Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

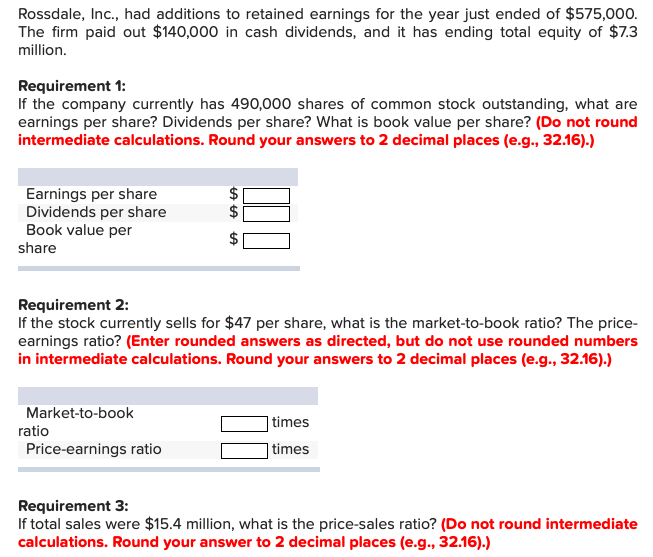

Transcribed Image Text:Rossdale, Inc., had additions to retained earnings for the year just ended of $575,000.

The firm paid out $140,000 in cash dividends, and it has ending total equity of $7.3

million.

Requirement 1:

If the company currently has 490,000 shares of common stock outstanding, what are

earnings per share? Dividends per share? What is book value per share? (Do not round

intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).)

Earnings per share

Dividends per share

Book value per

share

Requirement 2:

If the stock currently sells for $47 per share, what is the market-to-book ratio? The price-

earnings ratio? (Enter rounded answers as directed, but do not use rounded numbers

in intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).)

Market-to-book

|times

ratio

Price-earnings ratio

| times

Requirement 3:

If total sales were $15.4 million, what is the price-sales ratio? (Do not round intermediate

calculations. Round your answer to 2 decimal places (e.g., 32.16).)

EA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 6 images

Knowledge Booster

Similar questions

- Columbus Corp. had $410,000 additions to retained earnings for the year. The firm paid out $190,000 in cash dividends, and it has ending total equity of $6.7 million. The company currently has 210,000 shares of common stock outstanding and the stock currently sells for $75 per share. What is the PE ratio? Round it to two decimal places.arrow_forwardHelmuth Inc's latest net income was $1,500,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? Do not round your intermediate calculations. O a. $2.31 O b. $3.24 O c. $3.00 O d. $2.28 Oe. $3.21arrow_forwardneed all answerarrow_forward

- American Health Systems currently has 6,200,000 shares of stock outstanding and will report earnings of $22 million in the current year. The company is considering the issuance of 1,900,000 additional shares, which can only be issued at $16 per share. a. Assume that American Health Systems can earn 9 percent on the proceeds. Calculate earnings per share. Note: Do not round intermediate calculations and round your answer to 2 decimal places. Earnings per share b. Should the new issue be undertaken based on earnings per share? Yes O Noarrow_forwardGriffins Goat Farm, Inc., has sales of $670,000, costs of $332,000, depreciation expense of $76,000, interest expense of $48,000, a tax rate of 23 percent, and paid out $45,000 in cash dividends. The firm has 27,800 shares of common stock outstanding. a. What are the earnings per share figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are the dividends per share figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Earnings per share b. Dividends per sharearrow_forwardBolton Corporation had additions to retained earnings for the year just ended of $248,000. The firm paid out $187,000 in cash dividends, and it has ending total equity of $4.92 million. The company currently has 150,000 shares of common stock outstanding. a. What are earnings per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are dividends per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the book value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the stock currently sells for $80 per share, what is the market-to-book ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) e. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) f. If the…arrow_forward

- Frantic Fast Foods had earnings after taxes of $900,000 in 20X1 with 301, 000 shares outstanding. On January 1, 20X2, the firm issued 32,000 new shares. Because of the proceeds from these new shares and other operating improvements, earnings after taxes increased by 28 percent. Compute earnings per share for the year 20X1. Note: Round your answer to 2 decimal places. Compute earnings per share for the year 20X2. Note: Round your answer to 2 decimal places.arrow_forwardHelmuth Inc's latest net income was $1,415,000, and it had 250,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? Do not round your intermediate calculations. a. $3.11 Ob. $1.91 c. $5.66 Od. $8.21 O e. $2.55arrow_forwardHank Corp.'s common stock currently sells for $53 per share. The most recent dividend (Do) was $2.48, and the expected growth rate in dividends per year is 7%. The cost of common equity, Re, is ____%. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34%), but do not round any intermediate work in the process.arrow_forward

- Green Fire had Net Income for the year just ended of $34,000, and the firm paid out $8,000 in cash dividends. The company currently has 15,000 shares of common stock outstanding, and the stock currently sells for $89 per share. �What is the PE ratio?arrow_forwardByrd Lumber has 2 million shares of stock outstanding. On the balance sheet the company has $39 million worth of common equity. The company's stock price is $23 a share. What is the company's Market Value Added (MVA)? If negative, use the negative sign instead of parentheses, e.g. -130,000.arrow_forwardDove, Inc., had additions to retained earnings for the year just ended of $635,000. The firm paid out $80,000 in cash dividends, and it has ending total equity of $7.30 million. a. If the company currently has 670,000 shares of common stock outstanding, what are earnings per share? Dividends per share? What is book value per share? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If the stock currently sells for $30.00 per share, what is the market-to-book ratio? The price-earnings ratio? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. If total sales were $10.6 million, what is the price-sales ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. C. Earnings per share Dividends per share Book value per share Market-to-book ratio Price-earnings ratio Price-sales ratio times times timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education