FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-k

A

0

nces

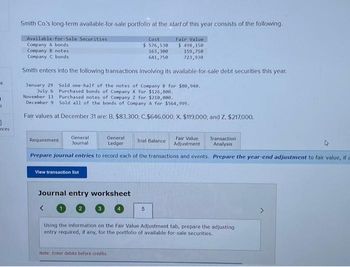

Smith Co.'s long-term available-for-sale portfolio at the start of this year consists of the following.

Available for Sale Securities

Cost

$ 576,530

163,300

Fair Value

$ 498,150

Company A bonds

Company B notes

159,750

Company C bonds.

641,750

723,930

Smith enters into the following transactions involving its available-for-sale debt securities this year.

January 29

July 6

November 13

Sold one-half of the notes of Company B for $80,940.

Purchased bonds of Company X for $126,800.

Purchased notes of Company 2 for $210,000.

December 9 Sold all of the bonds of Company A for $564,999.

Fair values at December 31 are: B, $83,300; C.$646,000; X, $119,000; and Z. $217,000.

Requirement

General

Journal

Fair Value Transaction

Adjustment Analysis

Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, if a

View transaction list

General

Ledger

Journal entry worksheet

<

Trial Balance

Note: Enter debits before credits.

5

Using the information on the Fair Value Adjustment tab, prepare the adjusting

entry required, if any, for the portfolio of available-for-sale securities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardTicker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these investments follow. Portfolio of Available-for-Sale Securities December 31, Year 1 December 31, Year 2 Cost $ 13,000 20,000 23,000 16,500 December 31, Year 3 December 31, Year 4 Complete this question by entering your answers in the tabs below. Prepare journal entries to record each year-end fair value adjustment for these securities. Adjustment General Journal Calculation Calculation adjustment required to fair value adjustment. 12/31/Year 1 Existing balance in Fair Value Adjustment-AFS (LT) Required balance in Fair Value Adjustment-AFS (LT) Adjustment required to Fair Value Adjustment-AFS (LT) 12/31/Year 2 Existing balance in Fair Value Adjustment-AFS (LT) Required balance in Fair Value Adjustment-AFS (LT) Adjustment required to Fair Value Adjustment-AFS (LT) 12/31/Year 3 Existing balance in Fair Value…arrow_forwardThe following bond investment transactions were completed during a recent year by Starks Company: Year 1 Jan. 31 Purchased 75, $1,000 government bonds at 100 plus accrued interest of $313 (one month). The bonds pay 5% annual interest on July 1 and January 1. July 1 Received semiannual interest on bond investment. Aug. 30 Sold 33, $1,000 bonds at 95 plus $275 accrued interest (two months). Required: a. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. b. Provide the December 31, Year 1, adjusting journal entry for semiannual interest earned on the bonds.arrow_forward

- Required information [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Company A bonds Fair Value $ 495,000 Company B notes Cost $530,500 159,080 663,000 Company C bonds 147,000 648,390 Stoll enters into the following transactions involving its available-for-sale debt securities this year. Sold one-half of the Company B notes for $78,170. Purchased Company X bonds for $127,000. January 29 July 6 November 13 Purchased Company Z notes for $267,500. December 9 Sold all of the Company A bonds for $517,400. Fair values at December 31 are B, $80,600; C, $600,800; X, $120,000; and Z, $279,000. Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports…arrow_forwardRantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these investments in its trading portfolio. The company’s fiscal year ends on December 31. The following selected transactions relating to Rantzow-Lear’s trading account occurred during December 2024 and the first week of 2025. December 17, 2024 Purchased 195 Grocers’ Supply Corporation bonds at par for $487,500. December 28, 2024 Received interest of $5,800 from the Grocers’ Supply Corporation bonds. December 31, 2024 Recorded any necessary adjusting entry relating to the Grocers’ Supply Corporation bonds. The market price of the bond was $3,000 per bond. January 5, 2025 Sold the Grocers' Supply Corporation bonds for $546,000. Prepare the appropriate journal entry or entries for each transaction. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income…arrow_forwardGarcia Company issues 13.5%, 15-year bonds with a par value of $490,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 11.5%, which implies a selling price of 112 1/4. Prepare the journal entry for the issuance of these bonds for cash on January 1. View transaction list Journal entry worksheet 1 Record the issue of bonds with a par value of $490,000 at a selling price of 112 1/4. Note: Enter debits before credits. Date January 01 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- I. Metro Company purchased $500,000, 10%, 5-year bonds on January 1, 20x1, with interest payable on July 1 and January 1. The market interest rate (yield) was 8% for bonds of similar risk and maturity. The market value on December 31, 20x1 was $555,000 and all bonds were sold for $507,500 on January 1, 20x2 after the second payment. Required: compute the bond price on January 1, 20x1, prepare the amortization schedule and record journal entries on January 1, 20x1, July 1, 20x1, December 31, 20x1 and January 1, 20x2 assuming the bond investment is classified as available-for-sale security.arrow_forwardSelected debt investment transactions for Easy A Inc., a retail business, are listed below. Easy A Inc. has a fiscal year ending on December 31. Year 1: Feb. 1 May 1 Jun. 1 Sept. 1 Oct. 1 Dec. 1 Dec. 31 Year 2: Mar. 1 Jun. 1 Sept. 1 Bought $35,000 of 6%, XYZ Co. 12-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on June 1 and December 1. Bought $200,000 of Simple Tree 5%, 20-year bonds at their face amount plus accrued interest of $2,500. The bonds pay interest semiannually on March 1 and September 1. Received semiannual interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Sold $15,000 of Simple Tree bonds at 102% plus accrued interest of $63. Received semiannual interest on the XYZ Co. bonds. Accrued $3,135 interest on the Simple Tree bonds. Accrued $175 interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Received semiannual interest on the XYZ Co. bonds. Received…arrow_forwardGarcia Company issues 8.0%, 15-year bonds with a par value of $290,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6.0%, which implies a selling price of 114 3/4. Prepare the journal entry for the issuance of these bonds for cash on January 1. View transaction list Journal entry worksheet < Record the issue of bonds with a par value of $290,000 at a selling price of 114 3/4. Note: Enter debits before credits. Date January 01 Record entry General Journal Clear entry Debit Credit He View general Journalarrow_forward

- Marketable Debt Securities Use the financial statement effects template to record the accounts and amounts for the following four transactions involving investments in marketable debt securities classified as available-for-sale securities. a. Loudder Inc. purchases 10,000 bonds with a face value of $1,000 per bond. The bonds are purchased at par for cash and pay interest at a semi-annual rate of 4%. b. Loudder receives semi-annual cash interest of $200,000. c. Year-end fair value of the bonds is $978 per bond. d. Shortly after year-end, Loudder sells all 10,000 bonds for $970 per bond. Use negative signs with answers, if appropriate. Transaction Loudder purchases bonds. Loudder receives cash interest. Bonds year-end fair value is determined. Loudder sells all bonds Cash Asset + Noncash Assets Balance Sheet = Liabilities + Contrib. Captial + Earned Capital Revenues Income Statement Expenses = Net incomearrow_forwardStoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Fair Value $ 490,000 154,000 713,630 Available-for-Sale Securities Cost Company A bonds Company B notes Company C bonds $ 535,300 159,380 662,750 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $79,200. July 6 Purchased Company X bonds for $126,600. November 13 Purchased Company Z notes for $267,900. December 9 Sold all of the Company A bonds for $515,000. Fair values at December 31 are B, $81,000; C, $665,000; X, $118,000; and Z, $278,000.arrow_forwardVikrambhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education