FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:bok

nt

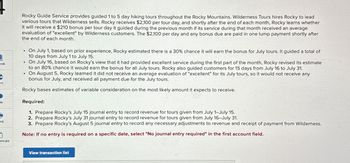

Rocky Guide Service provides guided 1 to 5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead

various tours that Wilderness sells. Rocky receives $2,100 per tour day, and shortly after the end of each month, Rocky learns whether

it will receive a $210 bonus per tour day it guided during the previous month if its service during that month received an average

evaluation of "excellent" by Wilderness customers. The $2,100 per day and any bonus due are paid in one lump payment shortly after

the end of each month.

On July 1, based on prior experience, Rocky estimated there is a 30% chance it will earn the bonus for July tours. It guided a total of

10 days from July 1 to July 15.

⚫ On July 16, based on Rocky's view that it had provided excellent service during the first part of the month, Rocky revised its estimate

to an 80% chance it would earn the bonus for all July tours. Rocky also guided customers for 15 days from July 16 to July 31.

. On August 5, Rocky learned it did not receive an average evaluation of "excellent" for its July tours, so it would not receive any

bonus for July, and received all payment due for the July tours.

Rocky bases estimates of variable consideration on the most likely amount it expects to receive.

sk

Required:

1. Prepare Rocky's July 15 journal entry to record revenue for tours given from July 1-July 15.

2. Prepare Rocky's July 31 journal entry to record revenue for tours given from July 16-July 31.

nt

ences

3. Prepare Rocky's August 5 journal entry to record any necessary adjustments to revenue and receipt of payment from Wilderness.

Note: If no entry is required on a specific date, select "No journal entry required" in the first account field.

View transaction list

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sarjit Systems sold software to a customer for $230,000. As part of the contract, Sarjit promises to provide "free" technical support over the next six months. Sarjit sells the same software without technical support for $200,000 and a stand-alone six-month technical support contract for $50,000, so these products would sell for $250,000 if sold separately. Prepare Sarjit's journal entry to record the sale of the software. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale of software for cash. Note: Enter debits before credits Transaction 1 General Journal Debit Credit Recept natry Clear entry View general journalarrow_forwardRocky Guide Service provides guided 1 to 5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,500 per tour day, and shortly after the end of each month, Rocky learns whether it will receive a $150 bonus per tour day it guided during the previous month if its service during that month received an average evaluation of "excellent" by Wilderness customers. The $1,500 per day and any bonus due are paid in one lump payment shortly after the end of each month. On July 1, based on prior experience, Rocky estimated there is a 30% chance it will earn the bonus for July tours. It guided a total of 10 days from July 1 to July 15. On July 16, based on Rocky’s view that it had provided excellent service during the first part of the month, Rocky revised its estimate to an 80% chance it would earn the bonus for July tours. Rocky also guided customers for 15 days from July 16 to July 31. On August 5, Rocky…arrow_forwardBrent Bishop is the vice president of operations froSouthern Swwet Bakery. He drives a 2019 Toyota Prius Prime as his company car, and it has a fair market value of $37,500. The prorate annual lease value per Publication 15-b for the vehicle is $10,250. He reported driving 35,250 miles during 2019, of which 20 percent were fro personal reasons. The company pays his fuel and chargers him five cents per miles for fuel chargers. Required: Using the leave value rule, what is the valuation of Brent company car benefits? (Do not round intermediate calculations and round your final answer to 2 decimal places.)arrow_forward

- On January 1, the Matthews Band pays $67,200 for sound equipment. The band estimates it will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During the first year, the band performs 45 concerts.arrow_forwardRequired information [The following information applies to the questions displayed below.] This year Elizabeth agreed to a three-year service contract with an engineering consulting firm to improve efficiency in her factory. The contract requires Elizabeth to pay the consulting firm $1,500 for each instance that Elizabeth requests its assistance. The contract also provides that Elizabeth only pays the consultants if their advice increases efficiency as measured 12 months from the date of service. This year Elizabeth requested advice on three occasions and she has not yet made any payments to the consultants. (Leave no answers blank. Enter zero if applicable.) b. How much should Elizabeth deduct this year under this service contract if she uses the cash method of accounting? Deductible amountarrow_forwardNonearrow_forward

- Service Industry AccountingThe Spectrum Fitness Club charges a nonrefundable annual membership fee of $1,200 for its services. For this fee, each member received a fitness evaluation (value $200), a monthly magazine (annual value $25), and two hours’ use of the equipment each week (annual value $1,100). Each of the three elements of the annual membership can be purchased separately. The initial direct costs to obtain the membership are $180. The direct cost of the fitness evaluation is $100, and the monthly direct costs to provide the other services are estimated to be $25 per person. Give the journal entries to record the transactions in 2019 relative to a membership sold on May 1, 2019.arrow_forwardKLB plc is one of your audit clients for the previous 8 years. The following information are available: The audit team included a manager and two juniors. The client was asking to finish the audit work early this year otherwise they are going to change the auditor next year. One-week bonus was paid to the audit team through their payroll as the client was happy that they finished auditing 5 days earlier than theplanned audit time. The audit team got 10% discounts on the client’s products. Thesame discount is normally given to the client’s staff. Your firm offered this client a bookkeeping service for this year. To reduce the audit cost, the engagement letter was not updated this year as there is no big changes in the audit tasks from last year. Audit fees are based on a percentage of the net profit before tax. One of the audit team received an offer to be appointed in the client’s internal audit department as a head of department. The finance director was recently working as an…arrow_forwardSanjeev enters into a contract that pays him $1,000 each month for six months of continuous consulting services. In addition, there is a 40% chance the contract will pay an additional $3,000, depending on the outcome of the consulting contract. Sanjeev used the most likely amount to determine transaction price. After Sanjeev has recognized revenue for two months of the contract, he changes his assessment of the chance the contract will pay him $3,000 up to 70%. How much revenue would Sanjeev recognize in the third month of the contract? $2,500 O $1.500 $1,850 O $1,600arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education