FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

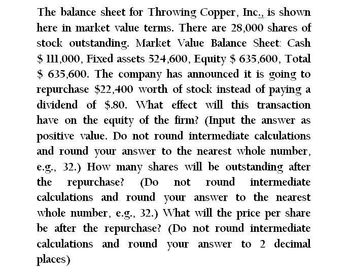

Transcribed Image Text:The balance sheet for Throwing Copper, Inc., is shown

here in market value terms. There are 28,000 shares of

stock outstanding. Market Value Balance Sheet: Cash

$ 111,000, Fixed assets 524,600, Equity $635,600, Total

$635,600. The company has announced it is going to

repurchase $22,400 worth of stock instead of paying a

dividend of $.80. What effect will this transaction.

have on the equity of the firm? (Input the answer as

positive value. Do not round intermediate calculations

and round your answer to the nearest whole number,

e.g., 32.) How many shares will be outstanding after

the repurchase? (Do not round intermediate

calculations and round your answer to the nearest

whole number, e.g., 32.) What will the price per share

be after the repurchase? (Do not round intermediate

calculations and round your answer to 2 decimal

places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Need help to solve this questionarrow_forwardDo not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely.arrow_forwardThe balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share\times total shares outstanding) of $1,358,000. Furthermore, the firm's income statement for the year just ended has a net income of $577, 000, which is $ 0.321 per share of common stock outstanding. The price - earnings ratio for firms similar to Underwood Motors is 21.33. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares?arrow_forward

- Byrd Lumber has 2 million shares of stock outstanding. On the balance sheet the company has $39 million worth of common equity. The company's stock price is $23 a share. What is the company's Market Value Added (MVA)? If negative, use the negative sign instead of parentheses, e.g. -130,000.arrow_forwardChikage Inc's latest net income was $1,400,000, and it had 210,000 shares outstanding. The company wants to pay out 40.0% of its net income as dividends. What dividend per share should it declare? Do not round your intermediate calculations.arrow_forwardTop Rope Productions has 3.00 million shares outstanding that currently trade at $11.66. The firm has $16.00 million of long-term debt, and $6.00 million in cash. What is a rough estimate for the firm's enterprise value? (Express answer in millions. For example, $1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- Marjorie Manufacturing's balance sheets report $250 million in total debt, $100 million in short-term investments, and $8 9 million in preferred stock. Marjorie has 13 million shares of common stock outstanding. A financial analyst estimated that Marjorie's value of operations is $900 million. What is the analyst's estimate of the intrinsic stock price per share?arrow_forwardcompanys current balance sheet shows total common equity of $5,295,000. The company has 350,000 shares of stock outstanding, and they sell at a price of $27.50 per share. By how much do the firm's market and book values per share differ? (Round your intermediate and final answers to two decimal places.)arrow_forwardThe balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding. Market Value Balance Sheet Cash $ 49,300 Fixed assets 355,000 Equity $ 404,300 Total $ 404,300 Total $ 404,300 The company has declared a dividend of $1.45 per share. The stock goes ex dividend tomorrow. Ignore any tax effects. What is the stock selling for today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. What will it sell for tomorrow? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education