FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Multiple Choice

о

($8,250)

о

О

$7,125

$9,500

о

$27,500

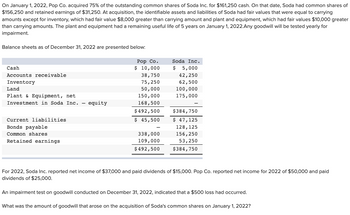

Transcribed Image Text:On January 1, 2022, Pop Co. acquired 75% of the outstanding common shares of Soda Inc. for $161,250 cash. On that date, Soda had common shares of

$156,250 and retained earnings of $31,250. At acquisition, the identifiable assets and liabilities of Soda had fair values that were equal to carrying

amounts except for inventory, which had fair value $8,000 greater than carrying amount and plant and equipment, which had fair values $10,000 greater

than carrying amounts. The plant and equipment had a remaining useful life of 5 years on January 1, 2022.Any goodwill will be tested yearly for

impairment.

Balance sheets as of December 31, 2022 are presented below:

Cash

Accounts receivable

Inventory

Land

Plant & Equipment, net

Investment in Soda Inc. - equity

Current liabilities

Bonds payable

Common shares

Retained earnings

Pop Co.

$ 10,000

Soda Inc.

$ 5,000

38,750

42,250

75,250

62,500

50,000

100,000

150,000

175,000

168,500

$384,750

$492,500

$ 45,500

-

338,000

109,000

$492,500

$ 47,125

128,125

156,250

53,250

$384,750

For 2022, Soda Inc. reported net income of $37,000 and paid dividends of $15,000. Pop Co. reported net income for 2022 of $50,000 and paid

dividends of $25,000.

An impairment test on goodwill conducted on December 31, 2022, indicated that a $500 loss had occurred.

What was the amount of goodwill that arose on the acquisition of Soda's common shares on January 1, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Flower Company purchased 100% of the common stock of Cornell Company for $380,000 cash. Fair values differed from book values as follows: Fair value Inventory $45,000 Land 50,000 Buildings 200,000 Bonds Payable 95,000 The trial balances of the companies at the acquisition date are as follows: Trial Balance Parent Sub. Account Titles Company Company Assets: Inventory 150,000 30,000 Cash 639,000 165,000 Investment in Sub. Company 380,000 Land 20,000 30,000 Buildings, net 250,000 180,000 Goodwill 40,000 Liabilities and Equity: Current Liabilities 191,000 65,000 Bonds Payable 500,000 100,000 Common Stock 100,000 50,000 Other Paid-in Capital 150,000 70,000 Retained Earnings 538,000 120,000 Which of the following is not one of the eliminations and adjustments included on the consolidation worksheet…arrow_forwardOn December 31, 2008, Mercury Corporation acquired 100% ownership of Saturn Corporation. On that date, Saturn reported assets and liabilities with book values of $300,000 and $100,000, respectively, common stock outstanding of $50,000, and retained earnings of $150,000. The book values and fair values of Saturn's assets and liabilities were same except land which had increased in value by $10,000 and inventories which had decreased by $5,000 Based on the preceding information, what amount of goodwill will be reported if the acquisition price was $240,000? Select one: a. 35,000 b. 40,000 c. 15,000 d. 0arrow_forwardOn January 1, 2018, Panorama Company acquired 80% of Scann Corporation for $6,400,000.At the time of the acquisition, the book value of Scann's assets and liabilities was equal to the fair value except for equipment that was undervalued $80,000 with a four-year remaining useful life and inventories that were undervalued $20,000 and sold in 2018. Panorama separate net income in 2018 and 2019 was $1,100,000 and $1,150,000, respectively. Scann separate net income in 2018 and 2019 was $300,000 and $360,000, respectively. Dividend payments by Scann in 2018 and 2019 were $60,000 and $60,000, respectively Required: Using equity method, Calculate Investment in Scann shown on Panorama's ledger at December 31, 2018 and 2019. Calculate Investment in Scann shown on the consolidated statements at December 31, 2018 and 2019. Calculate consolidated net income for 2018 and 2019. Calculate Noncontrolling interest balance on Panorama's ledger at December 31, 2018 and 2019. Calculate Noncontrolling…arrow_forward

- On January 1, 2020, Pail Corporation acquired 75 percent of Sand Company's common stock for $525,000 cash. The fair value of the noncontrolling interest at that date was determined to be $175,000. At the date of the business combination, the book values of Sand's net assets and liabilities approximated fair value except for depreciable plant assets, which were UNDERvalued by $4000 and Inventory, which was OVERvalued by $4500 The remaining useful life of the plant assets was set at 10 years. For the year ended December 31, 2020, Pail reported Depreciation Expense of $15000 on its general ledger. Sand reported Depreciation Expense of $9000 on its general ledger. What amount of Depreciation Expense should be reported on the 12/31/20 consolidated Income Statement?arrow_forwardOn January 1, 2025, Henderson Company purchased 100% of the common stock of Caramel Company for $590,000 cash. Fair values differed from book values as follows: Fair value Land 100,000 Patent 250,000 Bonds Payable 105,000 The trial balances of the companies at the acquisition date are as follows: Trial Balance Account Titles Henderson Caramel Cash 650,000 65,000 Land 120,000 30,000 Buildings, net 250,000 180,000 Goodwill 400,000 200,000 Current Liabilities 170,000 75,000 Bonds Payable 500,000 100,000 Common Stock 70,000 30,000 APIC 350,000 70,000 Retained Earnings 330,000 200,000 The amount reported for Cash on the consolidated balance sheet at the acquisition date is Question Answer a. $125,000 b. $650,000 c. $65,000 d. $715,000arrow_forwardOn January 2, 2020, Sheffield Company acquired 90% of the outstanding common stock of Wildhorse Company for $459,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Sheffield Wildhorse Cash $630,000 $180,000 Accounts Receivable (net) 405,000 74,000 Inventory 275,000 130,000 Plant and Equipment (net) 980,000 210,000 Land 205,000 88,000 Total Assets $2,495,000 $682,000 Accounts Payable $248,000 $144,000 Mortgage Payable 150,000 100,000 Common Stock, $2 par value 1,030,000 190,000 Other Contributed Capital 590,000 55,000 Retained Earnings 477,000 193,000 Total Equities $2,495,000 $682,000 The fair values of Wildhorse's assets and liabilities are equal to their book values with the exception of land. Cash Accounts Receivable Inventory Plant and Equipment Land. Total Assets Liabilities Accounts Payable Mortgage Payable Total Liabilities Stockholder's Equity Noncontrolling Interest Common Stock SHEFFIELD COMPANY AND SUBSIDIARY Consolidated Balance…arrow_forward

- On March 31, 2024, Wolfson Corporation acquired all of the outstanding common stock of Barney Corporation for $18,500,000 in cash. The book values and fair values of Barney’s assets and liabilities were as follows: Book Value Fair Value Current assets $ 7,500,000 $ 9,000,000 Property, plant, and equipment 12,500,000 15,500,000 Other assets 1,150,000 1,650,000 Current liabilities 5,500,000 5,500,000 Long-term liabilities 7,500,000 7,000,000 Required: Calculate the amount paid for goodwill.arrow_forwardOn January 1, 2023, QuickPort Company acquired 90 percent of the outstanding voting stock of NetSpeed, Incorporated, for $810,000 in cash and stock options. At the acquisition date. NetSpeed had common stock of $800,000 and Retained Earnings of $40,000. The acquisition-dete fair value of the 10 percent noncontrolling interest was $90.000. QuickPort attributed the $60.000 excess of NetSpeed's fair value over book value to a database with a five-year remaining life During the next two years, NetSpeed reported the following Income 8,000 Dividends Declared On July 1, 2023, QuickPort sold communication equipment to NetSpeed for $42.000. The equipment originally cost $48,000 and had accumulated depreciation of $9,000 and an estimated remaining life of three years at the date of the intra-entity transfer Required: Compute the equity method balance in QuickPort's Investment in NetSpeed, incorporated, account as of December 31, 2024. b. Prepere the worksheet adjustments for the December 31,…arrow_forwardOn January 1, 2019, Vachirawit Company acquired 80% of Metawin Company's common stock for 280,000 cash. At that date, Metawin reported common stock outstanding of 200,000 and retained earnings of 100,000 and the fair value of Metawin's assets and liabilities were equal, except for other intangible assets, which has a fair value 50,000 greater than book value and an 8- year remaining life. Metawin reported the following data for 2019 and 2020: Year Net Income Comprehensive Income Dividends Paid 2019 25,000 30,000 5,000 2020 35,000 45,000 10,000 Vachirawit reported separate net income from own operations of 100,000 and paid dividends of 30,000 for both years. What is the amount of comprehensive attributable to the controlling interest in 2020?arrow_forward

- On March 31, 2024, Wolfson Corporation acquired all of the outstanding common stock of Barney Corporation for $17,400,000 in cash. The book values and fair values of Barney’s assets and liabilities were as follows: Book Value Fair Value Current assets $ 6,400,000 $ 7,900,000 Property, plant, and equipment 11,400,000 14,400,000 Other assets 1,040,000 1,540,000 Current liabilities 4,400,000 4,400,000 Long-term liabilities 6,400,000 5,900,000 Required: Calculate the amount paid for goodwill.arrow_forwardOn January 1, 20X1, XYZ, Inc. purchased 70% of Set Corporation for $469,000. On that date the book value of the net assets of Set totaled $500,000. Based on the appraisal done at the time of the purchase, all assets and liabilities had book values equal to their fair values except as follows: Book Value Fair Value Inventory $100,000 $120,000 Land 75,000 85,000 Equipment (useful life 4 years) 125,000 165,000 The remaining excess of cost over book value was allocated to a patent with a 10-year useful life. During 20X1 XYZ reported net income of $200,000 and Set had net income of $100,000. What income from subsidiary did Promo include in its net income if Promo uses the simple equity method? a. $70,000 b. $42,000 c. $38,000 d. $110,000arrow_forwardThe DeBlois Family Co. acquired 40% of Orange Beach Co. with a $500,000 payment on January 1, 2023. The equivalent net book value (40% share) of Orange Beach on the date of acquisition was $425,000. $50,000 of the excess payment was attributable to equipment with a 10-year remaining life. The remainder of the excess payment was not attributable to any identifiable item. Orange Beach Co. Reported net income of $40,000 in 2023. No dividends were paid out. On January 1, 2024, DeBlois Family Co. Acquired an additional 50% ownership share in Orange Beach Co. With a cash payment of $700,000. The fair value of the noncontrolling interest was determined to be $140,000 on the date of acquisition. The total fair value of Orange Beach's identifiable assets and liabilities on January 1, 2024, was $1,000,000. The trading value of stock shares remained the same as acquisition date prices for several months after January 1, 2024. What amount should be reported as consolidated goodwill on January 1,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education