FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

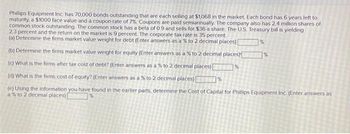

Transcribed Image Text:Phillips Equipment Inc. has 70,000 bonds outstanding that are each selling at $1,068 in the market. Each bond has 6 years left to

maturity, a $1000 face value and a coupon rate of 7%. Coupons are paid semiannually. The company also has 2.4 million shares of

common stock outstanding. The common stock has a beta of 0.9 and sells for $36 a share. The U.S. Treasury bill is yielding

2.3 percent and the return on the market is 9 percent. The corporate tax rate is 35 percent.

(a) Determine the firms market value weight for debt (Enter answers as a % to 2 decimal places) [

%

(b) Determine the firms market value weight for equity (Enter answers as a % to 2 decimal places)

(c) What is the firms after tax cost of debt? (Enter answers as a % to 2 decimal places)

(d) What is the firms cost of equity? (Enter answers as a % to 2 decimal places)

(e) Using the information you have found in the earlier parts, determine the Cost of Capital for Phillips Equipment Inc. (Enter answers as

a % to 2 decimal places) [

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Use the following information about Red Rocks Inc. to answer the following question: Assume the following: Pays no taxes Return on net operating assets (RNOA) = 18% %3D Has $2,000 in net operating assets financed by equity At the beg. of the year borrows $1000 at 8%. Uses debt to buy additional operating assets. What is the return on equity (ROE) for Red Rocks? Edit View Insert Format Tools Table 12pt v Paragraph v B IU A e T?v I.arrow_forward4arrow_forwardWhat is the ROE for a firm with a times interest earned ratio of 2, a tax liability of $1 million, and interest expense of $1.68 million if equity equals $1.68 million? O 23.81% O 25.22% 33.60% 40 48% 21arrow_forward

- Assume the firm has a tax rate of 23 percent. c-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is Issued. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-3. Calculate the return on equity (ROE) under each of the three economic scenarios assuming the firm goes through with the recapitalization. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-4. Given the recapitalization, calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round…arrow_forwardSuppose Essen Corp has the following weights and costs. What is the WACC if the company has a 21% tax rate? Component Common equity Debt (before tax) R 11.5% 0.8 0.2 7.5% 10.39% ()8.71% ()6.25% 9.50% 10.70% Page 29 of 30 Previous Page Next Pagearrow_forwardConsider the following data for the firms Acme and Apex: Acme Apex Required: Equity Debt ($ million) ($ million) 210 1,050 105 350 ROC Cost of Capital (*) (%) 17% 9% 15% 10% a-1. Calculate the economic value added for Acme and Apex. a-2. Which firm has the higher economic value added? b-1. Calculate the economic value added per dollar of invested capital for Acme and Apex. b-2. Which firm has the higher economic value added per dollar of invested capital? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Calculate the economic value added for Acme and Apex. Note: Enter your answers in millions rounded to 2 decimal places. Economic value added for Acme million Economic value added for Apex millionarrow_forward

- A levered firm has a pretax cost of debt of 6.8 percent and an unlevered cost of capital of 14 percent. The tax rate is 21 percent and the cost of equity is 17.7 percent. What is the debt-to-equity ratio? O 0.65 0.47 0.41 O 0.52arrow_forwardDomino’s Pizza, Inc. (DPZ)’s return on equity (ROE) is closest to A. 20.14%. B. 17.46%. C. 15.49%. D. 11.41%.arrow_forwardonly looking for parts c-1 and c-3arrow_forward

- Subject:- financearrow_forwardAssuming that there is an unlevered firm and a levered firm. The basic information is given by the following table. Table1: Information of the firms Unlevered firm Levered firm EBIT 20000 20000 Interest Taxable income Tax (tax rate: 34%) Net income CFFA Assuming that: The size of the debt is 8000; cost of debt =8%; unlevered cost of capital =10%; systematic risk of the asset is 1.5 Fill in the blanks What is the present value of the tax shield? Calculate the following values:a) Calculate value of unlevered firm; b) value of the levered firm; c) equity value; d) Cost of equity; e) cost of capital; f) systematic risk of the equity Suppose that the firm changes its capital structure so that the debt-to-equity ratio is 1.6, then recalculate the systematic risk of the equity If the firm now has the following project: in year 0, the cashflow is 5000, in year 1, the cashflow is -5500. Based on the IRR rule,…arrow_forwardWhich statement is correct?a. The cost of debt is determined by taking the present value of the interest payments and principal times one minus the tax rate.b. The difference in computing the cost of capital between using the accumulated profits and issuance of new ordinary shares is the growth rate.c. Increase in flotation costs, increase in the company’s beta and increase in the expected inflation will all lead to d. increase the company’s weighted average cost of capital.e. Increasing the company’s dividend payout would mitigate the company’s need to raise new ordinary shares.f. none of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education