A-1

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 15 images

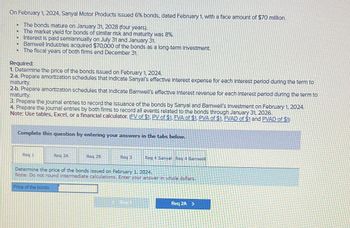

3. Prepare the

4. Prepare the journal entries by both firms to record all events related to the bonds through January 31, 2026.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

3. Prepare the

4. Prepare the journal entries by both firms to record all events related to the bonds through January 31, 2026.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

- x M Question 1-QUIZ - CH 17 - CX Chapter 5: Customers and Sal x o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H 17 i Saved 山☆ Help Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = K(x-772. 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement 0.1996 Frequency 3 0.2004 5 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements. Additionally, calculate the expected (i.e., average) loss per…arrow_forwardACC 10 X McGraw-Hill Edu Xx 3:05 C ezto.mheducation.com/ext/map/index.html?_con=con&ext... Q d Applicati.... WP WileyPLUS B Bloomberg for Edu... Frontline - Sign In R myRutgers Portal Multiple Choice $800,000. $1,200,000. $480,000. Question 10 - EX Forrester Company is considering buying new equipment that would decrease monthly fixed costs from $360,000 to $360,000 and would decrease the current variable costs of $70 by $10 per unit. The selling price of $100 is not expected to change. Forrester's current break-even sales are $1,200,000 and current break-even units are 12,000. If Forrester purchases this new equipment, the revised break-even point in dollars would be: $1,500,000. Save & Exit ☐ B Submit X : >>>arrow_forwardM Question 1-QUIZ- CH 17-C X Chapter 5: Customers and Sal x + o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H17 2 S Saved Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = (x-7)². 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement Frequency 3 0.1996 0.1997 5 0.1998 15 0.1999 14 0.2000 35 0.2001 14 0.2002 6 0.2003 5 0.2004 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education