the pension expense for the year 2020. Pension expense for 2020 $enter the Pension expense for 2020 in dollarsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education