Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

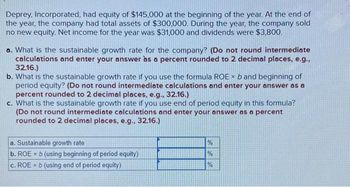

Transcribed Image Text:Deprey, Incorporated, had equity of $145,000 at the beginning of the year. At the end of

the year, the company had total assets of $300,000. During the year, the company sold

no new equity. Net income for the year was $31,000 and dividends were $3,800.

a. What is the sustainable growth rate for the company? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

b. What is the sustainable growth rate if you use the formula ROE × b and beginning of

period equity? (Do not round intermediate calculations and enter your answer as a

percent rounded to 2 decimal places, e.g., 32.16.)

c. What is the sustainable growth rate if you use end of period equity in this formula?

(Do not round intermediate calculations and enter your answer as a percent

rounded to 2 decimal places, e.g., 32.16.)

a. Sustainable growth rate

b. ROEx b (using beginning of period equity)

c. ROEx b (using end of period equity)

de de de

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Plank’s Plants had net income of $10,000 on sales of $40,000 last year. The firm paid a dividend of $2,300. Total assets were $700,000, of which $350,000 was financed by debt. a. What is the firm’s sustainable growth rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) b. If the firm grows at its sustainable growth rate, how much debt will be issued next year? (Do not round intermediate calculations.) c. What would be the maximum possible growth rate if the firm did not issue any debt next year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)arrow_forwardProvide Answer for this Questionarrow_forwardRadon Homes’ current EPS is $6.50. It was $4.42 5 years ago. The companypays out 40% of its earnings as dividends, and the stock sells for $36.a. Calculate the historical growth rate in earnings. (Hint: This is a 5-yeargrowth period.)arrow_forward

- At last year’s end, total assets for Roberts Inc. were $1.2 million and accounts payable were $375,000. Sales, which last year were $2.5 million, are expected to increase by 25 percent this year. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Robert Inc. typically uses no current liabilities other than accounts payable. Common stock amounted to $425,000 last year, and retained earnings were $295,000. Roberts Inc. plans to sell new common stock in the amount of $75,000. The Firm’s profit margin on sales is 6 percent; and 60 percent of earnings will be retained. Set up Roberts Inc.’s last year balance sheet, to the extent possible, based on the information provided in this problem. Based on the balance sheet setup in Part a above, determine how much was Roberts Inc.’s long-term debt last year? Perform financial forecasting using percent of sales method (i.e., constant ratio method; do not use the AFN Equation) to determine how much…arrow_forwardVdarrow_forwardTomey Supply Company’s financial statements for the most recent fiscal year are shown below. The company projects that sales will increase by 11 percent next year. Assume that all costs and assets increase directly with sales. The company has a constant 35 percent dividend payout ratio and has no plans to issue new equity. Any financing needed will be raised through the sale of long-term debt. Prepare pro forma financial statements for the coming year based on this information, and calculate the EFN for Tomey. Tomey Supply Company Income Statement and Balance Sheet Income Statement Balance Sheet Revenues $1,768,121 Assets Costs 1,116,487 Current Assets $280,754 EBT 651,634 Net Fixed Assets 713,655 Taxes (35%) 228,072 Total assets $994,409 Net Income $423,562 Liabilities and Equity: Current Liabilities $167,326 Long-term debt 319,456 Common Stock 200,000 Retained Earnings 307,627 Total liabilities…arrow_forward

- DEF Company is expected to have net income of $250,000 this year. The company traditionally pays out 40 percent of its net income as a dividend. DEF started the year with retained earnings of $490,500. What is their expected retained earnings at the end of the year?arrow_forwardA company had sales of $600 and costs of $300. Depreciation was an additional $150, and interest paid was $30. Taxes were 40% of pretax income. Dividends were $30. Beginning net fixed assets were $500 and ending net fixed assets were $750. The company started the year with a net working capital of $510 and ended with $550. No shares of stock were issued that year A. Calculate net income (nearest dollar without dollar sign ($) or comma, e.g. 15000. Negative cash flow is -15000 B. Calculate operating cash flow (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000arrow_forwardLast year, Lakesha’s Lounge Furniture Corporation had an ROA of 5.8 percent and a dividend payout ratio of 34 percent. What is the internal growth rate? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education