Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

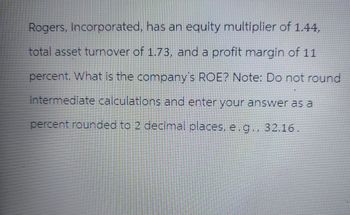

Transcribed Image Text:Rogers, Incorporated, has an equity multiplier of 1.44,

total asset turnover of 1.73, and a profit margin of 11

percent. What is the company's ROE? Note: Do not round

intermediate calculations and enter your answer as a

percent rounded to 2 decimal places, e.g., 32.16.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please do not give image format and explanationarrow_forwardNakamura, Incorporated, has a total debt ratio of .57, total debt of $317,000, and net income of $38,750. What is the company’s return on equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardThe Moraine Company has net income of $167,850. There are currently 32.65 days' sales in receivables. Total assets are $856,000, total receivables are $148,100, and the debt-equity ratio is .65. a. What is the company's profit margin? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the company's total asset turnover? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What is the company's ROE? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Profit margin b. Total asset turnover c. ROE % times %arrow_forward

- Compute the following for Stanley Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings. (a) Gross Profit Rate (in %) (b) Current Ratio (c) Quick Ratio B Stanley Limited Statement of Financial Position 31 December 2021 ($ in million) Stanley Limited Income Statement For the year ended 31 December 2021 ($ in million) Question B5 (continued) (d) Accounts Receivable Turnover Rate (e) Return on Equity (%) (f) Debt Ratio (in %) (g) Price-Earnings Ratioarrow_forwardvvk.3arrow_forwardSDJ, Incorporated, has net working capital of $3,490, current liabilities of $4,950, and inventory of $4,990. a. What is the current ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the quick ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Based on the information in financial statements for Emerson Corporation, the operating margin is Note: Round your intermediate and final answer to two decimal places. Emerson Corporationarrow_forwardAce Industries has current assets equal to $4 million. The company's current ratio is 2.0, and its quick ratio is 1.7. What is the firm's level of current liabilities? What is the firm's level of inventories? Do not round intermediate calculations. Round your answers to the nearest dollar. Current Liabilities $ Inventory $arrow_forwardNeedham Pharmaceuticals has a profit margin of 3% and an equity multiplier of 1.8. Its sales are $130 million and it has total assets of $50 million. What is its return on equity (ROE)? Do not round intermediate calculations. Round your answer to two decimal placesarrow_forward

- Borland, Inc., has a profit margin of 6.5 percent on sales of $22,600,000. Assume the firm has debt of $8,700,000 and total assets of $15,300,000. What is the firm's ROA? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardI followed the formulas per my textbook and cannot figure these practice questions out. Can you help me figure out what I am doing wrong?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education