CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Roger is 30% patner in the roc

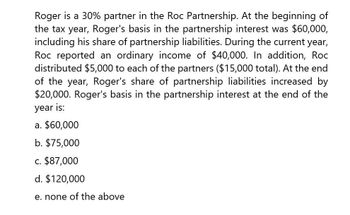

Transcribed Image Text:Roger is a 30% partner in the Roc Partnership. At the beginning of

the tax year, Roger's basis in the partnership interest was $60,000,

including his share of partnership liabilities. During the current year,

Roc reported an ordinary income of $40,000. In addition, Roc

distributed $5,000 to each of the partners ($15,000 total). At the end

of the year, Roger's share of partnership liabilities increased by

$20,000. Roger's basis in the partnership interest at the end of the

year is:

a. $60,000

b. $75,000

c. $87,000

d. $120,000

e. none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Recommended textbooks for you