FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

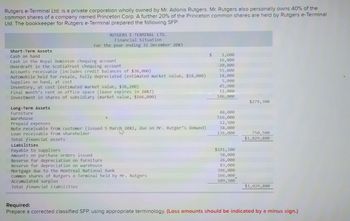

Transcribed Image Text:Rutgers e-Terminal Ltd. is a private corporation wholly owned by Mr. Adonis Rutgers. Mr. Rutgers also personally owns 40% of the

common shares of a company named Princeton Corp. A further 20% of the Princeton common shares are held by Rutgers e-Terminal

Ltd. The bookkeeper for Rutgers e-Terminal prepared the following SFP:

RUTGERS E-TERMINAL LTD.

Financial Situation

For the year ending 31 December 20X3

Short-Term Assets

Cash on hand

Cash in the Royal Dominion chequing account

Overdraft in the ScotiaTrust chequing account

Accounts receivable (includes credit balances of $30,000)

Automobile held for resale, fully depreciated (estimated market value, $18,000)

Supplies on hand, at cost

Inventory, at cost (estimated market value, $38,200)

Final month's rent on office space (lease expires in 20X7)

Investment in shares of subsidiary (market value, $166,000)

Long-Term Assets

Furniture

Warehouse

Prepaid expenses

Note receivable from customer (issued 5 March 20X1, due on Mr. Rutger's demand)

Loan receivable from shareholder

Total financial assets

Liabilities

Payable to suppliers

Amounts on purchase orders issued

Reserve for depreciation on furniture

Reserve for depreciation on warehouse

Mortgage due to the Montreal National Bank

Common shares of Rutgers e-Terminal held by Mr. Rutgers

Accumulated surplus

Total financial liabilities

1,600

16,800

-20,800

55,800

18,000

5,000

45,900

11,000

146,000

48,000

516,000

12,500

38,000

136,000

$191,300

58,000

26,000

83,000

396,000

166,000

109,500

$279,300

"

750,500

$1,029,800

$1,029,800

Required:

Prepare a corrected classified SFP, using appropriate terminology. (Loss amounts should be indicated by a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grier & Associates maintains its records on the cash basis. You have been engaged to convert its cash basis income statement to the accrual basis. The cash basis income statement, along with additional information, follows: Grier & Associates Income Statement (Cash Basis) For the Year Ended December 31, 2025 Cash receipts from customers $425,000 Cash payments: Salaries and wages $170,000 Income taxes 65,000 Insurance 40,000 Interest…arrow_forwardDuring the current year, Royal Industries sold treasury stock for $32,000 cash. The treasury stock was purchased last year for $28,000. The company also issued bonds payable for $430,000 cash and declared and paid dividends of $40,000. What amount did Royal report on its statement of cash flows for cash provided by financing activities? O $390,000 O $394,000 O $422,000 O $434,000arrow_forwardAs of 31 Jan 2018, PT D. has balances in the following Balance Sheet accounts (partial accounts only): Cash (USD 100) = IDR 14,000 Accounts Receivable (USD 5,000) = IDR 70,000,000 Accounts Payable (USD 2,000) = IDR 28,000,000 Paid-in Capital (IDR 1,000,000) = IDR 13,999,000,000 (according to the deed). If on 28 Feb 2018 the exchange rate of 1 USD = 14,500, -, and the USD balance of each of these accounts has not changed, make a journal for each of these accounts on 28 Feb 2018 Question: The Cash Revaluation Journal is.......a. Dr. Cash 50,000 Cr. Difference in Exchange 50,000b. Dr. Cash 1,450,000 Cr. Loss on Foreign Exchange 50,000 Cr. Cash 1,400,000c. Dr. Loss on Foreign Exchange 50,000 Cr. Cash 50,000d. Dr. Cash 1,400,000 Dr. Difference in Exchange 50,000 Cr. Cash 1,450,000arrow_forward

- Kela Corporation reports net income of $510,000 that includes depreciation expense of $85,000. Also, cash of $46,000 was borrowed on a 3-year note payable. Based on this data, total cash inflows from operating activities are: Multiple Choice O $641,000. $595,000. O $556,000 $425,000arrow_forwardSolvarrow_forwardRenaldo Cross Company paid $2,000 interest on short-term notes payable, $10,000 principal of long-term bonds, and $6,000 in dividends on its common stock. Renaldo Cross Company would report cash outflows from activities, as follows: Multiple Choice Operating, $0; investing, $10,000; financing, $8,000. Operating, $0; investing, $0; financing, $18,000. Operating, $2,000; investing, $10,000; financing, $6,000. Operating, $2,000; investing, $0; financing, $16,000. 身arrow_forward

- Minibikes, Inc. identified the following selected transactions that occurred during the year ended December 31, 2024 Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing activities section of the statement of cash flows. a. Issued 900 shares of $4 par common stock for cash of $24,000. b. Issued 5,300 shares of $4 par common stock for a building with a fair market value of $95,000. c. Purchased new truck with a fair market value of $33,000.Financed it 100% with a long-term note. d. Retired short-term notes of $24,000 by issuing 2,500 shares of $4 par common stock. e. Paid long-term note of $12,000 to Bank of Tallahassee. Issued new long-term note of $22,000 to Bank of Trustarrow_forwardI just don;t understand, any help is appriciatedarrow_forward8arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education