FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

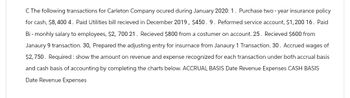

Transcribed Image Text:C The following transactions for Carleton Company ocured during January 2020: 1. Purchase two-year insurance policy

for cash, $8,400 4. Paid Utilities bill recieved in December 2019, $450. 9. Peformed service account, $1,200 16. Paid

Bi-monhly salary to employees, $2, 700 21. Recieved $800 from a costumer on account. 25. Recieved $600 from

Janaury 9 transaction. 30, Prepared the adjusting entry for insurnace from Janaury 1 Transaction. 30. Accrued wages of

$2,750. Required: show the amount on revenue and expense recognized for each transaction under both accrual basis

and cash basis of accounting by completing the charts below. ACCRUAL BASIS Date Revenue Expenses CASH BASIS

Date Revenue Expenses

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- HANDOUT PROBLEM for CURRENT LIABILITIES I. Prepare journal entries for the following chronological transactions and a. You sold merchandise on account for $250,000 on account. The products cost $110,000. Your company uses a perpetual inventory system. Your sales included a two-year warranty on the product. spent $1,400 to repair products in part "a." which were under warranty. b. You с. On December 31, 2021, you estimated that there would be an additional $8,000 of repairs on products in part "a." You estimated that $5.000 of the repairs would occur in 2022. In 2022, you performed $4,800 of repairs on products from part "a." and $1,920 of repairs on products sold in 2022. On December 31, 2022, you estimated that repairs on products sold in 2021 d. e. would be an additional $3,500 and for products sold in 2022 would be an additional $9,000. You believe that $5,400 of the $9,000 of repairs would occur in 2023. II. Based upon the transaction above, determine the amount of current…arrow_forwardOn April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $277,500. The interest rate charged by the bank was 4.50%. The bank made the loan on a discount basis. Exercise 7-5 (Algo) Part a Required: a-1. Calculate the loan proceeds made available to Powell. Loan proceedsarrow_forwardGallery located in Maine produces journals and photo albums. On May 1, 2021, G borrowed $250,000 from Midwest One Bank by signing a three year, 6% note payable. Interest is due each May 1. How much, if any, should interest expense be debited for on Dec 31, 2021? Fill in the blank. Omit $ sign.arrow_forward

- 1. Record journal entries for the following transactions of Hansen Bakery Company. Jan. 1, 2020 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Issued a $265,500 note to customer Jack Bullock as terms of a merchandise sale. The merchandise's cost to Hansen Bakery Company is $89,750. Note contract terms included a 36-month maturity date, and a 4.3% annual interest rate. Hansen Bakery Company records interest accumulated for 2020. Hansen Bakery Company records interest accumulated for 2021. Jack Bullock honors the note and pays in full with cash.arrow_forwardOn November 1, 2021, Aviation Training Corp. borrows $44,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 6% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Record the adjusting entry for interest. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021arrow_forwardPedroni Enterprises issues a $260,000, 45 day 5 % note to Zorzi Industries for merchandise inventory Journalize Pedroni Enterprises entries to record: The issuance of the note The payment of the note at maturity Journalize Zorzi Industries entries to record: The receipt of the note Receipt of the payment of the note at maturity On July 31, 2019 the balances of the accounts appearing in the ledger of Pedroni Interiors company a furniture wholesales, are as follows. Accumulated Depreciation – Building $365,000 Ray Zorzi – Capital $530,000 Administrative Expenses 440,000 Ray Zorzi – Drawing 15,000 Building 810,000 Sales 1,437,000 Cash 78,000 Sales tax Payable 4,500 Cost of Merchandise Sold…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education