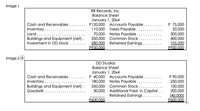

RR Records Inc. acquired all of DD Studios’ voting shares on January 1, 20x1, for P280,000. RR’s

Compute the balance of Goodwill to be reported in the consolidated balance sheet immediately after the acquisition.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- On January 2, 2020, Waterway Company acquired 90% of the outstanding common stock of Oriole Company for $549,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Cash Accounts Receivable (net) Inventory Plant and Equipment (net) Land Total Assets Accounts Payable Mortgage Payable Common Stock, $2 par value Other Contributed Capital Retained Earnings Total Equities Waterway $600,000 345,000 295,000 995,000 180,000 1,050,000 580,000 Oriole 303,000 $155,000 $2,415,000 74,000 $2,415,000 $770,000 168,000 $312,000 $134,000 170,000 275,000 98,000 115,000 210,000 60,000 251,000 $770,000 The fair values of Oriole's assets and liabilities are equal to their book values with the exception of land.arrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, fr $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies Included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation. Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Professor Corporation $ 50,300 90,000 Scholar Corporation $21,000 44,000 130,000 75,000 60,000 30,000 410,000 250,000 (150,000) (80,000) 102,200 $ 692,500 $340,000 $ 152,500 $ 35,000 250,000 180,000 80,000 40,000 210,000 85,000 $ 692,500 $340,000 At the date of the business combination, the book values of Scholar's assets and liabilities approximated fair value except for Inventory, which had a fair value of $81,000, and…arrow_forwardOn December 31, Phoenix Corporation acquired all of Sedona Corporation’s voting stock in exchange for $560,000 cash. At the acquisition date, the fair values of Sedona’s assets and liabilities equaled their carrying values, except that the fair value of the inventory was $20,000 lower than the carrying value, the fair value of the equipment was $50,000 higher than the carrying value, and the fair value of the long-term debt was $4,000 lower than the carrying value. The separate condensed balance sheets of the two companies immediately after the acquisition (on 12/31) are as follows: Phoenix Sedona Cash $ 90,000 $ 60,000 Accounts receivable 130,000 25,000 Inventory 160,000 70,000 Plant and equipment (net)…arrow_forward

- Item Cash Pie Corporation acquired 75 percent of slice Company's ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of slice's net assets at acquisition was $92,000. The book values and fair values of Slice's assets and liabilities were equall, except for Slice's buildings and equipment, which were worth $18,400 more than book value. Accumulated depreciation on the buildings and equipment was $24,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pie concluded at December 31, 20Xx8, that goodwill from its purchase of Slice shares had been impaired and the correct carrying amount was $2,600. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. Trial balance data for Pie and Slice on December 31, 20X8, are as follows: Prepare a three-part consolidation…arrow_forwardAudi Motors acquired 80% of BMW Service Center outstanding shares on January 1, 2022 by paying cash. The consolidated statement of financial position showed the following balances at the date of acquisition. Consolidated Balances Amount Total Assets 15,670,000 Total Liabilities 4,575,000 Total Shareholder’s Equity ? The book value of the net assets of BMW Services Center is P4,500,000. The assets of BMW Service Center are fairly valued except for the following: Patent on the product that is deemed worthless, P50,000. Goodwill of P150,000. Unrecognized identifiable R&D of P75,000. The fair value of the non-controlling interest is 705,000 and the book value of Audi’s equity balance is P9,500,000. On December 31, 2022 the following information were provided by BMW Services Center: Net income of 400,000 was recognized. Patents remaining useful life is 4 years. Pre-existing goodwill presented above was impaired with a current value of 120,000.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education