FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

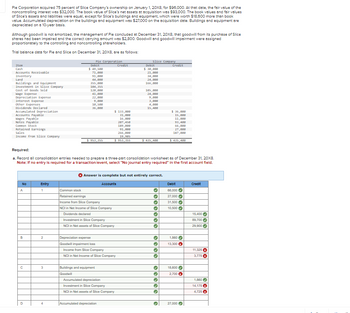

Transcribed Image Text:Pie Corporation acquired 75 percent of Slice Company's ownership on January 1, 20X8, for $96,000. At that date, the fair value of the

noncontrolling interest was $32,000. The book value of Slice's net assets at acquisition was $93,000. The book values and fair values

of Slice's assets and liabilities were equal, except for Slice's buildings and equipment, which were worth $18,600 more than book

value. Accumulated depreciation on the buildings and equipment was $27,000 on the acquisition date. Buildings and equipment are

depreciated on a 10-year basis.

Although goodwill is not amortized, the management of Pie concluded at December 31, 20X8, that goodwill from its purchase of Slice

shares had been impaired and the correct carrying amount was $2,800. Goodwill and goodwill impairment were assigned

proportionately to the controlling and noncontrolling shareholders.

Trial balance data for Pie and Slice on December 31, 20X8, are as follows:

Item

Cash

Pic Corporation

Debit

Credit

slice Company

Debit

Credit

$ 49,500

$ 30,000

Inventory

Land

Accounts Receivable

Buildings and Equipment

71,000

21,000

91,000

34,000

44,000

24,000

355,000

166,000

Investment in Slice Company

Cost of Goods Sold

Wage Expense

Depreciation Expense

184,355

120,000

105,000

41,000

24,000

22,000

9,000

Interest Expense

Other Expenses

9,000

10,500

3,000

4,000

Dividends Declared

36,000

15,400

Accumulated Depreciation

Accounts Payable

$ 133,000

31,000

$ 36,000

15,000

Wages Payable

16,000

11,000

Notes Payable

287,450

93,400

Common Stock

189,000

Retained Earnings

91,000

Sales

Income from slice Company

266,000

19,905

66,000

27,000

187,000

$ 953,355

$ 953,355

$ 435,400

$ 435,400

Required:

a. Record all consolidation entries needed to prepare a three-part consolidation worksheet as of December 31, 20X8.

Note: If no entry is required for a transaction/event, select "No journal entry required" In the first account field.

Answer is complete but not entirely correct.

No

Entry

Accounts

Debit

Credit

A

1

Common stock

66,000

Retained earnings

0

27,000

Income from Slice Company

0

31,500

NCI in Net Income of Slice Company

0

10,500

15,400

Dividends declared

Investment in Slice Company

0

89,700

NCI in Net assets of Slice Company

✔

29,900

B

2

Depreciation expense

Goodwill impairment loss

Income from Slice Company

NCI in Net Income of Slice Company

1,860

13,300x

0

11,325

0

3,775x

C

3

Buildings and equipment

Goodwill

D

4

Accumulated depreciation

Investment in Slice Company

NCI in Net assets of Slice Company

Accumulated depreciation

°

18,600

6 6 6 6

2,700 x

1,860

14,175x

4,725

27,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pit Coporation owns 75% of Stop Company's outstanding common stock. On 01/01/21, Pit sold sold a used piece of equipment to Stop in exchange for $236,000 cash. Pit's original cost of the equipment was $728,000 and accumulated depreciaiton of 01/01/21 was $447,000. The remaining useful life of the equipment is 10 years, and Stop will use that same usefull life. Both companies use the straight line method of depreciation. Pit's Journal Entries would include:arrow_forwardPie Corporation acquired 75 percent of Slice Company's ownership on January 1, 20X8, for $93,000. At that date, the fair value of the noncontrolling interest was $31,000. The book value of Slice's net assets at acquisition was $90,000. The book values and fair values of Slice's assets and liabilities were equal, except for Slice's buildings and equipment, which were worth $18,000 more than book value. Accumulated depreciation on the buildings and equipment was $27,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pie concluded at December 31, 20X8, that goodwill from its purchase of Slice shares had been impaired and the correct carrying amount was $2,900. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. Trial balance data for Pie and Slice on December 31, 20X8, are as follows: Item Cash Accounts Receivable Inventory Land…arrow_forwardOn January 1, 20X8, Ramon Corporation acquired 80 percent of Tester Company's voting common stock for $300,000. At the time of the combination, Tester reported common stock outstanding of $200,000 and retained earnings of $110,000, and the fair value of the noncontrolling interest was $75,000. The book value of Tester's net assets approximated market value except for patents that had a market value of $40,000 more than their book value. The patents had a remaining economic life of five years at the date of the business combination. Tester reported net income of $40,000 and paid dividends of $10,000 during 20X8. What is the amount of Total Excess Depreciation that will be recorded for 20X8? Group of answer choices $6,000 $5,000 $8,000 $40,000arrow_forward

- Pit Coporation owns 75% of Stop Company's outstanding common stock. On 01/01/21, Pit sold sold a used piece of equipment to Stop in exchange for $236,000 cash. Pit's original cost of the equipment was $728,000 and accumulated depreciaiton of 01/01/21 was $447,000. The remaining useful life of the equipment is 10 years, and Stop will use that same usefull life. Both companies use the straight line method of depreciation. The Consolidation Entry would include:arrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, fr $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies Included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation. Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Professor Corporation $ 50,300 90,000 Scholar Corporation $21,000 44,000 130,000 75,000 60,000 30,000 410,000 250,000 (150,000) (80,000) 102,200 $ 692,500 $340,000 $ 152,500 $ 35,000 250,000 180,000 80,000 40,000 210,000 85,000 $ 692,500 $340,000 At the date of the business combination, the book values of Scholar's assets and liabilities approximated fair value except for Inventory, which had a fair value of $81,000, and…arrow_forwardOn January 1, 2XX1, Bald Eagle Corporation purchased 100% of the common stock Ohio Enterprises for $1,800,000. This transaction is a "nontaxable" acquisition under the Internal Revenue Code. On the date of acquisition, Ohio had common stock of $600,000 and retained earnings of $840,000. The fair values of Ohio's net assets equal their respective book values except for equipment that is undervalued by $90,000 and an unrecorded brand name valued at $135,000. Assume that the tax bases of Ohio's pre-acquisition identifiable net assets equal their book values. Bald Eagle's tax effective tax rate is 30%. What is the amount of goodwill recorded in connection with this combination? Select one: O a. $135,000 O b. $202,500 O c. $67,500 d. $-0-arrow_forward

- Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisitior fair value of the noncontrolling Interest was equal to 25 percent of Saul's book value. The balance sheets of the two companies fc January 1, 20X1, are as follows: Cash Accounts Receivable. Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Saul Corporation Total Assets PENNY MANUFACTURING COMPANY Balance Sheet January 1, 20x1 Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Total Assets $ 231,500 Accounts Payable 75,000 Bonds Payable. 113,000 Common Stock 618,000 Additional Paid-In Capital (139,000) Retained Earnings 233,250 $ 1,131,758 Total Liabilities and Equities $ 159,750 380,000 181,000 31,000 380,000 $ 1,131,750 SAUL CORPORATION Balance Sheet January 1, 20x1 $ 61,000 Accounts Payable 115,000 Bonds Payable 193,000 Common Stock ($10 par) 618,000 Additional Paid-In Capital (239,000)…arrow_forwardPackage Corporation acquired 90 percent ownership of Sack Grain Company on January 1, 20X4, for $116,100 when the fair value of Sack’s net assets was $13,000 higher than its $116,000 book value. The increase in value was attributed to amortizable assets with a remaining life of 10 years. At that date, the fair value of the noncontrolling interest was equal to $12,900. During 20X4, Sack sold land to Package at a $7,000 profit. Sack Grain reported net income of $25,000 and paid dividends of $4,800 in 20X4. Package reported income, exclusive of its income from Sack Grain, of $34,000 and paid dividends of $14,300 in 20X4. Required: Compute the amount of income assigned to the controlling interest in the consolidated income statement for 20X4. By what amount will the 20X4 income assigned to the controlling interest increase or decrease if the sale of land had been from Package to Sack Grain, the gain on the sale of land had been included in Package’s $34,000 income, and the $25,000 was…arrow_forwardItem Cash Pie Corporation acquired 75 percent of slice Company's ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of slice's net assets at acquisition was $92,000. The book values and fair values of Slice's assets and liabilities were equall, except for Slice's buildings and equipment, which were worth $18,400 more than book value. Accumulated depreciation on the buildings and equipment was $24,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pie concluded at December 31, 20Xx8, that goodwill from its purchase of Slice shares had been impaired and the correct carrying amount was $2,600. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. Trial balance data for Pie and Slice on December 31, 20X8, are as follows: Prepare a three-part consolidation…arrow_forward

- Pennant Corporation acquired 80 percent of Saylor Company’s common stock for $20,000,000 in cash. At the date of acquisition, Saylor’s $5,000,000 of reported net assets were fairly stated, except land was overvalued by $200,000 and unrecorded developed technology was valued at $2,000,000. The estimated fair value of the noncontrolling interest is $4,000,000 at the acquisition date. Required: Calculate total goodwill and its allocation to the controlling and noncontrolling interests. Prepare the working paper eliminating entries needed to consolidate Pennant and Saylor at the date of acquisition.arrow_forwardOn January 1, 20X4, Pierce Corporation acquired 90 percent of Sharp Company's voting stock, at underlying book value. The fair value of the noncontrolling interest was equal to 10 percent of the book value of Sharp at that date. Pierce uses the equity method in accounting for its ownership of Sharp. On December 31, 20X4, the trial balances of the two companies are as follows: Item Current Assets Depreciable Assets Investment in Sharp Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Subsidiary Required: Pierce Company Debit $ 200,000 300,000 139,500 30,000 100,000 30,000 $ 799,500 Credit $ 120,000 62,000 75,000 100,000 120,000 300,000 22,500 $ 799,500 Sharp Corporation Debit $ 120,000 225,000 25,000 60,000 10,000 $ 440,000 Credit $ 75,000 25,000 90,000 75,000 65,000 110,000 $ 440,000 1) Provide all consolidating entries required as of December 31, 20X4, to prepare…arrow_forwardPlanet Corporation acquired 100 percent of the voting common stock of Saturn Company on January 1, 20X7, by issuing bonds with a par value and fair value of $670,000 and making a cash payment of $24,000. At the date of acquisition, Saturn reported assets of $740,000 and liabilities of $140,000. The book values and fair values of Saturn’s net assets were equal except for land and copyrights. Saturn’s land had a fair value $16,000 higher than its book value. All of the remaining purchase price was attributable to the increased value of Saturn’s copyrights with a remaining useful life of eight years. Saturn Company reported a loss of $88,000 in 20X7 and net income of $120,000 in 20X8. Saturn paid dividends of $24,000 each year. Required: Assuming that Planet Corporation uses the equity method in accounting for its investment in Saturn Company, prepare all journal entries for Planet for 20X7 and 20X8.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education