FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

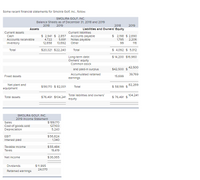

Transcribed Image Text:Some recent financial statements for Smolira Golf, Inc., follow.

SMOLIRA GOLF, INC.

Balance Sheets as of December 31, 2018 and 2019

2018

2019

2018

2019

Assets

Llabiltles and Owners' Equlty

Current assets

Current liabilities

$ 2,198 $ 2,690

$ 2,941 $ 2,857 Accounts payable

4,722

12,658

Cash

Notes payable

Other

Accounts recelvable

5,691

13,692

1,795

2,206

116

Inventory

99

Total

$20,321 $22,240

Total

$ 4,092 $ 5,012

$ 14,200 $16,960

Long-term debt

Owners' equity

Common stock

42,500

and paid-in surplus

$42,500 $

Accumulated retained

39,769

Flxed assets

15,699

earnings

Net plant and

82,269

$56,170 $ 82,001

Total

$ 58,199 $

equipment

Total liabilitles and owners'

104,241

Total assets

$76,491 $104,241

$ 76,491 $

equity

SMOLIRA GOLF, INC.

2019 Income Statement

Sales

$189,170

Cost of goods sold

Depreclation

127,103

5,243

$56,824

1,340

EBIT

Interest pald

Taxable Income

$55,484

Тахes

19,419

Net Income

$36,065

Dividends

$ 11,995

24,070

Retalned earnings

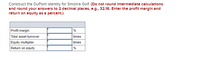

Transcribed Image Text:Construct the DuPont Identity for Smolira Golf. (Do not round Intermedlate calculations

and round your answers to 2 decimal places, e.g., 32.16. Enter the profit margln and

return on equlty as a percent.)

Profit margin

%

Total asset tumover

Equity multiplier

Return on equity

times

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Q6. Pujols Lumber Yard has a current accounts receivable balance of $394,539. Credit sales for the year just ended were $6,236,838. How long did it take on average for credit customers to pay off their accounts during the past year? (Enter the answer with 2 decimal places (e.g. 23.45)arrow_forwardPlease do not use aiarrow_forwardPlease read and enter answers carefully using the table provided.arrow_forward

- 42.The following data were available for ABC Company, which uses perpetual system, at Dec 31, 20X2:Accounts Payable, beg P15,000Accounts Payable, end P10,000Inventory, beg P17,000Inventory, end P9,000Cash payment to creditors(net of 2% discount) 294,000Purchase returns, P5,000How much were the credit purchases during the period? 285,000 294,000 300,000 315,000arrow_forwardRound answers to nearest dollararrow_forward! Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Cash Debit Credit $25,300 Accounts Receivable 14,300 Allowance for Uncollectible Accounts $1,600 Supplies 3,200 Notes Receivable (6%, due in 2 years) 27,000 Land 77,700 Accounts Payable 9,800 103,000 33,100 $147,500 $147,500 Common Stock Retained Earnings Totals During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $42,100. Write off accounts receivable as uncollectible, $1,800. (Assume the company uses the allowance method) Pay cash for salaries, $32,100. January 6 Provide services to customers on account, $79,400. January 15 January 20 January 22 Receive cash on accounts receivable, $77,000. January 25 Pay cash on accounts payable, $6,200. January 30 Pay cash for utilities during January, $14,400. 3. Prepare an adjusted trial…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Debit Credit Cash $ 27,300 Accounts Receivable 15,300 Allowance for Uncollectible Accounts $ 4,200 Supplies 4,200 Notes Receivable (6%, due in 2 years) 21,000 Land 80,600 Accounts Payable 9,100 Common Stock 101,000 Retained Earnings 34,100 Totals $ 148,400 $ 148,400 During January 2021, the following transactions occur: January 2 Provide services to customers for cash, $52,100. January 6 Provide services to customers on account, $89,400. January 15 Write off accounts receivable as uncollectible, $3,900. January 20 Pay cash for salaries, $33,100. January 22 Receive cash on accounts receivable,…arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardQ3: Salalah company’s recent financial statements showed the following information. Net Sales 250,000 OMR Accounts Receivables 180,000 OMR The management made two estimates for the uncollectible receivables It can be 4.5 % of net sales or It can be 3.2 % of accounts receivables Calculate and record journal entries in each case. If the company had already recognized an allowance amount of 8,000 OMR, make the journal entry. In this question, make the solution only for net sales casearrow_forward

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Step 1 In the credit account statement below, the values of the annual percentage rate (APR), finance charge, and the new balance must be calculated. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Recall that the annual percentage rate (APR) is tied to the monthly periodic rate by the following formula. monthly periodic rate = APR 12 By solving this equation for the APR, the known value for the monthly periodic rate can be substituted to calculate the APR. APR = monthly periodic rate ✕ 12 The…arrow_forwardMN.3.arrow_forward(Bonus Question 02) Record the sale by Verity Springs, Inc. of $136,000 in accounts receivable on May 1. Verity Springs is charged a 3.00% factoring fee. View transaction list Journal entry worksheet < 1 Record the sale of receivable. Note: Enter debits before credits. Date May 01 General Journal Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education