FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question solution general accounting

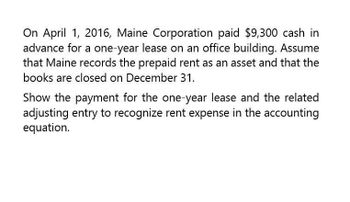

Transcribed Image Text:On April 1, 2016, Maine Corporation paid $9,300 cash in

advance for a one-year lease on an office building. Assume

that Maine records the prepaid rent as an asset and that the

books are closed on December 31.

Show the payment for the one-year lease and the related

adjusting entry to recognize rent expense in the accounting

equation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Windsor Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement. 1. 2. 3. 4. 5. Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically inden when amount is entered. Do not ind manually. Record journal entries in the order presented in the problem.) Date 20 0 /20 The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. The cost of the asset to the lessor is $230,000. The fair value of the asset at January 1, 2020, is $230,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,339, none of which is…arrow_forwardOn October 1, 2019, Viking Trivia Company paid $72,000 for a two-year lease on an office building. The payment was recorded as prepaid rent, and the lease commenced on the date of payment. Debit Account: Debit Amount: Credit Account: Credit Amount:arrow_forwardCB owns an office building and leases the office spaces under a one-year rental agreement. Not all tenants make timely payments of their rent. During 2021, CB, Inc. received P800,000 from tenants. The company’s statement of financial position on December 31, 2020 reported Rent Receivable of P96,000 and Unearned Rent Revenue of P320,000. The statement of financial position on December 31, 2021 and income statement for the year ended December 31, 2021 reported Rent Receivable and Rent Revenue of P124,000 and P908,000, respectively. How much was CB’s unearned rent revenue on December 31, 2021?arrow_forward

- BT21 Company owns an office building and leases the office spaces under a one-year rental agreement. Not all tenants make timely payments of their rent. During the year 2020, the company received P1,500,000 from tenants. The company’s statement of financial position on December 31, 2019, reported rent receivable of P100,000 and Unearned rent revenue of P40,000. The statement of financial position on December 31, 2020, and income statement for the year ended December 31, 2020, reported rent receivable and rent revenue of P75,000 and 1,350,000 respectively. How much was BT21’s Unearned rent revenue on December 31, 2020?arrow_forwardHaving sold the equipment, OPC pays off the note payable in full on 1/17. The amount paid is $23,613, which includes interest accrued in December and an additional $95 interest through January 17. Record the transaction.arrow_forwardPlease answer in good accounting form. Thank you! 1. On September 1, 2021, AYE Company entered into one-year nonrenewable lease, commencing on that date, for an office space and made the following payments to XYZ Properties:• Bonus to obtain lease - ₱ 120,000• First month’s rent - ₱ 40,000• Last month’s rent - ₱ 40,000The lease is considered “Short-term lease” in its income statement for the year ended Dec. 31, 2021. What amount should AYE report as rent expense for the year ended, December 31, 2021? 2. On January 1, 2021, BEE Corporation signed a 3-year operating lease for various office furniture and equipment at ₱300,000 per year. The lease included a provision for additional rent of 5% of annual company sales in excess of ₱2,000,000. BEE’s sales for the year ended Dec. 31, 2021 were ₱2,500,000. Upon execution of the lease, BEE Corporation paid ₱100,000 as a bonus for the lease What is BEE’s rent expense for the year ended December 31, 2021 if the lease is considered a “Low…arrow_forward

- On June 7,2019, Dilby Mechanical Corp completed $50,00 of servicing work for a client and billed them for that amount plus a GST of $2,500 and PST of $3,50; terms are N20. Required: a. Prepare the journal entry as it would appear in Dilby's accounting records. b. Assume the receivable established on June 7 was collected on June 27. Record the entry.arrow_forwardOn October 1, 2017, Trend Sound System Company leased office space at a monthly rental of P30,000 for 10 years expiring September 30, 2027. As an inducement for Trend to enter into a lease, the lessor permitted Trend to occupy the premises rent-free from October 1 to December 31, 2017. Improvements were made at the leased office at a total cost of P300,000, the improvements were finished on October 31, 2017. It was estimated that the improvements will be useful for 5 years. For the year ended December 31, 2017, Trend should record total expenses related to the lease facilities of10,00087,75097,750100,000arrow_forwardThe GAP Inc. discloses the following schedule to its fiscal 2018 (ended February 2, 2019) 10-K report relating to its leasing to its leasing activities. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. The aggregate minimum noncancelable annual lease payments under leases in effect on February 2, 2019, are as follows: Fiscal Year ($ millions) 2019 $1,098 2020 1,043 2021 847 2022 694 2023 512 Thereafter Total minimum lease commitments $5,638 1,444 Compute the present value of GAP's operating leases using the following assumptions Assmption Discount rate Round remaining lease term to the nearest whole year Year Present Value 1 $ 0 2 0 3 0 4 0 5 0 >5 0 $ 0 6%arrow_forward

- 1. Entity A received a 12% P200,000, note receivable on October 1, 2011. Entity A uses a calendar year period. The principal and interest on the note are due on October 1, 2012. What is the adjusting entry to take up accrued interest income on Dec. 31, 2011?2. Entity A is renting out its building to tenant for a monthly rent of P30,000. As of December 31,2011, the tenant has not yet paid the rent for the months November and December. What is the adjusting entry to take up accrued rent income on December 31, 2011?3. Entity A issued a 12% P500,000, one-year note payable on July 1, 2011. The principal and Interest are due on July 1, 2011. What is the adjusting entry to take up interest expense on December 31, 2011?4. Entity A has equipment with a historical cost of P 1 ,000,000. The equipment was estimated to have a 10- year useful life when was acquired four years ago . What is the adjusting entry to take up the annual depreciation expense on December 31, 2011?5. Entity A total accounts…arrow_forwardConnors Company paid $700 cash to make a repair on equipment it sold under a oneyear warranty in the prior year. The entry to record the payment will debita. Accrued Warranty Payable and creditCash.b. Operating Expense and credit Cash.arrow_forwardChance Enterprises leased equipment from Third Bank Leasing on January 1, 2021. Chance elected the short-term lease option. Appropriate adjusting entries are made annually. Related Information: Lease term Monthly lease payments Economic life of asset Interest rate charged by the lessor Required: Prepare appropriate entries for Chance from the beginning of the lease through April 1, 2021. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 Note: Enter debits before credits. Record the beginning of the lease for Chance. Date January 01, 2021 5 Record entry 1 year (12 monthly periods) $78,000 at Jan. 1, 2821, through Dec. 1, 2821. 5 years 9% General Journal Clear entry Debit Credit View general Journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education