Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

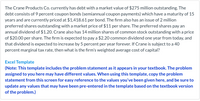

Transcribed Image Text:The Crane Products Co. currently has debt with a market value of $275 million outstanding. The

debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15

years and are currently priced at $1,418.61 per bond. The firm also has an issue of 2 million

preferred shares outstanding with a market price of $11 per share. The preferred shares pay an

annual dividend of $1.20. Crane also has 14 million shares of common stock outstanding with a price

of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and

that dividend is expected to increase by 5 percent per year forever. If Crane is subject to a 40

percent marginal tax rate, then what is the firm's weighted average cost of capital?

Excel Template

(Note: This template includes the problem statement as it appears in your textbook. The problem

assigned to you here may have different values. When using this template, copy the problem

statement from this screen for easy reference to the values you've been given here, and be sure to

update any values that may have been pre-entered in the template based on the textbook version

of the problem.)

Transcribed Image Text:Calculate the cost of debt. (Round intermediate calculations to 4 decimal places, eg. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.)

Cost of debt

%

Calculate the cost of preferred equity. (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.)

Cost of preferred equity

%

Calculate the cost of common equity. (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to O decimal places, e.g. 15%.)

Cost of common equity

What is the firm's weighted average cost of capital? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%,.)

WACC

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dinklage Corp. has 9 million shares of common stock outstanding. The current share price is $81, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, a yield to maturity of 10.45 percent, and sells for 96 percent of par. The second issue has a face value of $50 million, a yield to maturity of 10.26 percent, and sells for 104 percent of par. The first issue matures in 25 years, the second in 8 years. Suppose the most recent annual dividend was $5.30 and the annual dividend growth rate is 5 percent. The tax rate is 35 percent. Calculate the company's WACC. Start by calculating the firm's market value. (Enter your answer as a dollar amount, not millions of dollars, i.e. enter one million as 1,000,000) Firm's Market Value (debt & equity) $ Now calculate the firm's cost of equity and after-tax cost of debt. (Enter your answers as percent rounded to two decimals. Assume the YTMS are quoted as an EAR, not…arrow_forwardThe Ivanhoe Products Co. currently has debt with a market value of $250 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) that have a maturity of 15 years and are currently priced at $1423.92 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $15.00 per share. The preferred shares pay an annual dividend of $1.20. Ivanhoe also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 4 percent per year forever. If Ivanhoe is subject to a 28 percent marginal tax rate. Calculate the weights for debt, common equity, and preferred equity. (Round final answers to 4 decimal places)arrow_forwardBlooming Ltd. currently has the following capital structure:Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years.Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely.Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%.Company tax rate is 30%.Required: Complete the following tasks:a) Calculate the current price of the corporate bond? b) Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%? c) Calculate the current value of the preferred share if the average return of the shares in the same industry is 12%d) Calculate the current market value…arrow_forward

- Santa Claus Enterprises has 174,000 shares of common stock outstanding at a current price of $46 a share. The firm also has two bond issues outstanding. The first bond issue has a total face value of $250,000, pays 7.7 percent interest annually, and currently sells for 102.5 percent of face value. The second bond issue consists of 5,000 bonds that are selling for $993 each. These bonds pay 6.5 percent interest annually and mature in eight years. The tax rate is 34 percent. What is the capital structure weight of the firm's debt?arrow_forwardABC Trucking's balance sheet shows a total of noncallable $41 million long-term debt with a coupon rate of 8.10% and a yield to maturity of 8.50%. This debt currently has a market value of $52 million. The balance sheet also shows that the company has 9 million shares of common stock, and the book value of the common equity is $167.15 million. The current stock price is $21.35 per share; stockholders' required return, rs, is 12.80%; and the firm's tax rate is 34.00%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between the WACCs using market value and the book value? Work with at least 4 decimals and round your final answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72.arrow_forwardYour company currently has a bond issue outstanding with 13 years to maturity, a face value of $1,000 that trade for $1,042. The total face value amount outstanding is $5,720,000 and the expected return on the bonds is 3.79%. Your company has 507,000 shares of common stock outstanding. The shares have a beta of 1.26, and currently sells for $12/share. Treasury bills yield 1.35% and the expected rate of return on the S&P 1,500 index is 6.25%. The corporate tax rate is 26%. What is the WACC?arrow_forward

- Kim's Bridal Shoppe has 12,400 shares of common stock outstanding at a price of $58 per share. It also has 325 shares of preferred stock outstanding at a price of $88 per share. There are 400 bonds outstanding that have a coupon rate of 7.7 percent paid semiannually. The bonds mature in 39 years, have a face value of $2,000, and sell at 113 percent of par. What is the capital structure weight of the common stock?arrow_forwardHexaware Systems Limited uses the market value weights of Debt and Equity for its WACC computation. The firm has issued 1 million bonds and the bonds are currently trading at $255 each. The debt issued by the firm carries AAA rating. The credit spread is 150 basis points of 10-year treasury yield. The 10-year treasury is currently yielding 5.2%. Th firm has 20 million shares outstanding with a current market price of $410 each. The return from DJIA for the period is 12% and the beta of Hexaware is 1.3.arrow_forwardThe Sandhill Products Co. currently has debt with a market value of $250 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,418.61 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $14 per share. The preferred shares pay an annual dividend of $1.20. Sandhill also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 4 percent per year forever. If Sandhill is subject to a 40 percent marginal tax rate, then what is the firm’s weighted average cost of capital? Calculate the weights for debt, common equity, and preferred equity. (Round intermediate calculations and final answers to 4 decimal places, e.g. 1.2514.) Debt Preferred equity Common equityarrow_forward

- Nacho Libre S.A. has 3,000,000 common shares outstanding that trade for $20.00 per share. The company has also issued one bond with a par value of $60,000,000 that currently trades at 110 percent of par. You observe that the company's required return on stock is 10.00 percent and the (after-tax) yield to maturity on its debt is 2.00 percent. What is the weighted average cost of capital? Write your answer as a percent rounded to two decimals, but don't include % sign. Numeric Responsearrow_forwardThe Smith Company has 10,000 bonds outstanding. The bonds are selling at 102% of face value, have a 8% coupon rate, pay interest annually, mature in 10 years, and have a face value of $1,000. There are 500,000 shares of 9% preferred stock outstanding with a current market price of $91 a share and a par value of $100. In addition, there are 1.25 million shares of common stock outstanding with a market price of $64 a share and a beta of .95. The most recent dividend paid by the company on the common stock was of $1.10 and it expects to increase those dividends by 3% annually forever. The firm's marginal tax rate is 35%. The overall stock market is yielding 12% and the Treasury bill rate is 3.5%. What is the cost of equity based on the dividend growth model?arrow_forwardABC Trucking's balance sheet shows a total of noncallable $30 million long-term debt with a coupon rate of 6.80% and a yield to maturity of 8.10%. This debt currently has a market value of $48 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity is $213.00 million. The current stock price is $23.80 per share; stockholders' required return, rs, is 15.05%; and the firm's tax rate is 36.00%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between the WACCs using market value and the book value?Work with at least 4 decimals and round your final answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. Group of answer choices –0.46% –0.49% –0.44% –0.34% –0.36%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education