Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

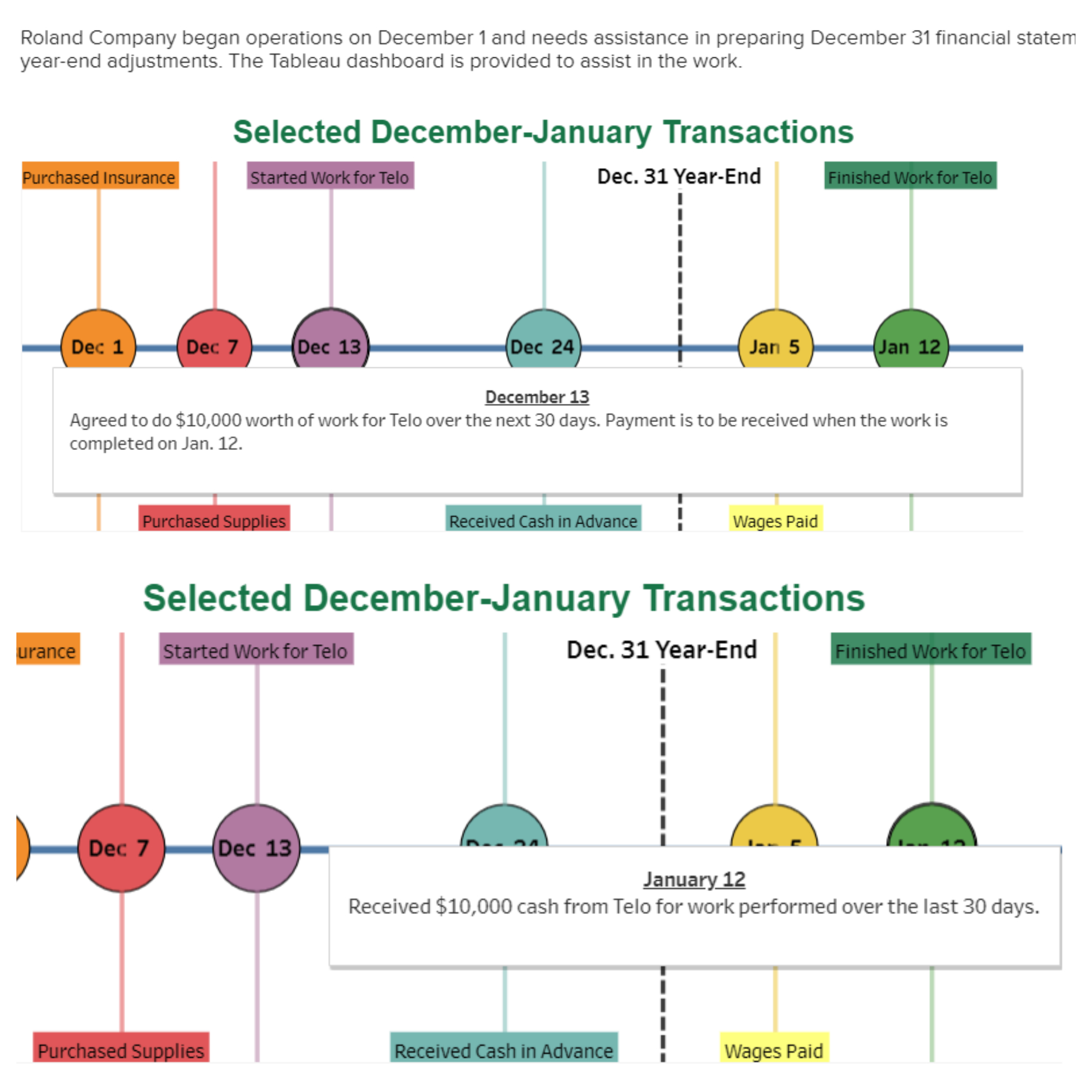

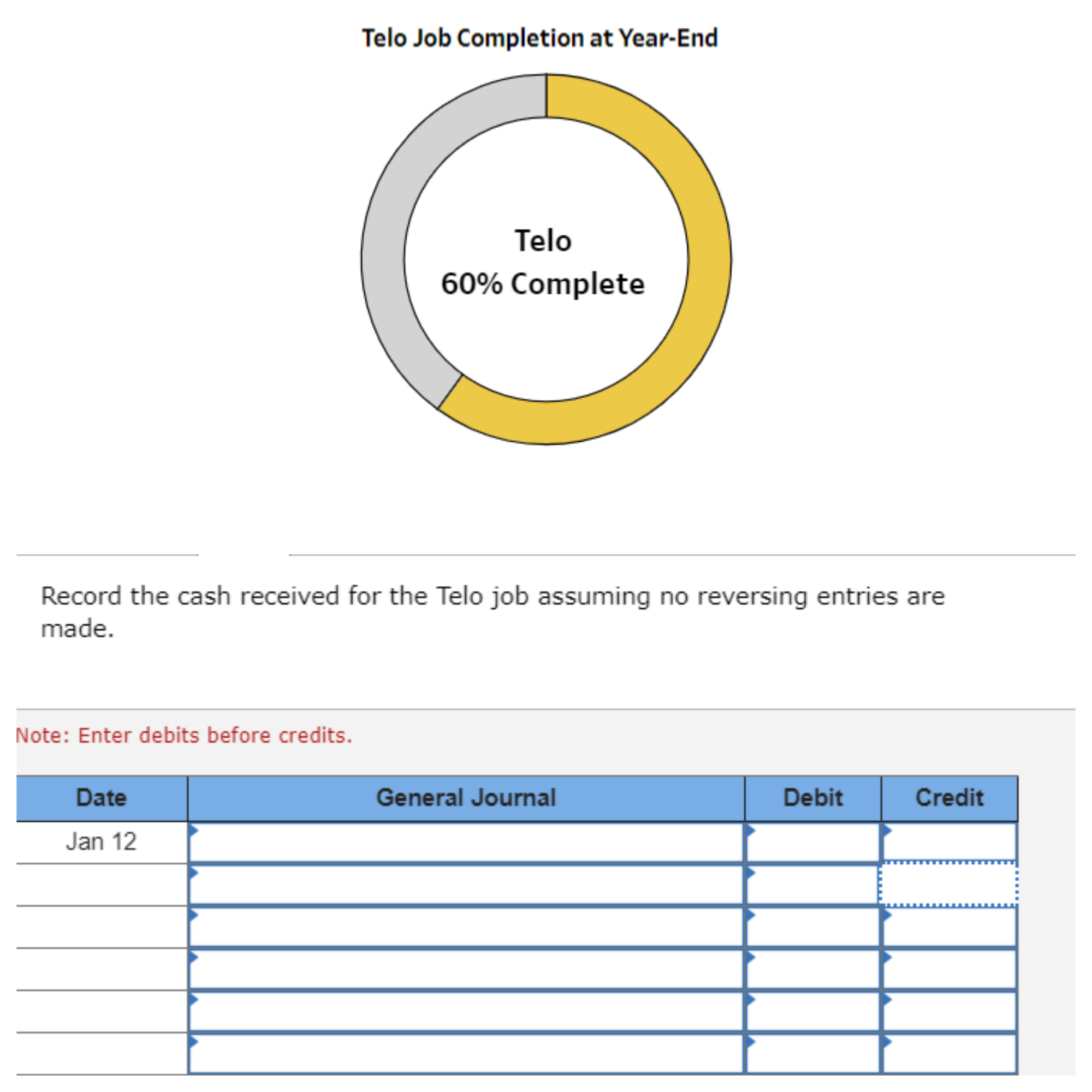

Transcribed Image Text:Roland Company began operations on December 1 and needs assistance in preparing December 31 financial statem

year-end adjustments. The Tableau dashboard is provided to assist in the work.

Selected December-January Transactions

Finished Work for Telo

Dec. 31 Year-End

Purchased Insurance

Started Work for Telo

Dec 13

Dec 7

Dec 24)

(Jan 12

Dec 1

Jan 5

December 13

Agreed to do $10,000 worth of work for Telo over the next 30 days. Payment is to be received when the work is

completed on Jan. 12.

Purchased Supplies

Received Cash in Advance

Wages Paid

Selected December-January Transactions

Dec. 31 Year-End

urance

Started Work for Telo

Finished Work for Telo

Dec 7

Dec 13

January 12

Received $10,000 cash from Telo for work performed over the last 30 days.

Purchased Supplies

Received Cash in Advance

Wages Paid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Specify the insurance expense of this financial accounting Problemarrow_forwardRiverrun Company provides medical care and insurance benefits to its retirees. In the current year, Riverrun agrees to pay $29,500 for medical insurance and contribute an additional $9,600 to a retirement program. Record the entry for these accrued (but unpaid) benefits on December 31. View transaction list Journal entry worksheet 1 Record the costs of employee benefits. Note: Enter debits before credits. Date December 31 Record entry General Journal Clear entry Debit Credit View general journal >arrow_forwardCalculate Little Pear Administration Pty Ltd’s superannuation expense for the month of September using the following information: (Show your workings for superannuation). For month of September Employee Salary Annual Leave Sick Leave Overtime Allowance Superannuation (Show your workings) David Reed $6,100 $469 $300 $600 $180 dry cleaning Carol Wright $3,732 - $144 $250 $50 first aid Debra Foy $2,180 - - $445 - Michael Green $4,920 $378 - - $250 car allowance John Mills $11,600 $892 $446 $125 $350 travel allowance Peter Black $400 - $15 - - Totalarrow_forward

- C The following transactions for Carleton Company ocured during January 2020: 1. Purchase two-year insurance policy for cash, $8,400 4. Paid Utilities bill recieved in December 2019, $450. 9. Peformed service account, $1,200 16. Paid Bi-monhly salary to employees, $2, 700 21. Recieved $800 from a costumer on account. 25. Recieved $600 from Janaury 9 transaction. 30, Prepared the adjusting entry for insurnace from Janaury 1 Transaction. 30. Accrued wages of $2,750. Required: show the amount on revenue and expense recognized for each transaction under both accrual basis and cash basis of accounting by completing the charts below. ACCRUAL BASIS Date Revenue Expenses CASH BASIS Date Revenue Expensesarrow_forwardOn June 7,2019, Dilby Mechanical Corp completed $50,00 of servicing work for a client and billed them for that amount plus a GST of $2,500 and PST of $3,50; terms are N20. Required: a. Prepare the journal entry as it would appear in Dilby's accounting records. b. Assume the receivable established on June 7 was collected on June 27. Record the entry.arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forward

- Mountaineer Excavation operates in a low-lying area that is subject to heavy rains and flooding. Because of this, Mountaineer purchases one year of flood insurance in advance on March 1, paying $25,200 ($2,100/month). 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0). Prepaid insurance ending balance:_____________ Insurance expense ending balance:________________arrow_forwardPlease Introduction and show work and please I humble request to no plagiarism pleasearrow_forwardMountaineer Excavation operates in a low-lying area that is subject to heavy rains and flooding. Because of this, Mountaineer purchases one year of flood insurance in advance on March 1, paying $27,600 ($2,300/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0).arrow_forward

- Apply what you have learned Task 8: (Individual/Pair/Group Work) Snoopy enterprises provides collection services to its customers. year-end adjusting journal entries are prepared every Dec. 31 as its books are closed. make the appropriate adjusting entry for each of the ff items: 1. Uncollectible accounts at year-end is estimated to be P6,950. 2. Rent paid last April amounted to P400, 000, one fourth of which has already expired. This was initially recorded as prepaid rent upon payment. 3. Depreciation expense for its transportation equipment, P6,780 4. Supplies purchased during the year amounted to P4,290, of which one- third has been used during the year. 5. Unpaid salaries of its cleaners as of December 31 is P7,460. 6. Unearned interest has a balance of P3,120, of which P2,560 has already been earned during the year. the amount was initially credited to unearned interest upon collectionarrow_forwardCensider the following note payable transactions of Cargo Video Productions. D(Click the icon to view the transactions.) Requirements 1. Journalize the transactions for the company. Considering the given transactions only, what are Cargo Video Productions' total liabilities on December 31, 2019? 2. X Select explanations on the last line More Info he note requires annual principal pa Credit 2018 Oct. 1 Purchased equipment costing $40,000 by issuing a five-year, 9% note payable. The note requires annual principal payments of $8,000 plus interest each October 1. Dec. 31 Accrued interest on the note payable. 2019 Oct. 1 Paid the first installment on the note. Dec. 31 Accrued interest on the note payable. Print Done 4arrow_forwardFollowing are transactions of Danica Company 13 Accepted a $9,500, 45-day, 81 note in granting Miranda Lee a extension on her past-due account receivable. Prepared an adjusting entry to record accrued interest the Lee note. Complete the table to calculate the Interest amounts at Dexember 31^ \st and use the calculated value to prepare your journal entries. (Do not round your intermediate calculations. Use 360 days a year.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage