FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

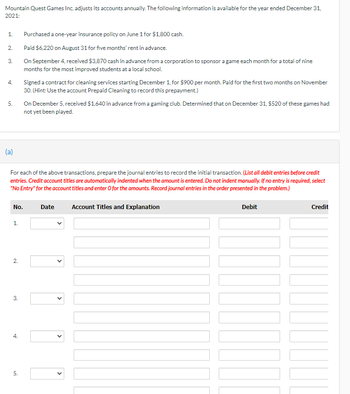

Transcribed Image Text:Mountain Quest Games Inc. adjusts its accounts annually. The following information is available for the year ended December 31,

2021:

1.

Purchased a one-year insurance policy on June 1 for $1,800 cash.

2.

Paid $6,220 on August 31 for five months' rent in advance.

3.

On September 4, received $3,870 cash in advance from a corporation to sponsor a game each month for a total of nine

months for the most improved students at a local school.

4.

Signed a contract for cleaning services starting December 1, for $900 per month. Paid for the first two months on November

30. (Hint: Use the account Prepaid Cleaning to record this prepayment.)

5.

On December 5, received $1,640 in advance from a gaming club. Determined that on December 31, $520 of these games had

not yet been played.

(a)

For each of the above transactions, prepare the journal entries to record the initial transaction. (List all debit entries before credit

entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.)

No.

Date

Account Titles and Explanation

Debit

Credit

1.

2.

3.

4.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The City of Castleton’s General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Debits Credits Cash $ 476,000 Taxes Receivable—Delinquent 601,000 Allowance for Uncollectible Delinquent Taxes $ 189,120 Interest and Penalties Receivable 28,080 Allowance for Uncollectible Interest and Penalties 12,960 Inventory of Supplies 17,900 Vouchers Payable 166,500 Due to Federal Government 77,490 Deferred Inflows of Resources—Unavailable Revenues 427,000 Fund Balance—Nonspendable—Inventory of Supplies 17,900 Fund Balance—Unassigned 232,010 $ 1,122,980 $ 1,122,980 Prepare a General Fund balance sheet as of June 30, 2020.arrow_forwardLyon County Bank agrees to len Grimwood Brick Company $100,000 on January 1. Grimwood Brick Company signs a $100,000, 8% 9-month note. The entry made by Grimwood Brick Company on January 1 to recor the proceeds and insurance of the note is?arrow_forwardGallery located in Maine produces journals and photo albums. On May 1, 2021, G borrowed $250,000 from Midwest One Bank by signing a three year, 6% note payable. Interest is due each May 1. How much, if any, should interest expense be debited for on Dec 31, 2021? Fill in the blank. Omit $ sign.arrow_forward

- Annette Corp. issued a $330,000, three-year, zero-interest-bearing note payable to Agnes Corp. for equipment on April 30, Year 5. Annette would normally pay interest at 6%. Annette has a December 31 year-end and will repay the note with three equal yearly payments of $110,000. Annette Corporation follows IFRS. Instructions Prepare the following journal entries for Annette Corporation: (show all your work) 1. Record the note 2. December 31, Year 5 interest accrual 3. April 30, Year 6 payment 4. December 31, Year 6 interest accrual 5. April 30, Year 7 paymentarrow_forwardRosewood Company made a loan of $7,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice O O $420 in Year 1 and $0 in Year 2 $0 in Year 1 and $420 in Year 2 $105 in Year 1 and $315 in Year 2 $315 in Year 1 and $105 in Year 2arrow_forwardOn September 1, Year 1, West Company borrowed $30,000 from Valley Bank. West agreed to pay interest annually at the rate of 5% per year. The note issued by West carried an 18-month term. West Company has a calendar year-end. What is the amount of interest expense that will be reported on West's income statement for Year 1? Multiple Choice $500 $375 $-0- $150arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education